FICA payroll calculations represent a critical component of payroll processing for businesses in Akron, Ohio. The Federal Insurance Contributions Act (FICA) mandates the collection of Social Security and Medicare taxes from both employers and employees, requiring precise calculations to ensure compliance with federal regulations. For Akron businesses across manufacturing, healthcare, retail, and service industries, accurate FICA calculations directly impact bottom lines, employee satisfaction, and regulatory compliance. With Ohio’s specific tax considerations and Akron’s diverse economic landscape, local businesses need reliable tools to navigate these complex payroll requirements.

In today’s digital workplace, automated FICA payroll calculators have become essential tools for businesses seeking efficiency and accuracy in their payroll operations. These specialized calculators streamline the process of determining correct withholding amounts, reducing the risk of costly errors and penalties. For Akron employers managing workforces across multiple locations or dealing with complex scheduling scenarios, integrating FICA calculations with comprehensive employee scheduling solutions can significantly enhance operational efficiency while ensuring tax compliance.

Understanding FICA Taxes for Akron Employers

FICA taxes form the foundation of the federal social insurance program, directly affecting every employer and employee in Akron. Understanding the components and current rates is essential for accurate payroll processing and compliance with federal regulations. For businesses utilizing employee scheduling software, integrating FICA knowledge ensures more accurate labor cost projections.

- Social Security Tax Component: Currently set at 6.2% for both employers and employees on wages up to the annual wage base limit ($168,600 for 2024), creating a combined rate of 12.4% per employee.

- Medicare Tax Component: Set at 1.45% for both employers and employees with no wage base limit, plus an Additional Medicare Tax of 0.9% on earnings above $200,000.

- Self-Employment Considerations: Self-employed individuals in Akron must pay both the employer and employee portions, totaling 15.3% for Social Security and Medicare combined.

- Akron Industry Variations: Different industries prevalent in Akron, such as manufacturing, healthcare, and service sectors, may face unique FICA calculation challenges based on shift patterns and overtime structures.

- Tax Deposit Requirements: Akron employers must adhere to specific federal deposit schedules for FICA taxes based on their total tax liability.

Proper understanding of these FICA components enables Akron businesses to accurately calculate withholdings, especially when managing complex shift scheduling strategies that may affect overtime calculations and tax implications. Regular monitoring of tax rate changes and wage base adjustments is essential for maintaining compliance.

Key Features of Effective FICA Payroll Calculators

When selecting a FICA payroll calculator for your Akron business, certain features can significantly enhance accuracy and efficiency. The right calculator should seamlessly integrate with your existing systems, including any team communication platforms, to ensure smooth information flow between scheduling, attendance, and payroll functions.

- Automatic Tax Rate Updates: Premium calculators automatically incorporate the latest FICA tax rates and wage base limits without requiring manual adjustments, ensuring compliance with current regulations.

- Multi-State Calculation Capabilities: Essential for Akron businesses with employees working across state lines in Pennsylvania or elsewhere, handling different state tax implications alongside federal FICA requirements.

- Integration with Time Tracking: Synchronization with time tracking tools provides real-time data flow, ensuring accurate FICA calculations based on actual hours worked, including overtime.

- Customizable Reporting Functions: Advanced reporting capabilities allow Akron employers to generate detailed documentation for internal auditing, financial planning, and regulatory compliance purposes.

- Employee Portal Access: Transparent access for employees to view their FICA contributions, enhancing communication and reducing payroll inquiries.

Implementing a calculator with these features helps Akron businesses maintain compliance while streamlining operations. Modern scheduling software that integrates with payroll systems can further enhance efficiency by automatically feeding accurate work hours into FICA calculations, reducing manual data entry and associated errors.

Benefits of Automated FICA Calculations for Akron Businesses

Adopting automated FICA payroll calculators offers numerous advantages for Akron businesses across various industries. These tools not only streamline compliance efforts but also enhance overall operational efficiency, particularly when integrated with comprehensive workforce optimization software.

- Significant Time Savings: Automated calculators reduce the hours spent on manual calculations, allowing Akron payroll staff to focus on more strategic tasks while ensuring consistent accuracy.

- Error Reduction: Human error in FICA calculations can result in costly penalties; automation reduces this risk substantially, with some systems achieving near-perfect accuracy rates.

- Compliance Assurance: Built-in compliance features help Akron businesses stay updated with changing tax regulations, reducing the risk of audits and penalties from regulatory agencies.

- Enhanced Record-Keeping: Digital FICA calculation systems maintain comprehensive records, simplifying audit preparation and historical reporting requirements.

- Cost Projection Accuracy: When integrated with scheduling software, these calculators improve labor cost projections by accurately factoring in FICA contributions for scheduled shifts.

The cost-benefit analysis for Akron businesses typically shows positive ROI within the first year of implementing automated FICA calculation systems. Particularly for businesses in Akron’s manufacturing sector with complex shift patterns or healthcare organizations with varying staffing needs, these tools provide valuable support for payroll integration across multiple operational systems.

FICA Compliance Challenges Specific to Akron Employers

Akron employers face unique FICA compliance challenges influenced by the city’s diverse economic landscape and Ohio’s specific regulatory environment. Navigating these challenges requires attention to detail and often specialized solutions that can integrate with schedule optimization tools.

- Multi-Industry Workforce Considerations: Akron’s economy spans manufacturing, healthcare, education, and service sectors, each with unique payroll structures requiring different FICA calculation approaches.

- Seasonal Employment Fluctuations: Retail and tourism businesses in the Akron area experience seasonal staffing changes that create FICA calculation complexities, particularly regarding tax deposit schedules.

- Municipal Tax Interactions: Akron’s 2.5% income tax creates additional complexity when calculating total tax withholdings alongside FICA obligations, requiring synchronized systems.

- Cross-Border Employment: Employees commuting from neighboring counties or states present jurisdictional challenges for Akron employers managing FICA calculations.

- Union Contract Compliance: Many Akron manufacturers and public sector employers must navigate union agreements that impact FICA calculations for different employee classifications.

For organizations facing these challenges, implementing comprehensive labor compliance systems that include FICA calculators can significantly reduce risk and improve operational efficiency. The manufacturing sector in Akron, with its complex shift patterns, particularly benefits from integrated scheduling and payroll systems that account for FICA requirements across varying work schedules.

Integrating FICA Calculators with Workforce Management Systems

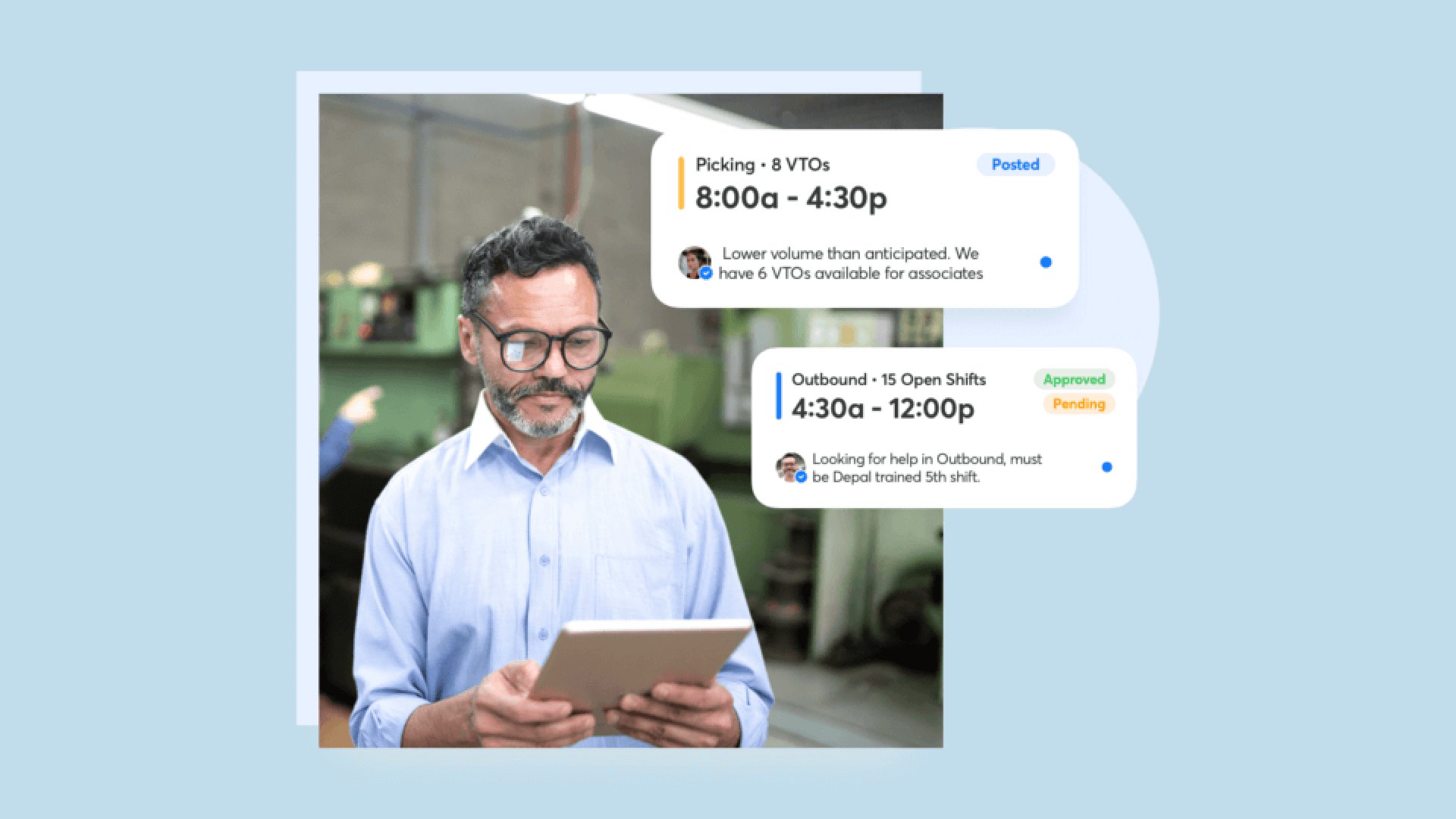

For optimal efficiency, Akron businesses should consider how FICA payroll calculators can integrate with broader workforce management systems, creating a seamless flow of information from scheduling to payroll processing. Integration eliminates data silos and reduces the manual transfer of information between systems, which is particularly valuable for businesses using shift marketplace solutions.

- Schedule-to-Payroll Automation: Direct data flow from employee scheduling systems to FICA calculators ensures that actual worked hours, including overtime, are accurately reflected in tax calculations.

- Time Tracking Integration: Connecting time clock data with FICA calculators provides real-time validation of hours worked against scheduled shifts, improving accuracy in tax withholding calculations.

- Employee Self-Service Portals: Integrated systems allow employees to view their scheduled hours, actual time worked, and resulting FICA contributions in a single interface, enhancing transparency.

- Cross-Departmental Access: Unified systems permit appropriate access for HR, management, and finance teams to FICA-related data, improving organizational communication.

- API Connectivity: Modern FICA calculators offer API connections to popular healthcare, retail, and manufacturing industry software used by Akron businesses.

By implementing integrated systems, Akron businesses can create efficient workflows that reduce administrative burden while improving compliance. Companies with variable staffing needs, like those in Akron’s retail and hospitality sectors, particularly benefit from solutions that connect scheduling flexibility with accurate FICA calculations, as discussed in flex scheduling best practices.

FICA Calculations for Special Employment Situations in Akron

Many Akron businesses deal with specialized employment situations that require careful consideration when calculating FICA taxes. From educational institutions to healthcare facilities, these scenarios present unique challenges that benefit from specialized calculation tools that work alongside comprehensive employee scheduling systems.

- Tipped Employees: Akron’s restaurant and hospitality sectors must account for tips when calculating FICA taxes, ensuring both reported tips and regular wages are properly incorporated.

- Exempt Student Workers: The University of Akron and other educational institutions must correctly identify student workers who qualify for FICA exemptions under specific IRS guidelines.

- Healthcare Workers with Multiple Employers: Medical professionals working at multiple Akron healthcare facilities require coordination of FICA calculations, especially regarding the Social Security wage base limit.

- Seasonal Manufacturing Employees: Akron’s manufacturing sector often employs seasonal workers, creating unique FICA calculation requirements for short-term employment periods.

- Municipal Government Employees: Some City of Akron employees may participate in alternative retirement systems that affect their FICA withholding requirements.

Advanced FICA calculators can handle these special situations through customizable settings that accommodate various employment classifications. For businesses managing complex employment scenarios, implementing systems that connect with retail or healthcare-specific scheduling tools provides comprehensive compliance support while streamlining administrative processes.

Selecting the Right FICA Calculator for Your Akron Business

Choosing the appropriate FICA calculator for your Akron business requires careful evaluation of several factors. The ideal solution should align with your specific industry needs, company size, and existing technology infrastructure, while potentially integrating with scheduling support resources.

- Industry-Specific Features: Seek calculators designed for your specific sector, whether manufacturing, healthcare, retail, or professional services, as each has unique FICA calculation requirements.

- Scalability Considerations: Select a system that can grow with your business, accommodating increased employee counts and additional locations without significant reconfiguration.

- Compliance Update Mechanisms: Prioritize calculators with automatic tax table updates to ensure your Akron business always applies current FICA rates and regulations.

- Integration Capabilities: Evaluate compatibility with your existing HR, accounting, and scheduling software to create a seamless information ecosystem.

- Support Services: Consider the availability of local Akron-based support or specialized virtual assistance for implementation and ongoing maintenance.

The investment in a quality FICA calculator typically delivers substantial returns through improved accuracy, reduced compliance risk, and administrative time savings. For businesses with complex scheduling needs, such as those in Akron’s manufacturing and healthcare sectors, solutions that integrate with workforce scheduling systems provide the most comprehensive benefits.

Implementing FICA Calculators in Akron Businesses

Successfully implementing a FICA payroll calculator requires careful planning and execution. Akron businesses should follow a structured approach to ensure smooth adoption and maximize the benefits of automation, particularly when integrating with existing hospitality or other sector-specific systems.

- Pre-Implementation Assessment: Conduct a thorough review of current FICA calculation processes, identifying pain points and compliance gaps that need addressing in the new system.

- Stakeholder Engagement: Involve finance, HR, and department managers in the selection process to ensure the calculator meets diverse operational needs across your Akron organization.

- Data Migration Planning: Develop a strategy for transferring historical payroll data to the new system, ensuring continuity in FICA reporting and compliance documentation.

- Staff Training Programs: Create comprehensive training for payroll staff and managers on the new calculator, emphasizing both technical operation and compliance implications.

- Phased Implementation: Consider a gradual rollout, particularly for larger Akron businesses, testing the calculator with a small employee group before full deployment.

During implementation, maintaining clear team communication about changes to payroll processes helps ensure smooth adoption. Akron businesses should also plan for a verification period where calculations from the new system are checked against manual calculations to confirm accuracy before fully transitioning.

Future Trends in FICA Calculation Technology

The landscape of FICA calculation technology continues to evolve, offering new opportunities for Akron businesses to enhance compliance and efficiency. Staying informed about emerging trends helps organizations prepare for future advancements that may integrate with their advanced scheduling tools.

- Artificial Intelligence Integration: AI-powered FICA calculators are emerging that can identify patterns, predict compliance risks, and recommend optimization strategies for Akron businesses.

- Blockchain for Tax Verification: Blockchain technology is beginning to appear in payroll systems, offering secure, immutable records of FICA calculations and payments for enhanced audit protection.

- Real-Time Tax Consultation: Advanced calculators are incorporating on-demand access to tax professionals who can provide Akron-specific guidance on complex FICA situations.

- Predictive Compliance Alerts: Newer systems can anticipate regulatory changes affecting Akron businesses and provide advance notice of required adjustments to FICA calculations.

- Mobile-First Design: FICA calculators are increasingly designed for mobile devices, allowing Akron managers to review and approve payroll calculations from anywhere.

These advancements represent significant opportunities for Akron businesses to further streamline their payroll operations while enhancing compliance. Organizations with complex scheduling needs should particularly consider how these technologies might integrate with their existing time tracking and payroll systems to create comprehensive workforce management solutions.

Conclusion

Accurate FICA payroll calculations represent a critical aspect of business operations for Akron employers across all industries. By implementing specialized FICA calculators, businesses can significantly reduce compliance risks, improve operational efficiency, and ensure accurate tax contributions for both employers and employees. These tools prove particularly valuable when integrated with comprehensive workforce management systems that handle scheduling, time tracking, and payroll processing in a unified environment. For Akron businesses navigating complex regulatory requirements, seasonal staffing fluctuations, or multi-state operations, robust FICA calculation tools provide essential support for maintaining compliance while optimizing administrative resources.

As technology continues to evolve, Akron businesses should regularly evaluate their FICA calculation systems to ensure they leverage the latest advancements in automation, integration capabilities, and compliance features. By prioritizing these critical payroll functions, organizations can protect themselves from potential penalties while creating more streamlined processes that benefit both the company and its employees. Whether you operate in Akron’s manufacturing sector, healthcare industry, retail environment, or service economy, investing in quality FICA calculation tools delivers significant returns through improved accuracy, reduced administrative burden, and enhanced compliance with ever-changing tax regulations.

FAQ

1. What are the current FICA tax rates that Akron employers need to apply?

For 2024, Akron employers must withhold Social Security tax at 6.2% on wages up to the annual wage base limit of $168,600, and Medicare tax at 1.45% on all wages with no limit. Additionally, employers must match these contributions, effectively doubling the amount paid to the federal government. For employees earning more than $200,000 annually, an Additional Medicare Tax of 0.9% applies to wages exceeding this threshold, though employers do not match this additional amount. These rates apply uniformly across all of Ohio, including Akron, as FICA is a federal tax program administered consistently nationwide.

2. How do seasonal employment fluctuations in Akron affect FICA calculation requirements?

Seasonal employment fluctuations, common in Akron’s retail, tourism, and manufacturing sectors, create several FICA calculation challenges. Employers must carefully track wage bases for employees who may work intensively during peak seasons but not throughout the year. Tax deposit schedules may change based on total payroll during high-volume seasons, requiring adjustments to filing frequencies. Additionally, seasonal employers must maintain accurate records to ensure proper W-2 reporting despite employment gaps. Advanced FICA calculators can help manage these complexities by automatically adjusting for seasonal staffing patterns while maintaining compliance with deposit requirements and wage base limitations.

3. Can FICA calculators integrate with employee scheduling software used by Akron businesses?

Yes, modern FICA calculators typically offer integration capabilities with employee scheduling software used by Akron businesses. This integration creates a seamless workflow where scheduled hours, actual time worked, and resulting FICA calculations all communicate within a unified system. When scheduling changes occur, the integrated calculator automatically adjusts projected FICA withholdings. This is particularly valuable for Akron’s healthcare facilities, manufacturing operations, and retail businesses that manage complex shift patterns. The integration helps ensure that overtime, shift differentials, and special pay considerations are accurately reflected in FICA calculations, reducing compliance risks while improving administrative efficiency.

4. What documentation should Akron employers maintain for FICA tax compliance?

Akron employers should maintain comprehensive documentation for FICA tax compliance, including complete payroll records showing gross wages, FICA withholding calculations, and employer contributions for each pay period. These records should be preserved for at least four years from the due date of the associated tax returns. Additional required documentation includes all Forms 941 (Employer’s Quarterly Federal Tax Return), annual Forms W-2 and W-3, tax deposit receipts, and any related correspondence with the IRS. For employees with special FICA situations—such as exempt student workers or those reaching the Social Security wage base—supplemental documentation justifying the special treatment should be maintained. Digital FICA calculators can significantly streamline this record-keeping process through automated report generation and secure data storage.

5. How often should Akron businesses update their FICA calculation systems?

Akron businesses should ensure their FICA calculation systems are updated at minimum annually to reflect changes in tax rates, wage bases, and regulatory requirements. However, for optimal compliance, quarterly reviews are recommended to capture mid-year adjustments and legislative changes. Many modern FICA calculators offer automatic updates that implement tax table changes as they occur, eliminating the need for manual intervention. Businesses should also conduct a comprehensive system review whenever experiencing significant organizational changes such as mergers, acquisitions, expansion into new states, or substantial workforce restructuring. Regular updates are particularly important for Akron’s manufacturing, healthcare, and educational institutions that may have complex employment classifications affecting FICA calculations.