Setting up employee retirement plans is a critical aspect of workforce management for small and medium-sized businesses in Denton, Texas. As the competitive landscape for talent continues to evolve, offering comprehensive retirement benefits has become increasingly important for attracting and retaining quality employees. Retirement plans not only provide financial security for your workforce but also offer significant tax advantages for your business. Understanding the nuances of retirement plan options, compliance requirements, and implementation strategies is essential for SMB owners and HR professionals in Denton who want to create effective benefits packages while managing costs.

The Denton business community faces unique challenges and opportunities when establishing employee retirement plans. With a diverse economic base spanning education, healthcare, manufacturing, and retail, Denton businesses must tailor their retirement offerings to meet the specific needs of their workforce while navigating federal regulations and local market conditions. Whether you’re considering implementing your first retirement plan or looking to optimize an existing one, this comprehensive guide will provide you with the essential information needed to make informed decisions that benefit both your business and your employees.

Understanding Retirement Plan Options for Denton SMBs

Small and medium-sized businesses in Denton have several retirement plan options to consider, each with distinct advantages and requirements. Selecting the right plan depends on your business size, financial resources, and workforce needs. Before implementing any retirement program, it’s essential to understand the various options available and how they align with your strategic workforce planning goals.

- 401(k) Plans: The most widely recognized retirement option, allowing employees to contribute pre-tax dollars with potential employer matching. These plans offer higher contribution limits but require more administrative oversight.

- Simplified Employee Pension (SEP) IRAs: Ideal for small businesses and self-employed individuals, SEP IRAs feature minimal paperwork and lower administrative costs while allowing significant employer contributions.

- Savings Incentive Match Plan for Employees (SIMPLE) IRAs: Designed specifically for businesses with fewer than 100 employees, these plans require less administration than 401(k)s while mandating employer contributions.

- Payroll Deduction IRAs: The simplest option with minimal administrative requirements and no employer contributions, allowing employees to save through automatic payroll deductions.

- Profit-Sharing Plans: Flexible plans allowing employers to make discretionary contributions to employee retirement accounts, which can vary based on company performance.

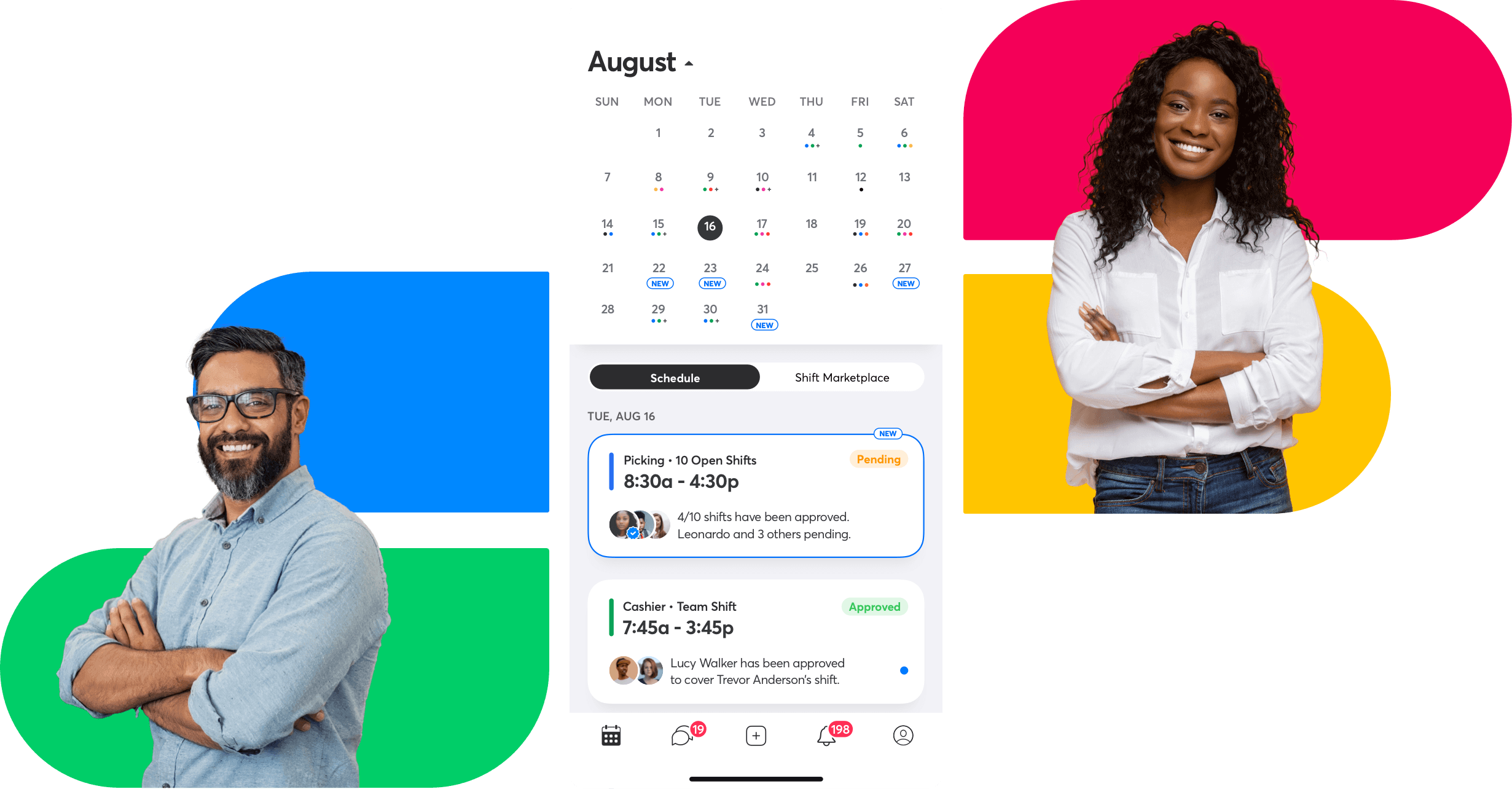

Each plan type offers different levels of flexibility in terms of contribution management and administrative requirements. Denton businesses should evaluate these options in the context of their specific workforce demographics, budget constraints, and long-term objectives. Implementing an effective employee scheduling software like Shyft can help manage related HR processes more efficiently.

Key Benefits of Offering Retirement Plans in Denton

Establishing retirement benefits provides numerous advantages for both Denton employers and their workforce. Understanding these benefits can help build a compelling case for implementing a retirement plan, even for smaller businesses with limited resources. Retirement plans serve as powerful tools for enhancing your overall employee value proposition and supporting long-term business success.

- Enhanced Recruitment Capabilities: In Denton’s competitive job market, offering retirement benefits helps attract skilled talent, particularly for industries like healthcare, education, and technology where benefit expectations are high.

- Improved Employee Retention: Retirement plans create financial incentives for long-term employment, reducing turnover costs and preserving institutional knowledge. Studies show benefits of reducing employee turnover include significant cost savings.

- Tax Advantages for Employers: Businesses can generally deduct contributions made to employee retirement plans, and certain start-up costs may qualify for tax credits specifically designed for small businesses.

- Enhanced Employee Financial Wellness: Retirement plans help employees build long-term financial security, which can reduce financial stress and improve workplace productivity.

- Competitive Positioning: Offering retirement benefits helps Denton SMBs compete with larger employers and positions your business as one that invests in its workforce.

By implementing retirement benefits, Denton businesses can create a more engaged workforce while reaping significant tax advantages. This investment in employee well-being often translates to improved employee satisfaction and productivity. Utilizing workforce management tools like Shyft’s team communication features can help effectively communicate these benefits to employees.

Legal and Compliance Considerations for Denton Businesses

Retirement plans are subject to complex federal regulations that protect participants’ interests and ensure proper plan administration. Denton businesses must navigate these compliance requirements carefully to avoid penalties and maintain plan qualification status. Understanding the legal framework is essential for implementing and managing a successful retirement program.

- ERISA Compliance: The Employee Retirement Income Security Act establishes standards for retirement plans, including reporting requirements, fiduciary responsibilities, and participant rights. SMBs must understand these obligations regardless of plan size.

- Non-Discrimination Testing: Most qualified retirement plans must undergo annual testing to ensure they don’t disproportionately benefit highly compensated employees or owners, requiring careful labor compliance monitoring.

- IRS Filing Requirements: Depending on the plan type, businesses may need to file Form 5500 annually, with potential penalties for late or incomplete filings. Smaller plans may qualify for simplified reporting options.

- Fiduciary Responsibilities: Plan sponsors have legal obligations to act in participants’ best interests, requiring prudent selection of investments, reasonable fees, and appropriate plan oversight.

- Participant Disclosures: Employers must provide specific information to employees about plan features, investment options, fees, and performance—requiring effective employee communication systems.

Staying compliant with these regulations requires ongoing attention and expertise. Many Denton businesses work with retirement plan specialists, third-party administrators, or financial advisors to ensure proper compliance. Implementing systematic approaches to compliance training and leveraging digital tools for documentation can streamline these requirements, allowing your business to focus on core operations while maintaining regulatory adherence.

Selecting the Right Service Providers for Your Retirement Plan

Choosing qualified service providers is crucial for establishing and maintaining an effective retirement plan. Denton businesses should carefully evaluate potential partners based on expertise, service offerings, fees, and track record. The right service providers can significantly reduce administrative burden while enhancing plan performance and compliance.

- Third-Party Administrators (TPAs): These specialists handle day-to-day plan operations, compliance testing, and government filings. Look for TPAs with experience serving similar-sized Denton businesses in your industry.

- Financial Advisors: Qualified advisors help with plan design, investment selection, and employee education. Seek advisors with fiduciary capability and retirement plan expertise rather than general financial planners.

- Recordkeepers: These providers maintain participant accounts, process contributions, and provide statements and online access. Evaluate their technology platforms, customer service, and reporting and analytics capabilities.

- Investment Managers: Responsible for selecting and monitoring plan investment options. Consider their investment philosophy, performance history, and fee structures.

- ERISA Attorneys: Specialized legal counsel for complex compliance issues and plan document preparation. Local attorneys familiar with Denton business regulations may offer additional insights.

When evaluating providers, consider their ability to integrate with your existing HR and payroll systems. Providers that offer integration capabilities with workforce management tools like Shyft can streamline operations and reduce administrative errors. Request references from other Denton businesses, particularly those in your industry, and consider conducting formal RFPs for larger plans. Regular provider reviews should be part of your ongoing resource utilization optimization strategy.

Designing an Effective Retirement Plan for Your Denton Workforce

Creating a retirement plan that meets both your business objectives and employee needs requires thoughtful design considerations. Denton businesses should customize their plans based on workforce demographics, competitive benchmarking, and financial capabilities. A well-designed plan balances cost control with attractive benefits that drive employee participation and appreciation.

- Contribution Structures: Determine whether to offer employer matching, profit-sharing, or non-elective contributions. Consider tiered matching formulas that reward longer service while managing overall costs.

- Eligibility Requirements: Define who can participate based on age, service requirements, and employment classification. Balancing inclusivity with administrative efficiency is key for reducing administrative costs.

- Vesting Schedules: Establish when employees gain ownership of employer contributions, using either cliff (all at once) or graded (incremental) vesting to promote retention.

- Investment Options: Select a diverse range of investment choices that accommodate varying risk tolerances and retirement horizons while avoiding overwhelming employees with too many options.

- Automatic Features: Consider auto-enrollment and auto-escalation features to boost participation and contribution rates, while providing appropriate opt-out provisions.

Effective plan design should incorporate feedback from employees through surveys or focus groups. Understanding your workforce’s retirement readiness and financial priorities can help tailor a plan that addresses their specific needs. Tools for employee feedback collection can facilitate this process. Additionally, consider how your retirement benefits integrate with other components of your compensation package, creating a holistic approach to workforce planning and talent management.

Implementing Your Retirement Plan in Denton

Once you’ve selected a plan type and designed its features, proper implementation is crucial for success. A systematic approach to rollout ensures compliance, minimizes disruptions, and promotes employee understanding and participation. Denton businesses should develop a comprehensive implementation timeline with clear responsibilities and milestones.

- Documentation Preparation: Work with service providers to develop required plan documents, including the plan document, summary plan description, and adoption agreement in compliance with IRS requirements.

- Administrative Setup: Establish procedures for contribution processing, enrollment, distributions, and loans. Configure payroll systems to handle retirement contributions accurately.

- Employee Communication Strategy: Develop comprehensive materials explaining plan benefits, enrollment procedures, and investment options. Consider using team communication tools for consistent messaging.

- Educational Programs: Schedule workshops, webinars, or one-on-one sessions to help employees understand the retirement plan and make informed decisions about participation and investments.

- Testing and Quality Assurance: Verify that all systems and processes work correctly before full implementation, including contribution calculations, investment allocations, and reporting mechanisms.

Creating a cross-functional implementation team with representatives from HR, finance, IT, and operations ensures all aspects of the plan are properly addressed. Effective project management tools can help coordinate these efforts. Consider a phased rollout approach, particularly for larger organizations, to manage change effectively and address issues before full deployment. Document all implementation steps for future reference and compliance purposes, utilizing documentation practices that ensure accessibility and completeness.

Employee Education and Communication Strategies

Effective communication is essential for maximizing retirement plan participation and helping employees make informed decisions. Denton businesses should develop comprehensive education strategies that address diverse learning styles, financial literacy levels, and language preferences. Well-informed employees are more likely to appreciate and utilize retirement benefits effectively.

- Multi-Channel Communication: Utilize various formats including in-person meetings, digital resources, printed materials, and video content to reach all employees effectively using communication channels that resonate with your workforce.

- Clear, Jargon-Free Messaging: Present retirement concepts in simple, accessible language with relevant examples and visual aids to improve understanding across all education levels.

- Personalized Guidance: Offer individual consultations with financial advisors to address specific employee situations and questions, particularly during initial enrollment and life changes.

- Ongoing Education Program: Establish a year-round communication calendar with regular touchpoints about retirement planning, investment basics, and plan features rather than one-time enrollment events.

- Technology Solutions: Implement retirement planning calculators, mobile apps, and online portals to help employees track progress and model different savings scenarios.

Tailor communications to different employee segments based on age, career stage, and financial goals. Younger employees may need basic education about the importance of early saving, while those approaching retirement require guidance on distribution options and transition planning. Leverage employee self-service tools to provide on-demand access to retirement information and account management. Regular feedback through surveys or focus groups can help refine your communication approach for maximum effectiveness, incorporating continuous improvement principles to your education strategy.

Managing and Optimizing Your Retirement Plan

Once your retirement plan is implemented, ongoing management and optimization are critical for long-term success. Regular review and refinement ensure the plan continues to meet business objectives, comply with changing regulations, and serve employee needs effectively. Denton businesses should establish a structured approach to plan management with clear responsibilities and performance metrics.

- Establish a Retirement Committee: Form a dedicated group responsible for plan oversight, including representatives from finance, HR, and operations to provide diverse perspectives on plan management.

- Regular Plan Reviews: Conduct quarterly and annual reviews of plan performance, participation rates, investment options, and administrative procedures to identify improvement opportunities.

- Compliance Monitoring: Stay current with regulatory changes affecting retirement plans through industry resources, advisor updates, and compliance monitoring systems.

- Fee Analysis: Periodically benchmark plan and investment fees against industry standards to ensure cost-effectiveness and fulfillment of fiduciary responsibilities.

- Participation Strategies: Develop targeted approaches to boost enrollment and contribution rates, particularly among employee segments with lower participation.

Use data-driven decision making to guide plan adjustments based on utilization patterns, demographic changes, and financial metrics. Consider conducting periodic re-enrollment campaigns to engage employees who initially opted out or to update investment allocations. Leverage technology solutions for efficient plan administration, including integration with payroll software integration and HR systems. Document all plan management activities and decisions to demonstrate prudent processes and support compliance requirements.

Tax Considerations for Denton SMB Retirement Plans

Tax advantages represent one of the most significant benefits of employer-sponsored retirement plans. Understanding these tax implications helps Denton businesses maximize financial benefits while ensuring compliance with IRS requirements. Strategic tax planning should be integrated into retirement plan design and management.

- Employer Tax Deductions: Contributions to employee retirement accounts are generally tax-deductible business expenses, reducing your company’s taxable income while providing valuable benefits.

- Tax Credits for Plan Startup: Small businesses may qualify for tax credits of up to $5,000 annually for the first three years to offset retirement plan startup costs, including administration and employee education expenses.

- Additional Auto-Enrollment Credit: An additional tax credit is available for small employers who include automatic enrollment features in their retirement plans, encouraging higher participation rates.

- Employee Tax Benefits: Traditional pre-tax contributions reduce employees’ current taxable income, while Roth options provide tax-free growth and qualified withdrawals in retirement.

- Annual Contribution Limits: Stay informed about IRS-established contribution limits that change periodically with inflation adjustments to ensure plan compliance.

Work with tax professionals familiar with Denton business regulations to optimize your plan’s tax efficiency. Consider how retirement benefits integrate with your overall tax strategy and business financial planning. Maintain meticulous records of all plan contributions, distributions, and related expenses to support tax filings and potential audits. Educate employees about the tax advantages of participation as part of your broader financial wellness and training programs, which can increase appreciation of this valuable benefit.

Local Denton Resources for Retirement Plan Setup

Denton businesses can leverage local resources to support retirement plan implementation and management. Connecting with regional expertise and networks provides valuable insights into local market conditions, peer practices, and specialized service providers familiar with the North Texas business environment. These resources can complement national providers and offer more personalized guidance.

- Denton Chamber of Commerce: Offers networking opportunities, educational events, and connections to local financial professionals with expertise in small business retirement planning.

- North Texas SBDC: The Small Business Development Center provides free consulting services and workshops that can include guidance on benefits planning and implementation.

- Local Financial Advisors: Denton-based advisors understand the regional business climate and can provide contextually relevant guidance on retirement plan design and investment options.

- Professional Associations: Industry-specific groups in the Denton area often share best practices for benefits administration and can provide benchmarking data for your sector.

- University Resources: The University of North Texas and Texas Woman’s University offer workforce research, continuing education, and business development resources that can support benefits planning.

Building relationships with local service providers who understand Denton’s unique business environment can enhance your retirement plan’s effectiveness. Consider implementing workforce analytics to better understand your employees’ needs and preferences regarding retirement benefits. Local networking events and business forums provide opportunities to learn from other Denton employers about their experiences with various retirement plans and providers, helping you avoid common pitfalls and identify successful strategies for your HR management systems integration.

Conclusion

Implementing an employee retirement plan represents a significant investment in your workforce’s financial future and your business’s competitive positioning in the Denton market. By carefully evaluating plan options, understanding compliance requirements, selecting qualified service providers, and developing effective education strategies, SMBs can create retirement programs that deliver value to both the organization and its employees. Remember that retirement plans should evolve with your business, requiring ongoing management and periodic reassessment to ensure continued alignment with company objectives and employee needs.

For Denton businesses, the journey to retirement plan implementation begins with clear objectives and thoughtful planning. Start by assessing your workforce demographics and financial resources, then consult with qualified advisors to design a plan tailored to your specific situation. Prioritize employee education and communication to maximize participation and appreciation. Establish robust administrative processes and regular review procedures to ensure ongoing compliance and effectiveness. By taking a systematic approach to retirement plan setup and management, your business can enhance its employer brand, improve workforce stability, and contribute to the financial wellbeing of the people who drive your company’s success.

FAQ

1. What is the minimum size business that should consider offering a retirement plan in Denton?

There’s no minimum size requirement for establishing a retirement plan. Even solo entrepreneurs and very small businesses can benefit from retirement plans like SEP IRAs or Solo 401(k)s that offer tax advantages and savings opportunities. As businesses grow, different plan types become more appropriate based on workforce size and administrative capacity. Small businesses in Denton should evaluate options like SIMPLE IRAs that are specifically designed for organizations with fewer than 100 employees and have simpler administration requirements than traditional 401(k) plans.

2. How much does it typically cost to set up and administer a retirement plan for a small business in Denton?

Costs vary significantly based on plan type, complexity, and provider. Initial setup fees can range from virtually nothing for basic plans like payroll deduction IRAs to several thousand dollars for customized 401(k) plans. Ongoing administration costs typically include base fees plus per-participant charges, ranging from a few hundred to several thousand dollars annually. Investment management fees, typically calculated as a percentage of assets, represent an additional expense. Many small businesses in Denton can offset initial costs with available tax credits of up to $5,000 per year for the first three years, making even more robust plans financially feasible.

3. Are there retirement plan options that don’t require employer contributions?

Yes, several retirement plan options don’t require employer contributions. Payroll Deduction IRAs allow employees to save through automatic payroll deductions with no employer contribution requirement. Traditional 401(k) plans can be designed without mandatory employer contributions, though matching contributions often encourage higher participation rates. Safe Harbor 401(k) plans require employer contributions but offer simplified compliance testing. SEP IRAs require employer-only contributions but provide flexibility in contribution amounts, which can be adjusted annually based on business performance or even skipped in challenging financial years.

4. How frequently should we review our Denton business’s retirement plan?

At minimum, conduct an annual comprehensive review of your retirement plan, evaluating participation rates, investment performance, fee structures, and compliance status. Quarterly monitoring is recommended for investment options and participation metrics. Additionally, review your plan whenever significant business changes occur, such as mergers, acquisitions, substantial workforce changes, or major shifts in company financial position. Regulatory changes should also trigger plan reviews to ensure continued compliance. Establish a retirement committee that meets regularly to oversee the plan and document all review processes and decisions to demonstrate prudent management practices.

5. What are the consequences of non-compliance with retirement plan regulations?

Non-compliance consequences can be severe, including plan disqualification (resulting in immediate taxation of all plan assets), excise taxes, penalties, and potential fiduciary liability. The IRS can impose penalties for late or missed Form 5500 filings, ranging from $250 to $150,000 depending on the violation severity. Prohibited transactions can result in excise taxes of 15% of the transaction amount. Fiduciary breaches may lead to personal liability for plan losses. Department of Labor investigations can result in additional penalties and corrective actions. However, voluntary correction programs are available that allow plan sponsors to address compliance issues with reduced penalties when proactively reported.