When an employment relationship comes to an end in Sacramento, California, employers must navigate a complex set of final paycheck regulations that are among the strictest in the nation. California’s labor laws, particularly those governing termination pay, provide significant protections for employees and impose substantial penalties on employers who fail to comply. For Sacramento businesses, understanding these rules isn’t just good practice—it’s essential for avoiding costly litigation and penalties that can significantly impact your bottom line. Whether you’re managing a retail operation, hospitality venue, or healthcare facility, final paycheck compliance is a critical component of effective workforce management.

The timing requirements for final paychecks in Sacramento follow California state law but require attention to specific details based on the nature of the employment separation. With different deadlines for voluntary resignations versus involuntary terminations and special considerations for seasonal work or temporary assignments, employers need systematic processes to ensure compliance. Effective employee scheduling and offboarding systems can help businesses manage these requirements efficiently while maintaining accurate records for payroll processing and regulatory compliance.

California Final Paycheck Laws Overview

Sacramento employers must adhere to California’s comprehensive final paycheck laws, which are primarily governed by the California Labor Code. These regulations establish strict timeframes for issuing final paychecks and outline specific requirements for what must be included in that final payment. The California Division of Labor Standards Enforcement (DLSE) enforces these laws and has the authority to investigate complaints, issue citations, and impose penalties on non-compliant employers.

- Legal Foundation: California Labor Code sections 201-203 establish the primary framework for final paycheck requirements in Sacramento and throughout the state.

- Employee Protection Focus: California’s laws are designed to ensure employees receive all earned wages promptly upon termination of employment.

- No Exceptions: All employers in Sacramento, regardless of size or industry, must comply with these regulations without exception.

- Local Compliance: While Sacramento doesn’t have additional city-specific final paycheck laws, employers must still navigate the interplay between state requirements and any applicable company policies.

- Enforcement Authority: The Labor Commissioner’s Office enforces these laws through its wage claim process and can assess significant penalties for violations.

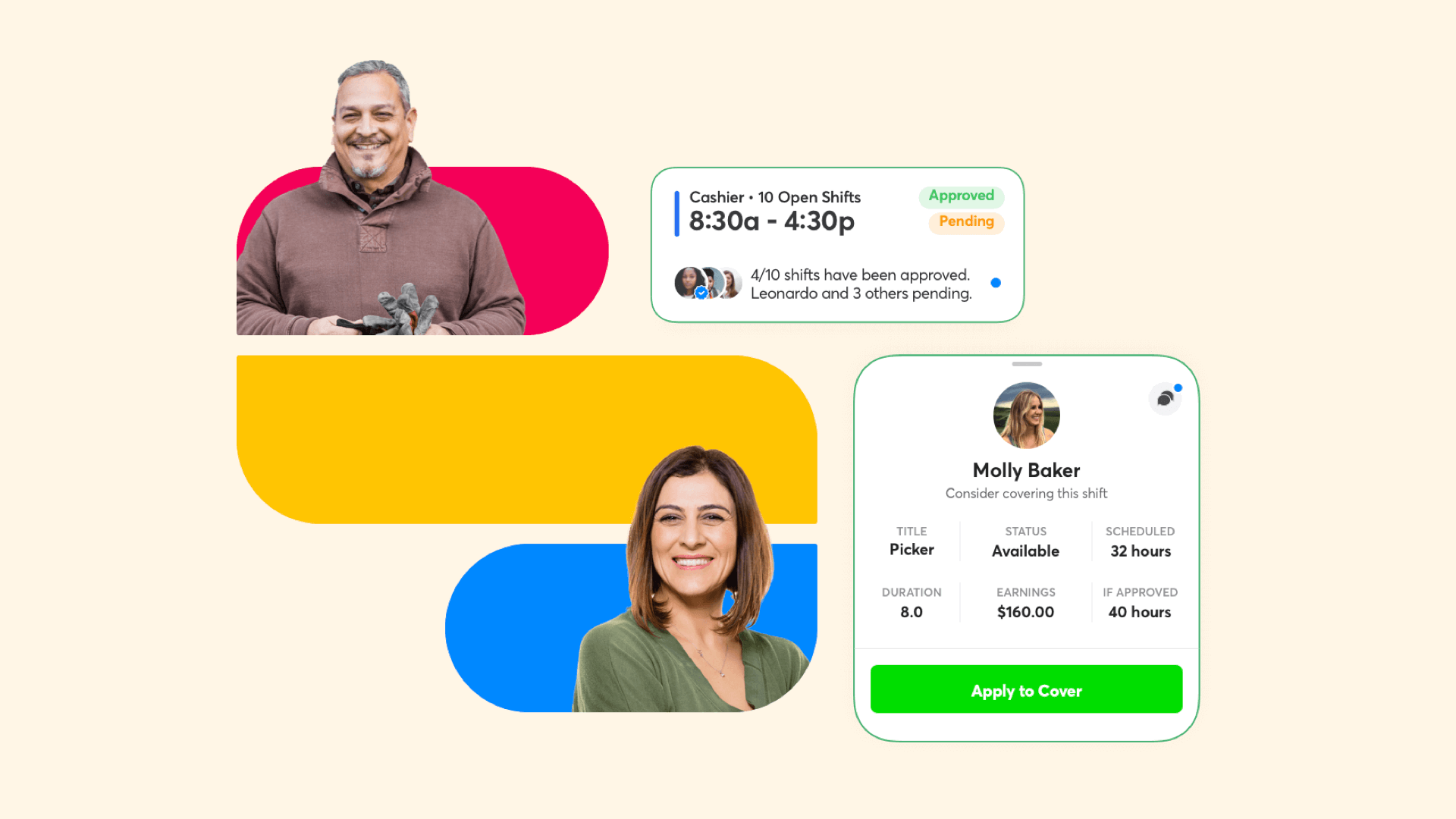

Sacramento employers often face challenges implementing compliant systems, especially those managing operations across multiple locations or with complex shift marketplace arrangements. Modern workforce management platforms that integrate termination processes with payroll systems can help ensure legal compliance while streamlining administrative workflows.

Timeframes for Issuing Final Paychecks in Sacramento

The timing requirements for final paychecks in Sacramento follow California state law, which establishes different deadlines based on the circumstances of employment separation. These timeframes are non-negotiable, and failure to meet them can result in waiting time penalties. Sacramento employers must develop efficient team communication processes to ensure payroll departments are promptly notified of terminations and resignations.

- Involuntary Termination: When an employer terminates an employee in Sacramento, the final paycheck must be provided at the time of termination. This includes situations involving layoffs, firings, or when an employer ends a temporary or seasonal position.

- Voluntary Resignation With Notice: If an employee gives at least 72 hours (three days) notice of their intention to quit, the employer must provide the final paycheck on their last day of work.

- Voluntary Resignation Without Notice: When an employee quits without providing at least 72 hours notice, the employer has 72 hours from the time of resignation to provide the final paycheck.

- Alternative Delivery Methods: If an employee requests mail delivery of their final check, the mailing date is considered the payment date, but the check must still be prepared within the required timeframe.

- Seasonal or Temporary Work: Even for short-term employment, the same final paycheck timeframes apply based on whether the separation was voluntary or involuntary.

For Sacramento businesses in the retail or hospitality sectors that experience high turnover, implementing automated systems to trigger final paycheck processing upon termination notice can help ensure compliance with these strict timeframes. Businesses using time tracking tools that integrate with payroll systems are better positioned to meet these deadlines consistently.

What to Include in the Final Paycheck

Sacramento employers must ensure that final paychecks include all compensation owed to the departing employee. This extends beyond regular wages to encompass various forms of earned but unpaid compensation. Accurate calculation of these amounts requires efficient data management utilities and systematic record-keeping.

- Regular Wages: All wages earned up to and including the final day of work must be included, calculated at the employee’s regular rate of pay.

- Overtime: Any overtime hours worked during the final pay period must be paid at the appropriate overtime rate (typically 1.5 or 2 times the regular rate depending on circumstances).

- Accrued Paid Time Off: California law requires employers to pay out all accrued, unused vacation time or PTO as wages in the final paycheck. This is calculated at the employee’s final rate of pay.

- Commissions and Bonuses: All earned commissions and bonuses must be included if they can be calculated at the time of termination. If not yet calculable, they must be paid as soon as the amounts can be determined.

- Expense Reimbursements: Outstanding business expense reimbursements should be included in the final paycheck, though these may be processed separately if company policy specifies this.

Sacramento businesses implementing integrated systems for tracking accrued leave, commissions, and other compensation elements can more easily generate accurate final paychecks. However, it’s important to note that sick leave typically does not need to be paid out in California unless required by company policy or a collective bargaining agreement. Employers with healthcare operations or complex shift structures may benefit from specialized payroll processing systems that account for industry-specific pay elements.

Special Considerations for Different Types of Termination

The circumstances surrounding an employee’s departure in Sacramento can affect final paycheck requirements. Various separation scenarios may trigger different obligations for employers, requiring flexible workforce scheduling and payroll processes to ensure compliance across all termination types.

- Retirement: Treated as a voluntary resignation, requiring final payment according to whether proper notice was given.

- Death of Employee: Final wages must be paid to the employee’s designated beneficiary or legal representative. If no designation exists, wages may need to go through probate.

- Job Abandonment: Though considered a voluntary resignation, determining the effective date can be complex. Best practice is to document when abandonment is confirmed and issue final pay within 72 hours of that determination.

- Contract Completion: For fixed-term contract workers in Sacramento, the end of the contract period is considered a termination by the employer, requiring immediate payment.

- Temporary Layoffs or Furloughs: If the interruption in work is definite and for a specified period, final pay may not be required. However, indefinite layoffs are treated as terminations requiring immediate final payment.

Sacramento employers, particularly those in seasonal industries like retail or hospitality, need to establish clear policies for identifying and processing different types of separations. Implementing automation technology in termination processes can help ensure proper classification and timely payment for all termination scenarios.

Penalties for Non-Compliance

Sacramento employers face significant financial consequences for failing to comply with California’s final paycheck laws. These penalties are designed to discourage non-compliance and can quickly escalate into substantial amounts, particularly for employers with multiple violations. Implementing efficient scheduling software mastery and proper offboarding processes can help avoid these costly penalties.

- Waiting Time Penalties: When an employer willfully fails to pay final wages on time, they may be assessed “waiting time penalties” equal to the employee’s daily rate of pay for each day the wages remain unpaid, up to a maximum of 30 days.

- Calculation Method: Penalties are calculated by multiplying the employee’s daily wage rate by the number of days they were forced to wait for their final paycheck, up to the 30-day maximum.

- Additional Penalties: Beyond waiting time penalties, employers may face civil penalties, attorney’s fees, and court costs if employees pursue legal action to recover unpaid wages.

- PAGA Claims: Under California’s Private Attorneys General Act, employees can sue on behalf of themselves and other employees, potentially multiplying penalties across the workforce.

- Audit Triggers: Final paycheck violations may trigger broader wage and hour audits by regulatory agencies, exposing employers to additional scrutiny and potential penalties.

Sacramento businesses can mitigate these risks by implementing robust compliance training for managers and payroll staff. Companies with complex scheduling needs may benefit from automated scheduling systems that integrate with payroll processes to facilitate timely final payments.

Best Practices for Employers

To ensure compliance with final paycheck requirements in Sacramento, employers should implement standardized processes and leverage appropriate technology solutions. Developing robust offboarding procedures that address both the human and financial aspects of employment termination can significantly reduce compliance risks. Team communication tools can help facilitate seamless information flow between departments during the termination process.

- Create Written Policies: Develop clear, written policies regarding final paycheck procedures that comply with California law and train all relevant personnel on these policies.

- Implement Same-Day Processing: Establish systems to process final paychecks immediately upon termination, including preparing contingency checks for unexpected resignations or terminations.

- Automate PTO Tracking: Use automated systems to track vacation and PTO accruals accurately, ensuring these amounts are readily available for final paycheck calculations.

- Coordinate Between Departments: Ensure effective communication between HR, management, and payroll to facilitate prompt processing of final paychecks.

- Document Everything: Maintain thorough records of termination dates, final paycheck calculations, and delivery methods to demonstrate compliance if challenged.

Sacramento businesses may benefit from implementing performance evaluation and improvement systems that flag potential terminations in advance, allowing payroll teams to prepare. Integration capabilities between HR, scheduling, and payroll systems can streamline the final paycheck process and reduce errors.

Documentation Requirements

Proper documentation is crucial for Sacramento employers to demonstrate compliance with final paycheck laws and defend against potential claims. Systematic record-keeping practices should be integrated into standard termination procedures to ensure all necessary documentation is maintained. Using employee self-service portals can facilitate more efficient document management and provide employees with access to their own records.

- Final Pay Statements: Provide detailed pay statements with the final check showing all earnings, deductions, and paid time off calculations.

- Termination Notices: Document the date and circumstances of termination, including copies of resignation letters or termination notices.

- Acknowledgment of Receipt: Obtain signed acknowledgments from employees confirming receipt of their final paycheck and understanding of the amounts included.

- Calculation Records: Maintain documentation showing how final wage amounts were calculated, including regular wages, overtime, and PTO payouts.

- Delivery Documentation: If final paychecks are mailed, keep records of mailing dates and tracking information if available.

Sacramento employers should retain these records for at least four years, the statute of limitations period for most wage claims in California. Software performance considerations are important when selecting document management systems that will need to maintain records for extended periods. Businesses with multiple locations may benefit from centralized cloud storage services to standardize documentation practices across all operations.

Employee Rights Regarding Final Paychecks

Sacramento employees have substantial rights regarding their final paychecks under California law. Understanding these rights is important for both employers implementing compliant systems and employees seeking to ensure they receive all compensation they’re legally entitled to. Effective communication tools integration can help ensure employees are properly informed of these rights during the offboarding process.

- Right to Timely Payment: Employees have the right to receive their final paycheck within the legally mandated timeframes based on their separation circumstances.

- Right to Complete Payment: Employees are entitled to receive all earned wages, including regular pay, overtime, bonuses, commissions, and accrued vacation or PTO.

- Right to File a Wage Claim: If an employer fails to provide a proper final paycheck, employees can file a wage claim with the California Labor Commissioner’s Office or pursue civil litigation.

- Right to Waiting Time Penalties: Employees may be entitled to receive waiting time penalties if their employer willfully fails to pay final wages on time.

- Right to Information: Employees have the right to receive an itemized statement showing how their final pay was calculated, including all earnings and deductions.

Sacramento employers should consider implementing exit interview data collection processes that include confirmation of final pay arrangements. This can help address any discrepancies before they escalate to formal complaints. Organizations operating across different sectors like healthcare, retail, or hospitality should ensure their offboarding processes address industry-specific compensation elements.

Common Mistakes to Avoid

Sacramento employers frequently make certain errors when processing final paychecks that can lead to non-compliance and potential penalties. Being aware of these common pitfalls can help businesses develop more effective termination procedures. Implementing supply chain style process management for offboarding can help eliminate these errors through standardized workflows.

- Miscalculating PTO Payout: Failing to accurately calculate and include all accrued, unused vacation or PTO in the final paycheck.

- Missing Overtime: Overlooking overtime hours worked in the final pay period, particularly when termination occurs mid-pay-period.

- Withholding Final Pay: Illegally withholding final paychecks until company property is returned or for other conditional reasons.

- Misclassifying Separations: Incorrectly categorizing the type of separation (voluntary vs. involuntary), leading to deadline miscalculations.

- Late Processing: Failing to have systems in place to issue immediate final paychecks for terminated employees.

Sacramento businesses can mitigate these risks by implementing payroll software integration with HR systems and providing managers with proper training programs and workshops on termination procedures. Organizations with complex scheduling needs may benefit from adapting to change by implementing more automated, integrated systems for managing employment transitions.

Conclusion

Navigating final paycheck requirements in Sacramento requires diligent attention to California’s strict labor laws and systematic implementation of compliant procedures. By understanding the timing requirements, calculating all components of final pay correctly, maintaining proper documentation, and avoiding common mistakes, employers can significantly reduce their legal and financial risks. The penalties for non-compliance—particularly waiting time penalties that can amount to 30 days of an employee’s wages—make proper final paycheck handling a critical business priority.

Sacramento businesses should consider investing in integrated HR, scheduling, and payroll systems that facilitate accurate and timely final paycheck processing. Establishing clear written policies, conducting regular training for managers and payroll staff, and implementing standardized offboarding procedures can help ensure consistent compliance. By treating final paycheck administration as an essential component of effective workforce management rather than a mere administrative task, employers can protect themselves from penalties while providing a more professional conclusion to the employment relationship.

FAQ

1. When must final paychecks be issued in Sacramento?

In Sacramento, following California law, final paychecks must be provided immediately at the time of termination if an employee is fired or laid off. If an employee resigns with at least 72 hours notice, their final paycheck must be provided on their last day of work. If an employee quits without providing 72 hours notice, the employer has 72 hours from the time of resignation to provide the final paycheck. These deadlines apply to all employers in Sacramento regardless of size or industry, and failure to meet them can result in waiting time penalties equal to the employee’s daily wage for up to 30 days.

2. What must be included in a final paycheck in Sacramento?

A final paycheck in Sacramento must include all wages earned through the last day of work, including regular pay, overtime, double time, and premium pay if applicable. It must also include payment for all accrued but unused vacation time or PTO, which California law treats as earned wages that cannot be forfeited. Any earned commissions, bonuses, or profit-sharing that can be calculated at the time of termination should also be included. Expense reimbursements may be included in the final paycheck or processed separately according to company policy, but must be paid promptly. Sick leave typically does not need to be paid out unless required by company policy.

3. Can a Sacramento employer withhold a final paycheck until company property is returned?

No, Sacramento employers cannot legally withhold or delay final paychecks until an employee returns company property such as keys, equipment, or uniforms. California law requires final paychecks to be issued within the statutory deadlines regardless of any outstanding issues with company property. Instead, employers should address the return of company property through separate channels, such as written agreements, deductions authorized in advance by the employee (subject to limitations under labor code), or civil remedies if necessary. Withholding a final paycheck as leverage will likely result in waiting time penalties and other possible legal consequences.

4. What are the penalties if a Sacramento employer fails to provide a final paycheck on time?

If a Sacramento employer willfully fails to pay final wages within the required timeframe, they may be subject to “waiting time penalties” under California Labor Code Section 203. These penalties equal the employee’s daily rate of pay for each day the wages remain unpaid, up to a maximum of 30 calendar days. For example, if an employee earned $200 per day and the employer was 20 days late with the final paycheck, the penalty would be $4,000 ($200 × 20 days). In addition to these penalties, employers may face civil litigation, attorney’s fees, court costs, and potentially class action or PAGA claims if the violation affects multiple employees.

5. How should Sacramento employers handle final pay for employees with irregular schedules or fluctuating wages?

For Sacramento employees with irregular schedules or fluctuating wages—common in retail, hospitality, and healthcare sectors—employers should calculate final pay based on average earnings. For waiting time penalty calculations, the daily rate should be determined by averaging the employee’s pay over the last pay period or a representative period. All overtime premiums and differentials should be included in these calculations. For commission-based employees, any commissions that can be calculated at the time of termination must be included in the final paycheck. For those that cannot yet be calculated, employers should document when these will be paid and process them promptly when determinable. Maintaining accurate time tracking tools records is essential for proper calculation of final pay for workers with variable schedules.