In today’s globalized business environment, managing currency considerations is a critical aspect of mobile and digital scheduling tools. Organizations with international operations must navigate the complexities of multiple currencies when scheduling employees, tracking labor costs, and managing payroll across borders. Currency handling affects everything from wage calculations to budget forecasting, making it an essential component of effective workforce management. As businesses expand globally, the ability to seamlessly handle different currencies within scheduling systems becomes not just a convenience but a necessity for operational efficiency and financial accuracy.

The challenges of currency handling extend beyond simple conversions. Scheduling managers must consider exchange rate fluctuations, country-specific labor regulations, tax implications, and regional financial practices. Modern scheduling solutions are increasingly incorporating sophisticated currency management features that integrate with other business systems to provide comprehensive global workforce management. Understanding these capabilities and implementing best practices can help organizations overcome the complexities of multinational scheduling and achieve greater control over their global labor costs.

Understanding Currency Challenges in Global Scheduling

When organizations operate across multiple countries, their scheduling tools must accommodate different currencies, creating several unique challenges. Effective currency handling in scheduling systems requires understanding these obstacles and implementing appropriate solutions. Companies using employee scheduling software must ensure their systems can handle the complexity of global operations while maintaining accuracy and compliance.

- Exchange Rate Volatility: Fluctuating exchange rates can significantly impact labor costs and budget forecasting when scheduling across multiple currency zones.

- Multiple Pay Rate Structures: Different regions often have varying pay scales, minimum wage requirements, and overtime calculations that must be reflected in scheduling tools.

- Reporting Complexity: Generating consistent reports across different currencies requires sophisticated conversion mechanisms and standardized formats.

- Compliance Requirements: Different countries have unique regulations regarding wage payment, tax withholding, and financial record-keeping that affect scheduling systems.

- System Integration Challenges: Currency handling often requires seamless integration between scheduling platforms, payroll systems, and financial software.

Organizations implementing cross-border team scheduling need to establish consistent policies for currency handling. This includes determining when and how conversions are applied, which currency serves as the base for reporting, and how historical data is maintained. Companies should consider developing standard operating procedures that address these currency challenges while supporting their global scheduling needs.

Currency Configuration in Scheduling Platforms

Modern scheduling platforms must offer robust currency configuration options to support global operations. The flexibility to define and manage multiple currencies directly impacts an organization’s ability to effectively schedule across borders while maintaining financial accuracy. Advanced automated scheduling solutions incorporate several essential currency-related features.

- Base Currency Settings: The ability to establish a primary organizational currency while supporting regional currencies for local operations and reporting.

- Currency Symbol Display: Visual indicators and proper formatting of different currencies throughout the scheduling interface to improve clarity and reduce errors.

- User-Level Currency Preferences: Options for individual users to view schedules and related financial information in their preferred currency.

- Decimal and Formatting Rules: Support for various numerical formats and decimal conventions used in different regions.

- Default Currency Assignment: The capability to assign specific currencies to locations, departments, or projects automatically.

When implementing multi-location scheduling coordination, organizations should carefully configure currency settings to reflect their operational structure. This may involve setting location-specific defaults while maintaining the ability to generate consolidated reports in a single currency. The ideal configuration should balance local needs with global oversight requirements.

Exchange Rate Management for Accurate Scheduling

Exchange rate management is one of the most challenging aspects of currency handling in global scheduling systems. Fluctuations in exchange rates can significantly impact labor costs, budget forecasting, and financial reporting. Organizations must implement reliable methods for managing these fluctuations while maintaining scheduling accuracy. Companies using mobile scheduling applications need effective exchange rate strategies.

- Real-Time vs. Fixed Rates: Deciding between using current market rates or establishing fixed internal rates for specific time periods to create stability in scheduling.

- Rate Source Integration: Connecting scheduling systems to reliable financial data sources that provide accurate and timely exchange rate information.

- Historical Rate Storage: Maintaining records of exchange rates used for past scheduling periods to ensure accurate historical reporting and analysis.

- Rate Update Frequency: Determining how often exchange rates should be updated within the scheduling system based on business needs and volatility.

- Conversion Timing Policies: Establishing clear guidelines on when currency conversions occur in the scheduling and payroll process.

Effective exchange rate management requires close collaboration between scheduling managers, finance teams, and IT departments. Organizations should develop clear policies that address rate sourcing, update frequency, and handling of historical data. These policies should be documented and communicated to all stakeholders involved in time zone management and global scheduling operations.

Payroll Integration and Currency Considerations

Seamless integration between scheduling systems and payroll platforms is essential for accurate currency handling in global operations. This integration ensures that hours worked, pay rates, and currency calculations flow correctly from scheduling to payment processing. Organizations implementing payroll integration must address several currency-related considerations.

- Data Transfer Protocols: Establishing secure and accurate methods for transferring currency-specific scheduling data to payroll systems without errors or discrepancies.

- Conversion Point Determination: Deciding whether currency conversions happen in the scheduling system, during data transfer, or within the payroll platform.

- Pay Cycle Alignment: Ensuring that scheduling periods align with pay cycles across different regions with varying payment frequencies and calendar structures.

- Rounding Rules: Implementing consistent rounding policies for currency conversions to maintain accuracy and fairness in employee compensation.

- Audit Trail Maintenance: Creating comprehensive records of currency conversions and calculations for compliance and verification purposes.

The benefits of integrated systems become particularly evident when handling multiple currencies. When scheduling and payroll systems work together seamlessly, organizations can reduce manual conversion errors, improve financial accuracy, and enhance employee satisfaction through correct and timely payments. This integration should include real-time validation checks to identify potential currency-related issues before they impact employee compensation.

Compliance and Regulatory Requirements for Global Currency Handling

Currency handling in global scheduling must adhere to various international, national, and local regulations. Compliance requirements often dictate how currencies are managed, reported, and documented across different jurisdictions. Organizations must stay informed about these regulations to avoid penalties and maintain legal operations. Understanding multi-jurisdiction compliance is essential for global currency handling.

- Financial Reporting Standards: Adhering to international financial reporting standards (IFRS) and local GAAP requirements for currency transactions and conversions.

- Tax Documentation: Maintaining appropriate currency records for tax reporting purposes across multiple tax jurisdictions.

- Labor Law Compliance: Ensuring that currency handling practices comply with local labor laws regarding minimum wage, overtime calculation, and payment methods.

- Data Privacy Regulations: Following international and regional data protection laws when storing and processing currency-related personal information.

- Record Retention Requirements: Adhering to varying record-keeping timeframes for financial and scheduling data across different countries.

Organizations should establish a compliance framework that addresses currency handling within their scheduling systems. This may involve regular audits, policy reviews, and system updates to align with changing regulations. Companies implementing compliance with labor laws across multiple countries need to ensure their scheduling tools can adapt to regional requirements while maintaining consistent global standards.

Mobile Access and Currency Display Considerations

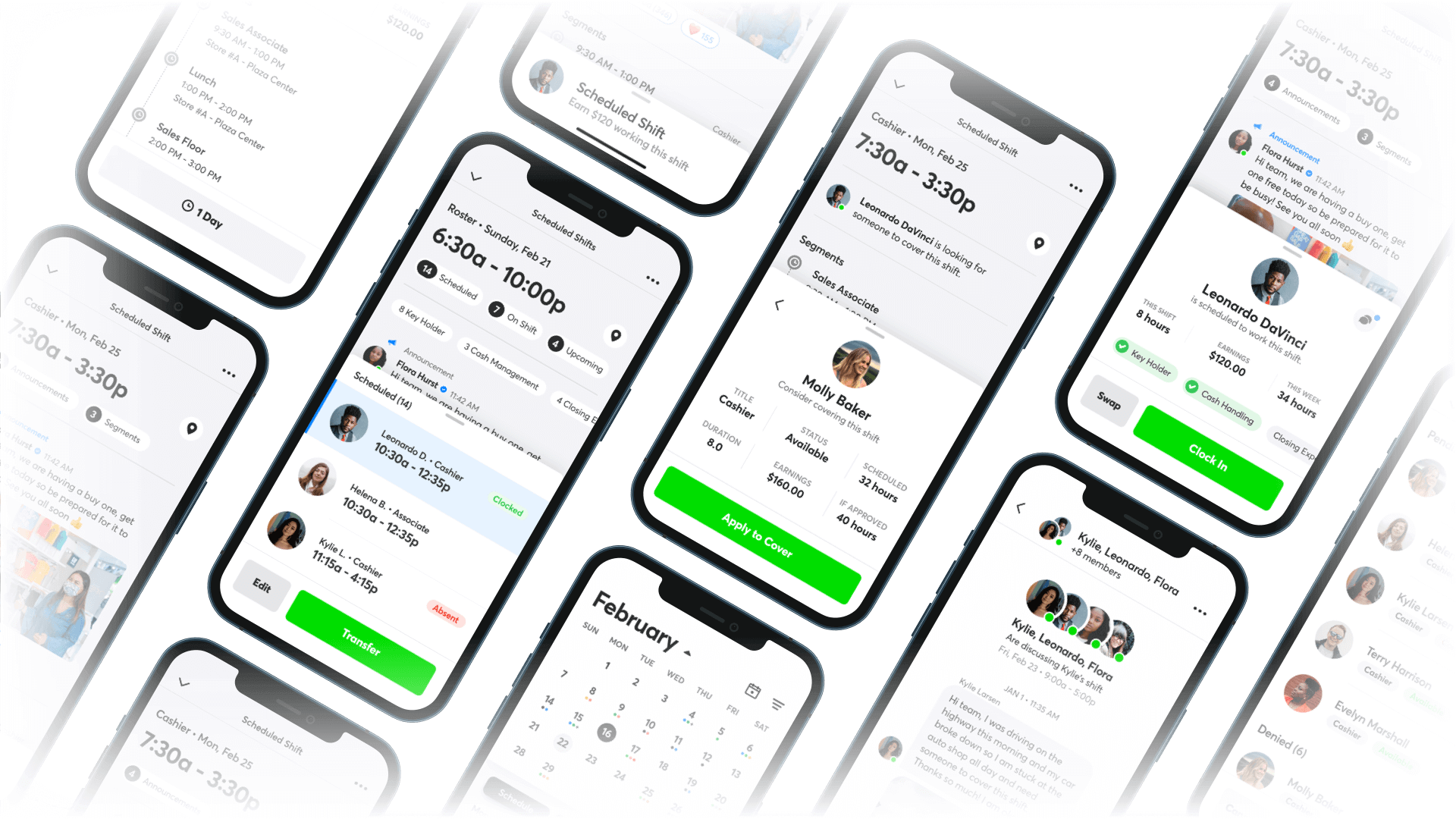

With the increasing use of mobile devices for workforce scheduling, organizations must ensure that currency information is properly displayed and managed on smartphones and tablets. Mobile interfaces present unique challenges for currency handling, including screen size limitations and varying device capabilities. Effective mobile access to scheduling information must address these challenges.

- Responsive Currency Formatting: Adapting currency displays to different screen sizes while maintaining clarity and accuracy.

- User Location Detection: Using device location services to automatically adjust currency displays based on a user’s current location.

- Offline Currency Handling: Providing reliable currency information even when mobile devices have limited or no connectivity.

- Currency Toggle Options: Allowing users to easily switch between different currency views on mobile interfaces.

- Notification Clarity: Ensuring that mobile alerts and notifications clearly indicate the relevant currency for financial information.

Mobile scheduling applications should provide consistent currency experiences across all devices while accommodating the specific needs of mobile users. This includes optimizing data transfer to reduce mobile data usage while ensuring currency information remains current. Organizations implementing mobile scheduling apps should test currency displays across various devices and operating systems to ensure accuracy and usability.

Reporting and Analytics for Multi-Currency Operations

Effective reporting and analytics are crucial for organizations managing scheduling across multiple currencies. Decision-makers need clear insights into labor costs, budget variances, and scheduling efficiency regardless of currency differences. Advanced reporting and analytics capabilities help organizations overcome the complexities of multi-currency data analysis.

- Consolidated Reporting: Generating unified reports that convert all currencies to a standard base currency for organizational-level analysis.

- Currency-Specific Filtering: Allowing users to filter and segment reports by currency to analyze regional performance.

- Exchange Rate Impact Analysis: Tools to evaluate how currency fluctuations affect labor costs and budget adherence over time.

- Visual Currency Indicators: Clear visual cues in dashboards and reports to indicate which currency is being displayed.

- Historical Currency Comparison: Capabilities to analyze scheduling data across time periods with normalized currency values.

Organizations should develop reporting strategies that address both global and local currency needs. This may include creating different report templates for various stakeholders based on their currency requirements. Companies using data-driven decision making approaches should ensure their currency handling supports accurate cross-regional comparisons and meaningful trend analysis.

Cultural Considerations in Currency Management

Beyond technical and regulatory aspects, currency handling in global scheduling must also address cultural factors that influence how financial information is presented and interpreted. Different regions have varying expectations and preferences regarding currency presentation, financial transparency, and compensation discussions. Understanding cultural differences in scheduling helps organizations implement more effective currency handling practices.

- Numerical Formatting Conventions: Respecting regional differences in how numbers, decimals, and currency symbols are displayed.

- Salary Discussion Norms: Adapting currency presentation to align with cultural sensitivities regarding compensation transparency.

- Financial Privacy Expectations: Understanding varying cultural attitudes toward sharing currency and compensation information.

- Currency Prestige Factors: Recognizing that in some cultures, being paid in certain currencies may carry status implications.

- Local vs. Global Currency Preferences: Acknowledging regional preferences for local currency information versus standardized global currencies.

Organizations should consult with regional managers and cultural experts when designing currency displays and communication strategies for their scheduling systems. This cultural sensitivity can improve user adoption and satisfaction. Companies implementing global team communication strategies should include guidelines for discussing currency-related topics in cross-cultural contexts.

Implementation Best Practices for Currency Handling

Successfully implementing currency handling features in scheduling systems requires careful planning, stakeholder involvement, and systematic testing. Organizations can avoid common pitfalls by following implementation best practices that address the complexities of global currency management. Proper implementation and training ensure that currency features work effectively across the organization.

- Cross-Functional Implementation Team: Involving finance, HR, IT, and operations stakeholders in the design and implementation of currency handling features.

- Phased Rollout Approach: Implementing currency features gradually, starting with pilot regions before expanding globally.

- Comprehensive Testing Scenarios: Creating test cases that cover various currency conversion scenarios, exchange rate changes, and edge cases.

- Data Migration Planning: Carefully mapping currency data when transitioning from legacy systems to new scheduling platforms.

- User Training Programs: Developing targeted training materials that address currency-specific features for different user roles.

Organizations should develop a detailed implementation plan that addresses both technical and organizational aspects of currency handling. This includes establishing clear governance structures for currency-related decisions and creating feedback mechanisms to identify and resolve issues. Companies focusing on data migration planning should pay special attention to currency conversion accuracy when transferring historical scheduling data.

Future Trends in Global Currency Handling for Scheduling

The landscape of currency handling in scheduling systems continues to evolve with technological advancements and changing global business practices. Organizations should stay informed about emerging trends to maintain competitive and efficient scheduling operations. Several developments are shaping the future of integration capabilities for currency handling in scheduling tools.

- AI-Powered Exchange Rate Forecasting: Machine learning algorithms that predict currency fluctuations to improve scheduling budget accuracy.

- Blockchain for Currency Transparency: Distributed ledger technologies that enhance the security and auditability of multi-currency transactions.

- Digital Currency Integration: Emerging capabilities to handle cryptocurrencies and central bank digital currencies in global payroll.

- Real-Time Micro-Conversions: Instant currency conversions at the individual shift level rather than batch processing.

- Automated Compliance Updates: Systems that automatically adjust currency handling practices based on changing international regulations.

Organizations should develop strategic roadmaps for enhancing their currency handling capabilities as these technologies mature. This includes evaluating new tools, participating in industry forums, and monitoring regulatory developments. Companies investing in payroll software integration should ensure their systems can accommodate these emerging currency handling methods while maintaining compatibility with existing processes.

Conclusion

Effective currency handling is a critical component of successful global scheduling operations. Organizations must navigate complex challenges including exchange rate management, compliance requirements, system integration, and cultural considerations. By implementing robust currency handling practices within their scheduling tools, companies can improve financial accuracy, enhance employee satisfaction, and gain better visibility into their global labor costs. The most successful approaches combine technical solutions with clear policies, comprehensive training, and ongoing optimization to address the evolving demands of international business.

As businesses continue to expand globally, the importance of sophisticated currency handling will only increase. Organizations should evaluate their current capabilities, identify gaps, and develop strategic plans to enhance their currency management within scheduling systems. By leveraging the best practices and emerging technologies discussed in this guide, companies can transform currency handling from a logistical challenge into a strategic advantage. With the right tools and approaches, organizations can achieve seamless scheduling operations that transcend currency boundaries while maintaining financial precision and compliance across their global workforce.

FAQ

1. How do exchange rate fluctuations impact scheduling costs in global operations?

Exchange rate fluctuations can significantly impact labor costs and budget accuracy in global scheduling. When rates change, the cost of scheduled shifts may increase or decrease when converted to the organization’s base currency. This volatility creates challenges for budget forecasting, cost center allocation, and financial reporting. Organizations can mitigate these impacts by implementing fixed exchange rate periods for scheduling, using forward-looking rate projections, or building rate fluctuation buffers into labor budgets. Advanced scheduling systems may include features that allow managers to see real-time cost impacts as exchange rates change, enabling more responsive scheduling decisions.

2. What are the key integration points between scheduling systems and financial platforms for currency handling?

Key integration points include payroll systems, accounting platforms, ERP systems, banking interfaces, and tax reporting tools. These integrations should address exchange rate synchronization, conversion timing, data validation, error handling, and audit trail maintenance. Effective integration ensures that currency information flows accurately between systems while maintaining data integrity and compliance. Organizations should establish clear data governance policies that define how currency information is transferred, transformed, and validated across these integration points. Modern API-based integrations can provide real-time currency handling across systems, reducing errors and improving financial accuracy.

3. How should organizations handle historical scheduling data when currency values change?

Organizations should maintain records of historical exchange rates alongside scheduling data to enable accurate retrospective analysis. When reporting on historical periods, companies can either use the exchange rates that were in effect during those periods (for compliance and historical accuracy) or restate the data using current rates (for comparative analysis). The approach should be clearly documented and consistently applied. Scheduling systems should store both the original local currency values and the converted amounts in the base currency, along with the exchange rates used. This comprehensive approach supports both historical accuracy and meaningful trend analysis across different time periods.

4. What compliance considerations are most important for multi-currency scheduling?

Key compliance considerations include adherence to local labor laws regarding minimum wage and overtime calculations in local currencies, financial reporting requirements for multinational operations, tax regulations for international employees, data privacy laws affecting personal financial information, and record retention requirements that vary by jurisdiction. Organizations must also consider transparency obligations, ensuring employees understand how their compensation is calculated across currencies. Compliance frameworks should include regular audits, clear documentation of currency handling procedures, and mechanisms to stay updated on changing regulations across all operating regions.

5. How can organizations prepare for future developments in global currency management?

Organizations should adopt flexible scheduling systems with configurable currency handling features that can adapt to emerging needs. This includes evaluating solutions with open APIs for integration with new financial platforms, monitoring developments in digital currencies and blockchain technologies, and participating in industry forums to stay informed about regulatory changes. Companies should also develop internal expertise in global currency management through training and knowledge sharing. Creating a cross-functional currency steering committee can help organizations anticipate changes and develop proactive strategies to address new requirements in global currency handling for scheduling operations.