Setting up an employee retirement plan is a critical step for small and medium-sized businesses (SMBs) in Queens, New York looking to attract and retain top talent while securing their employees’ financial futures. In today’s competitive job market, retirement benefits have become an essential component of a comprehensive employee benefits package, particularly in high-cost-of-living areas like New York City. Queens-based businesses face unique challenges related to the diverse workforce, varying industry requirements, and specific New York State regulations that must be navigated carefully when establishing retirement plan options.

For HR professionals and business owners in Queens, implementing the right retirement plan requires careful consideration of costs, administrative requirements, and employee needs. With various plan types available—from traditional 401(k)s to SEP IRAs and SIMPLE plans—each offering different advantages for both employers and employees, choosing the most appropriate option can significantly impact a business’s financial health and workforce stability. This comprehensive guide will explore everything Queens-based SMBs need to know about setting up employee retirement plans, including compliance requirements, provider selection, implementation strategies, and best practices for maximizing both employer and employee benefits.

Understanding Retirement Plan Options for SMBs in Queens

Navigating the various retirement plan options available to small and medium-sized businesses in Queens requires understanding the specific advantages, requirements, and limitations of each plan type. The right choice depends on factors such as company size, budget constraints, and workforce demographics. Queens businesses should consider both federal guidelines and New York State-specific requirements when evaluating different retirement plan structures.

- Traditional 401(k) Plans: Offer high contribution limits ($23,000 for 2023, with $7,500 catch-up for those 50+), flexibility in plan design, and potential employer matching, making them attractive for growing Queens businesses with 10+ employees.

- SEP IRAs (Simplified Employee Pension): Ideal for self-employed individuals or very small businesses in Queens, featuring simplified administration, employer-only contributions of up to 25% of compensation, and minimal paperwork requirements.

- SIMPLE IRAs (Savings Incentive Match Plan for Employees): Well-suited for Queens businesses with fewer than 100 employees, requiring mandatory employer contributions but offering easier administration than 401(k) plans.

- Solo 401(k) Plans: Perfect for self-employed individuals in Queens with no employees (except a spouse), providing the highest possible contribution limits through both employer and employee contributions.

- New York State Secure Choice Savings Program: A state-facilitated retirement savings option that provides Queens businesses with a simple way to offer retirement benefits with minimal administrative burden.

When selecting the appropriate plan, Queens business owners should consider factors beyond just cost, including employee expectations in the competitive New York job market, administrative capacity, and long-term business growth projections. Workforce analytics can help businesses understand employee demographics and preferences to guide this important decision.

Legal Requirements and Compliance for Retirement Plans

Compliance with federal and state regulations is essential when establishing a retirement plan for your Queens-based business. The regulatory landscape for retirement plans is complex and requires careful attention to reporting requirements, fiduciary responsibilities, and employee protections. Failing to meet these obligations can result in significant penalties and potential legal liability for business owners.

- ERISA Compliance: Most employer-sponsored retirement plans are subject to the Employee Retirement Income Security Act (ERISA), which sets minimum standards for plan features, funding, participation, vesting, and disclosure to participants.

- IRS Reporting Requirements: Annual reporting obligations include Form 5500 filing, which varies in complexity based on plan size and type, with specific deadlines that Queens businesses must adhere to.

- Fiduciary Responsibilities: Plan sponsors in Queens must act solely in the interest of plan participants, exercise prudence in managing plan assets, diversify investments to minimize risk, and follow plan documents.

- New York State Regulations: In addition to federal requirements, Queens businesses must comply with NY-specific regulations, including potential requirements under the New York State Secure Choice Savings Program for businesses that don’t offer retirement plans.

- Non-Discrimination Testing: Qualified retirement plans must undergo annual testing to ensure they don’t disproportionately benefit highly compensated employees, a particular concern for Queens businesses with varied compensation structures.

Working with experienced retirement plan professionals who understand both federal requirements and New York State regulations is crucial for Queens businesses. Labor compliance expertise can help ensure all regulatory requirements are met while minimizing administrative burden. Additionally, utilizing compliance with labor laws resources can keep your business updated on changing regulations.

Setting Up a 401(k) Plan for Queens-based SMBs

For many Queens-based SMBs, a 401(k) plan represents the gold standard in retirement benefits, offering significant tax advantages, high contribution limits, and the flexibility that employees value. Implementing a 401(k) involves several key steps and considerations to ensure the plan meets both business objectives and regulatory requirements.

- Plan Document Preparation: Creating legally sound plan documents that outline eligibility criteria, contribution formulas, vesting schedules, and distribution options in compliance with both federal and New York State requirements.

- Selecting a Plan Provider: Evaluating potential partners based on fee structures, investment options, administrative support, and technology platforms that integrate with existing HR management systems.

- Determining Contribution Structure: Deciding whether to offer employer matching contributions (and at what percentage), profit-sharing components, or non-elective contributions based on your Queens business’s financial capacity.

- Setting Up Payroll Integration: Ensuring seamless coordination between your payroll integration systems and 401(k) administration to facilitate accurate and timely contributions.

- Developing a Communication Strategy: Creating comprehensive educational materials and enrollment processes that address the diverse needs of Queens’ multicultural workforce.

Implementing a 401(k) plan typically takes 2-3 months from initial planning to employee enrollment, so Queens businesses should plan accordingly. Many providers now offer streamlined solutions specifically designed for small businesses, with simplified administration and competitive fee structures. Utilizing employee self-service portals can significantly reduce administrative burden while empowering employees to manage their retirement accounts.

Alternative Retirement Plans for Queens Small Businesses

While 401(k) plans are popular, they aren’t always the most suitable option for every Queens-based small business. Alternative retirement plans offer simplified administration, reduced costs, and specific advantages that might better align with certain business models and workforce needs, particularly for businesses with fewer employees or fluctuating revenue streams.

- SEP IRA Benefits: Offers tax-deductible employer contributions up to 25% of compensation (maximum $66,000 for 2023), minimal paperwork, no annual filing requirements, and flexibility to adjust contribution amounts annually based on business performance.

- SIMPLE IRA Advantages: Features employee salary deferrals up to $15,500 (2023) with $3,500 catch-up contributions, mandatory but straightforward employer contributions (either 2% fixed or 3% matching), and simplified administration compared to 401(k) plans.

- Payroll Deduction IRAs: Represents the simplest option for Queens micro-businesses, requiring no employer contributions or ERISA compliance, while still facilitating employee retirement savings through convenient payroll deductions.

- Cash Balance Plans: Offers higher contribution limits than 401(k)s, making them attractive for high-earning business owners in Queens looking to accelerate retirement savings while providing defined benefits to employees.

- Multiple Employer Plans (MEPs): Allows smaller Queens businesses to join together to offer retirement benefits with shared administration and potentially reduced costs compared to establishing individual plans.

Each alternative has distinct eligibility requirements, contribution limits, and administrative processes that Queens business owners should evaluate based on their specific situation. For businesses with seasonal staffing needs or those in industries common to Queens like hospitality, retail, or healthcare, certain plan types may offer more appropriate flexibility in contribution structures.

Selecting the Right Retirement Plan Provider

Choosing the right retirement plan provider is a critical decision that will impact both your administrative experience as an employer and your employees’ satisfaction with their retirement benefits. For Queens-based businesses, this selection should consider factors beyond just cost, including service quality, investment options, and technological capabilities.

- Fee Structure Transparency: Evaluate providers based on clear disclosure of all fees, including administrative fees, investment management fees, participant fees, and any hidden charges that could impact long-term plan performance.

- Investment Option Quality: Assess the diversity, performance history, and expense ratios of available investment options, ensuring they meet the needs of a diverse Queens workforce with varying investment knowledge and risk tolerances.

- Technology Platform Usability: Prioritize providers offering intuitive mobile access and robust online tools that integrate with existing HR systems, facilitating easier administration and employee engagement.

- Customer Service and Support: Consider the availability of dedicated support teams, educational resources in multiple languages (reflecting Queens’ diversity), and on-site enrollment assistance capabilities.

- Fiduciary Support Services: Evaluate providers offering fiduciary services that can help Queens business owners navigate complex compliance requirements and mitigate legal risk.

Request detailed proposals from multiple providers and carefully compare their offerings against your specific requirements. Many Queens businesses benefit from working with providers who have experience serving similar-sized companies in the New York metro area and understand local market conditions. Vendor comparison frameworks can help systematically evaluate different options to make the most informed decision for your business and employees.

Employee Education and Participation Strategies

The success of your retirement plan ultimately depends on employee participation and engagement. For Queens-based businesses with diverse workforces, developing effective education and communication strategies is essential to encourage enrollment and help employees make informed decisions about their retirement savings.

- Multilingual Communication Materials: Develop retirement plan information in multiple languages reflective of Queens’ diverse population (particularly Spanish, Chinese, Korean, and South Asian languages) to ensure all employees understand their benefits.

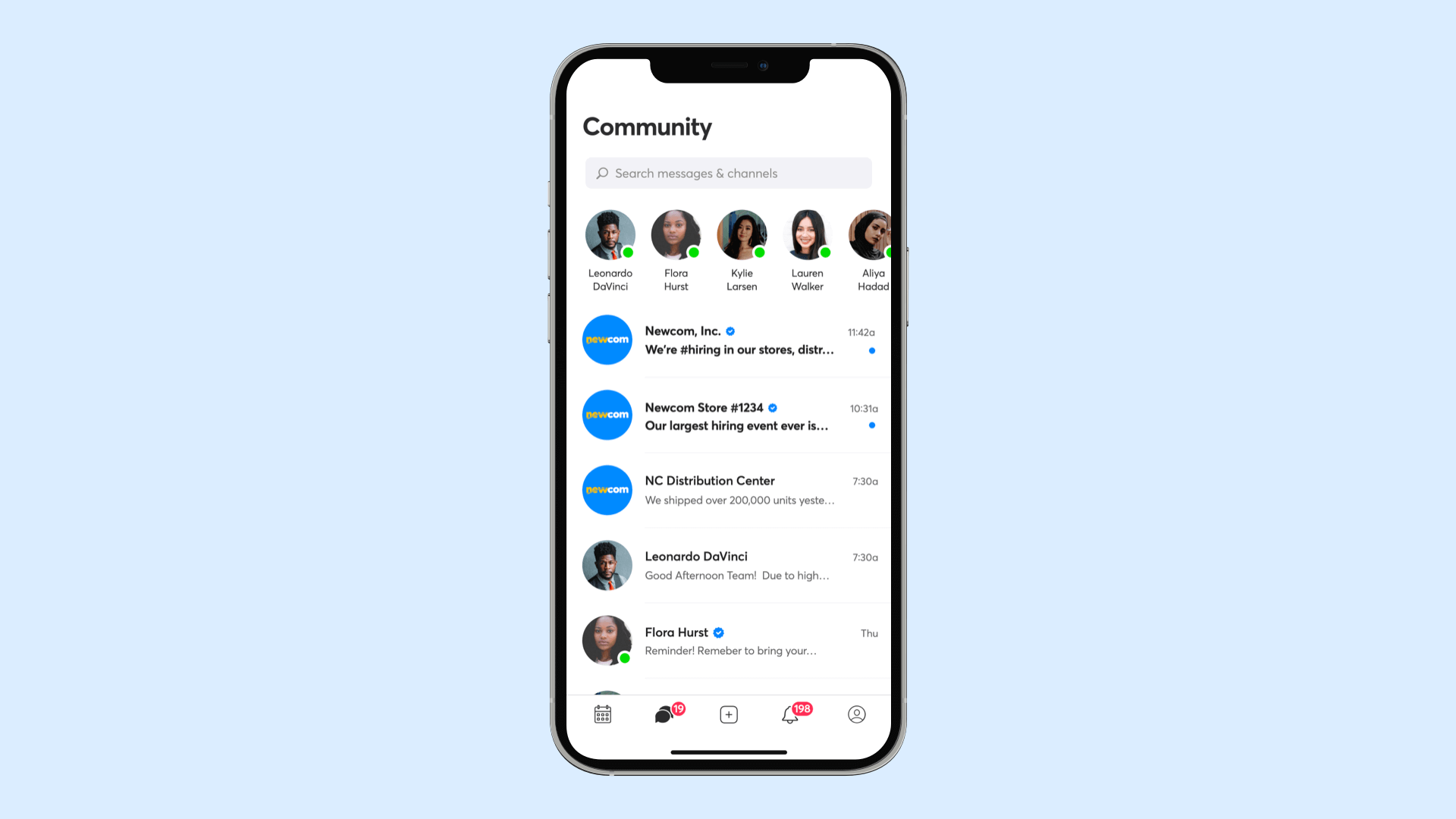

- Digital and In-Person Education Options: Implement a hybrid approach to financial education, combining team communication channels with in-person workshops to accommodate different learning preferences and work schedules.

- Auto-Enrollment Features: Consider implementing automatic enrollment with opt-out options to increase participation rates, particularly effective for overcoming inertia in retirement planning decisions.

- Financial Wellness Programs: Extend beyond retirement-specific education to broader financial literacy topics, addressing the diverse economic challenges faced by Queens’ workforce.

- Regular Communication Schedule: Establish ongoing retirement benefit communications through multiple channels, including mobile experience platforms, to maintain awareness and engagement throughout the year.

Studies show that personalized education approaches yield higher participation rates. Consider using demographic data to tailor communications to different employee segments within your Queens business. For example, younger employees might respond better to messaging about long-term growth potential, while older employees may be more concerned with catch-up contribution strategies. Utilizing employee engagement techniques can significantly improve participation rates and satisfaction with retirement benefits.

Administrative Considerations and Technology Solutions

Efficient administration is crucial for managing retirement plans effectively while minimizing the burden on HR staff. For Queens-based SMBs with limited administrative resources, leveraging appropriate technology solutions can streamline processes, ensure compliance, and improve the overall experience for both employers and employees.

- Payroll System Integration: Implement seamless connections between your retirement plan and payroll systems to automate contribution processing, reducing manual data entry and potential errors through payroll software integration.

- Compliance Monitoring Tools: Utilize platforms that automatically track regulatory requirements, deadlines, and testing needs to ensure your Queens business maintains compliance with changing federal and New York State regulations.

- Employee Self-Service Portals: Provide user-friendly interfaces where employees can manage their accounts, adjust contribution rates, and access educational resources without requiring HR intervention.

- Mobile Accessibility: Ensure retirement plan information and account management features are available through mobile-first communication strategies, accommodating the on-the-go lifestyle of Queens’ workforce.

- Reporting and Analytics Capabilities: Leverage platforms offering comprehensive reporting and analytics to track participation rates, investment performance, and other key metrics for ongoing plan evaluation.

When evaluating technology solutions, consider both current needs and future scalability as your Queens business grows. Many providers now offer integrated platforms specifically designed for small businesses that combine retirement plan administration with broader HR functions. This integrated approach can reduce overall administrative costs while providing a more seamless experience for employees. Regular system audits and updates are essential to ensure your technology continues to meet evolving business needs and compliance requirements.

Cost Management and Budgeting for Retirement Plans

Understanding and effectively managing the costs associated with retirement plans is essential for Queens-based SMBs operating with constrained budgets. While offering retirement benefits represents an investment in your workforce, careful planning can help control expenses while still providing valuable benefits.

- Plan Setup Costs: Initial establishment fees typically range from $500-$3,000 depending on plan complexity, with potential for negotiation based on provider relationships and business size.

- Ongoing Administrative Expenses: Annual costs include recordkeeping fees ($20-$50 per participant), compliance testing ($800-$3,000 annually), and form preparation fees that should be clearly outlined in service agreements.

- Investment Management Fees: These asset-based fees (typically 0.5%-1.5% of assets) significantly impact long-term returns and should be carefully evaluated when selecting investment options.

- Tax Incentives and Credits: Queens businesses should leverage available tax benefits, including the SECURE Act’s start-up tax credit (up to $5,000 annually for three years) and deductions for employer contributions.

- Fee Allocation Strategies: Decisions about whether the business absorbs all fees or shares costs with employees should balance cost management with employee perception of the benefit value.

Develop a comprehensive budget that accounts for both fixed costs and variable expenses that will change as your workforce grows. For Queens businesses with seasonal fluctuations, consider how varying employee counts might impact costs throughout the year. Regularly benchmark your plan costs against industry standards and similar-sized businesses in the Queens area to ensure you’re receiving competitive pricing. Many providers offer pricing advantages for automation impacts that reduce administrative burden.

Measuring Success and Plan Optimization

Once your retirement plan is established, ongoing evaluation and optimization are essential to ensure it continues to meet both business objectives and employee needs. For Queens-based SMBs, regular assessment of plan performance using key metrics can identify improvement opportunities and demonstrate the value of your investment in retirement benefits.

- Participation Rate Tracking: Monitor the percentage of eligible employees enrolled in the plan, aiming for rates above 80%, with special attention to participation across different demographic groups within Queens’ diverse workforce.

- Average Deferral Rates: Analyze employee contribution percentages, targeting an average of at least 6% of salary, while tracking trends by department, age group, and salary level.

- Investment Performance Assessment: Regularly review the performance of plan investment options against appropriate benchmarks, ensuring they continue to provide competitive returns with reasonable fees.

- Employee Satisfaction Surveys: Conduct periodic assessments of employee satisfaction with retirement benefits, including ease of use, educational resources, and perceived value within the total compensation package.

- Retirement Readiness Metrics: Evaluate whether employees are on track for retirement security by analyzing projected income replacement ratios across different workforce segments.

Establish an annual review process that includes benchmarking your plan against industry standards and local competitors in Queens. Consider forming a retirement plan committee that includes representatives from different departments to provide diverse perspectives on plan performance and employee needs. Data-driven decision making should guide plan modifications, with careful documentation of the review process to demonstrate fiduciary responsibility. Remember that plan optimization is an ongoing process that should adapt to changing business conditions, workforce demographics, and regulatory requirements.

Future Trends in SMB Retirement Plans

The landscape of retirement plans for small and medium-sized businesses continues to evolve, influenced by regulatory changes, technological innovations, and shifting workforce expectations. Queens-based businesses should stay informed about emerging trends to ensure their retirement benefits remain competitive and aligned with best practices.

- Pooled Employer Plans (PEPs): These new plan structures, authorized by the SECURE Act, allow unrelated employers to join a single 401(k) plan, potentially reducing costs and administrative burden for Queens SMBs through economies of scale.

- Financial Wellness Integration: Retirement plans increasingly incorporate broader financial wellness components, addressing issues like emergency savings, student loan assistance, and budgeting tools alongside traditional retirement saving.

- ESG Investment Options: Growing interest in environmental, social, and governance factors is driving demand for socially responsible investment options within retirement plans, particularly among younger workers in diverse urban areas like Queens.

- Artificial Intelligence Applications: AI solutions for employee engagement are transforming retirement plan administration, from personalized investment recommendations to automated compliance monitoring and anomaly detection.

- State-Mandated Programs: The evolution of New York’s Secure Choice program and similar initiatives in neighboring states may impact the competitive landscape and compliance requirements for Queens businesses.

Stay informed about legislative developments, including potential federal changes that could impact retirement plan regulations and incentives. Industry associations, financial advisors, and technology in shift management resources can provide valuable insights into emerging trends. Consider how these developments might align with your business strategy and workforce needs in the coming years. As remote and hybrid work arrangements become more permanent, retirement benefits that offer flexibility and digital accessibility will be increasingly important for attracting and retaining talent in the competitive Queens business environment.

Conclusion

Establishing an employee retirement plan represents a significant step for Queens-based SMBs committed to supporting their workforce’s financial future while enhancing their competitive position in the talent marketplace. By carefully evaluating the various plan options, compliance requirements, provider partnerships, and implementation strategies outlined in this guide, business owners and HR professionals can design retirement benefits that balance organizational objectives with employee needs. Remember that retirement plan implementation is not a one-time event but an ongoing process requiring regular review and optimization to maximize value for both the business and its employees.

As you move forward with retirement plan implementation, prioritize clear communication, technological integration, and measurable goals to track success. Leverage available resources, including financial advisors with expertise in the Queens business environment, industry associations, and plan providers offering specialized solutions for small businesses. Consider your retirement plan as part of a comprehensive benefits strategy that supports recruitment, retention, and overall employee wellbeing. With thoughtful planning and ongoing management, your retirement benefit offering can become a cornerstone of your employer value proposition, contributing to business success while helping employees build financial security for their future.

FAQ

1. What are the minimum requirements for offering a retirement plan to employees in Queens, NY?

There are no strict minimum requirements for offering a retirement plan in Queens, as most plans are governed by federal rather than local regulations. However, different plan types have varying eligibility rules. For 401(k) plans, you can generally establish eligibility criteria requiring employees to be at least 21 years old and have completed one year of service (1,000 hours). For SIMPLE IRAs, you must include employees who earned at least $5,000 in the previous two years and are expected to earn at least $5,000 in the current year. SEP IRAs typically must include all employees who are at least 21 years old, have worked for you in three of the last five years, and received at least $650 in compensation for 2023. Note that while New York State doesn’t currently mandate employers to offer retirement plans, the NY Secure Choice Savings Program may eventually require businesses without retirement plans to automatically enroll employees in the state program.

2. How can small businesses in Queens maximize tax benefits from offering retirement plans?

Queens-based small businesses can maximize tax benefits through several strategies. First, take advantage of the SECURE Act’s start-up tax credit, which allows eligible employers to claim up to $5,000 annually for the first three years to offset retirement plan startup costs. An additional tax credit of up to $500 per year for three years is available for implementing automatic enrollment. Employer contributions to employee retirement accounts are tax-deductible business expenses, reducing your company’s taxable income. For self-employed individuals or business owners, personal contributions to plans like Solo 401(k)s or SEP IRAs can significantly reduce personal tax liability. Consider working with a tax professional familiar with both federal tax incentives and New York State tax considerations to optimize your approach. Timing business contributions strategically within your fiscal year can help manage cash flow while maximizing tax advantages. Finally, proper documentation of all plan-related expenses is essential for claiming applicable deductions and credits.

3. What are the reporting and disclosure requirements for SMB retirement plans in New York?

Reporting and disclosure requirements vary by plan type, but most employer-sponsored retirement plans in New York must comply with federal ERISA regulations. This typically includes filing Form 5500 annually with the IRS and Department of Labor, with filing complexity depending on plan size. Plans must provide Summary Plan Descriptions (SPDs) to participants explaining plan features and benefits in understandable language. Annual fee disclosures detailing investment options and associated costs are required, as are individual benefit statements (quarterly for participant-directed plans, annually for others). Material modifications to the plan must be communicated through Summary of Material Modifications (SMM) documents. While New York State doesn’t impose additional major reporting requirements beyond federal regulations, Queens businesses should stay informed about potential changes related to the NY Secure Choice program. Additionally, plans must maintain records of all notices, disclosures, and participant communications for potential DOL or IRS audits. Working with a plan administrator familiar with both federal requirements and any New York-specific considerations can help ensure compliance.

4. How can Queens-based businesses encourage higher employee participation in retirement plans?

Queens businesses can boost retirement plan participation through several proven strategies. Implementing automatic enrollment (with opt-out options) can dramatically increase participation rates, often achieving 90%+ compared to 70% with traditional enrollment. Offering employer matching contributions creates a powerful financial incentive—even matching 50% of contributions up to 6% of salary can significantly drive participation. Developing culturally sensitive, multilingual education programs is particularly important in Queens’ diverse business environment. Consider team building tips that incorporate retirement plan education into regular activities. Simplifying enrollment processes through digital platforms with mobile technology access removes barriers to participation. Personalizing communications based on employee demographics and life stages increases relevance and engagement. Providing ongoing education through multiple channels helps maintain awareness and participation. Celebrating savings milestones creates positive reinforcement, while conducting periodic re-enrollment campaigns can capture employees who initially declined. Finally, integrating retirement planning with broader financial wellness initiatives addresses employees’ holistic financial needs, making retirement saving more achievable within their overall financial picture.

5. What are the costs associated with setting up and maintaining a retirement plan for a small business?

The costs of setting up and maintaining a retirement plan for Queens small businesses vary by plan type and provider but include several common elements. Initial setup fees typically range from minimal for SIMPLE IRAs (often $0-$500) to more substantial for 401(k) plans ($1,000-$3,000). Ongoing administrative costs include recordkeeping fees ($15-$60 per participant annually), annual compliance testing for 401(k) plans ($850-$3,000), and Form 5500 preparation ($500-$2,500). Investment management fees, usually expressed as a percentage of assets (0.5%-1.5%), represent the largest long-term cost and significantly impact investment returns. Additional services like plan design consulting, fiduciary services, or specialized employee education programs may incur extra fees. For 401(k) plans, total annual costs typically range from 1%-3% of plan assets, with larger plans achieving economies of scale. SIMPLE and SEP IRAs generally have lower administrative costs but fewer features and flexibility. Many providers now offer transparent pricing models specifically designed for small businesses. When evaluating costs, consider not just the expense but the value delivered in terms of plan features, service quality, investment performance, and employee satisfaction.