When employment ends in San Antonio, Texas, understanding final paycheck requirements is crucial for both employers and employees. Texas has specific laws governing when final paychecks must be issued, what they must include, and the consequences of non-compliance. For San Antonio businesses, navigating these regulations efficiently requires knowledge of state labor laws and implementing effective systems to ensure smooth termination processes. Whether an employee resigns or is terminated, employers must follow strict timelines and requirements to avoid potential penalties and legal issues.

Final paycheck compliance is more than just a legal obligation—it’s an important aspect of maintaining a positive company reputation and ensuring fair treatment of workers. In today’s competitive labor market, employers who handle terminations professionally, including prompt and accurate final payments, are better positioned to maintain goodwill even as employment relationships end. For employees, understanding their rights regarding final compensation provides necessary financial security during job transitions.

Texas Final Paycheck Laws: What San Antonio Employers Must Know

Texas final paycheck laws are primarily governed by the Texas Payday Law, enforced by the Texas Workforce Commission (TWC). Unlike some states that simply follow federal regulations, Texas has established its own specific requirements that San Antonio employers must understand and follow. These laws establish clear timelines for final payment distribution and outline the rights of both employers and employees during the termination process. The timing requirements differ significantly depending on whether an employee resigns voluntarily or is terminated involuntarily.

- Legal Framework: Final paycheck requirements in Texas are governed by Chapter 61 of the Texas Labor Code, commonly known as the Texas Payday Law.

- Regulatory Authority: The Texas Workforce Commission is responsible for enforcing final paycheck laws and handling wage claims.

- Local Compliance: San Antonio employers must comply with both state regulations and any applicable federal laws regarding final compensation.

- Different Requirements: Texas distinguishes between voluntary and involuntary separations when determining final paycheck deadlines.

- Documentation Importance: Employers must maintain proper records of termination dates and final payments to demonstrate compliance.

Understanding these laws is essential for compliance with labor laws. San Antonio businesses should incorporate these requirements into their termination and offboarding procedures to ensure they’re meeting their legal obligations. Implementing effective employee management software can help streamline these processes and maintain accurate records of all employment transactions, including final payments.

Final Paycheck Deadlines in San Antonio: Timing is Everything

In San Antonio, as throughout Texas, the timing of final paycheck distribution is strictly regulated and varies based on the nature of the employment separation. These deadlines are not flexible guidelines but hard legal requirements that carry significant consequences if missed. Employers must have systems in place to process final payments quickly, especially in cases of termination where the timeline is particularly compressed.

- Termination Deadline: When an employer terminates an employee, the final paycheck must be provided within six calendar days of the discharge.

- Resignation Deadline: If an employee resigns voluntarily, the final paycheck is due on the next regularly scheduled payday.

- Calendar Day Counting: The six-day rule for terminations counts all calendar days, not just business days.

- Delivery Methods: Final checks can be delivered in person, mailed (if requested by the employee), or deposited directly if that was the established payment method.

- Documentation Requirements: Employers should document when and how the final payment was provided to demonstrate compliance.

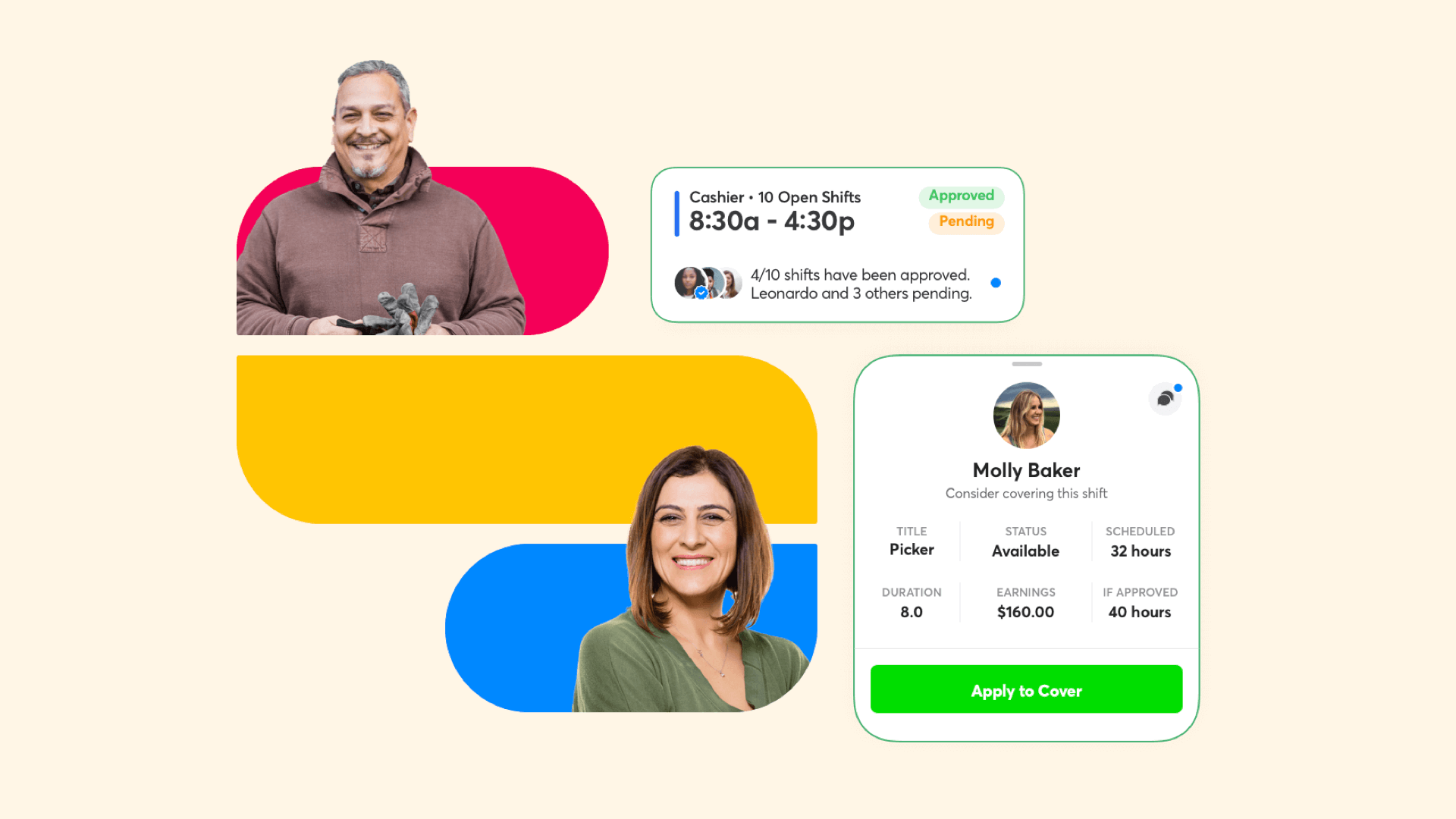

Meeting these deadlines requires efficient coordination between managers, HR, and payroll departments. Many San Antonio businesses are turning to technology in shift management to streamline these processes. Platforms like Shyft help ensure proper documentation of termination dates and automate notifications to relevant departments, reducing the risk of missed deadlines. Implementing mobile workforce management solutions can further enhance compliance by enabling faster processing of final payments.

Components of a Final Paycheck in Texas

Final paychecks in San Antonio must include all compensation owed to the employee as of their last day of work. This extends beyond just regular wages to encompass various forms of earned compensation. Understanding exactly what must be included helps employers avoid incomplete payments that could trigger wage claims and ensures employees receive all compensation they’re legally entitled to receive.

- Regular Wages: All unpaid wages for hours worked up to the termination date must be included.

- Overtime Pay: Any earned overtime that hasn’t been paid must be calculated and included in the final check.

- Commissions and Bonuses: Earned commissions and bonuses must be paid according to company policy or employment agreements.

- Expense Reimbursements: Outstanding approved business expenses should be reimbursed in the final payment.

- Severance Pay: If promised in an employment contract or company policy, severance must be included (though Texas law doesn’t require severance pay).

Properly calculating these components requires accurate time tracking and record-keeping systems. Modern workforce management platforms can help San Antonio businesses maintain precise records of hours worked, overtime accrued, and commissions earned. This data becomes invaluable when preparing final paychecks, as it ensures all earned compensation is properly accounted for. Using employee scheduling software with mobile accessibility allows for real-time tracking that simplifies final paycheck calculations.

Vacation and PTO Payout Requirements in Texas

One area that often creates confusion for both employers and employees in San Antonio is the handling of unused vacation time and paid time off (PTO) in final paychecks. Unlike some states, Texas does not have a statutory requirement mandating the payout of accrued, unused vacation or PTO upon termination. However, this doesn’t mean employers have complete discretion in how they handle these benefits.

- No State Mandate: Texas law does not require employers to pay out unused vacation or PTO upon termination.

- Written Policy Controls: An employer’s written policy or employment agreement determines whether vacation/PTO must be paid out.

- Policy Enforcement: If an employer’s policy states that vacation will be paid out, the TWC will enforce this as a wage claim.

- Clear Communication: Policies should clearly state what happens to unused vacation/PTO upon termination.

- “Use It or Lose It” Policies: These policies are permissible in Texas if clearly communicated to employees.

San Antonio employers should review their vacation and paid time off policies to ensure they clearly specify whether unused time will be paid out upon termination. This information should be included in employee handbooks and communicated during the onboarding process. Tracking PTO usage accurately is also critical, as disputes often arise over how much time was actually accrued. Using time tracking tools and automated systems can help maintain accurate records and prevent disputes during the offboarding process.

Permissible Deductions from Final Paychecks

Employers in San Antonio must be extremely careful when making deductions from final paychecks, as improper deductions can violate state law and lead to wage claims. The Texas Payday Law places strict limitations on what can be deducted from an employee’s final payment, regardless of the circumstances of the employment separation.

- Written Authorization: Most deductions require specific written authorization from the employee.

- Standard Deductions: Taxes, court-ordered garnishments, and other legally mandated deductions are always permissible.

- Advance Wages: Recovery of wage advances can be deducted if properly documented.

- Company Property: Deductions for unreturned property are only permissible with prior written authorization.

- Unauthorized Deductions: Employers cannot withhold final paychecks to coerce the return of company property without prior agreement.

Employers should obtain written authorization for potential deductions at the beginning of employment rather than waiting until termination. This practice ensures compliance with the law and prevents disputes. Documenting the return of company property during the offboarding process is also critical. Modern employee self-service portals can streamline this documentation, allowing both employers and employees to track issued equipment and its return.

Penalties and Enforcement for Non-Compliance

San Antonio employers who fail to comply with Texas final paycheck laws face substantial consequences. The Texas Workforce Commission has broad authority to enforce these regulations, and employees have clear pathways to file complaints if they believe their rights have been violated. Understanding these potential penalties can help businesses prioritize compliance with final paycheck requirements.

- Wage Claims: Employees can file wage claims with the TWC within 180 days of when the wages were due.

- Investigation Authority: The TWC has the power to investigate claims, hold hearings, and make determinations about violations.

- Financial Penalties: Employers found in violation may be ordered to pay the wages owed plus penalties that can include additional damages.

- Legal Costs: In some cases, employers may also be required to pay the employee’s attorney fees and court costs.

- Collection Actions: The TWC can take various collection actions, including liens against an employer’s property.

The costs of non-compliance extend beyond just financial penalties. Wage disputes can damage a company’s reputation and affect its ability to attract talent. Implementing compliance training for HR and management staff helps ensure everyone understands final paycheck requirements. Additionally, using payroll software integration with scheduling and time-tracking systems can automate much of the final paycheck process, reducing the risk of human error and ensuring timely payments.

Best Practices for Managing Final Paychecks

To ensure compliance with Texas final paycheck laws and create a smooth termination process, San Antonio employers should implement proven best practices. These approaches not only help maintain legal compliance but also contribute to more positive offboarding experiences for departing employees, protecting company reputation even during separations.

- Clear Written Policies: Develop and communicate transparent policies regarding final paychecks and PTO payout in employee handbooks.

- Termination Checklists: Create comprehensive checklists that include final paycheck processing to ensure nothing is overlooked.

- Centralized Information: Maintain current employee information in a central system for quick access during offboarding.

- Automation Tools: Implement software that automatically triggers final paycheck processing when termination is recorded.

- Regular Audits: Periodically review termination processes to identify and address potential compliance gaps.

Effective employee scheduling software like Shyft can play a crucial role in supporting these best practices. By maintaining accurate records of hours worked, overtime accrued, and PTO balances, these systems provide the data needed to calculate final paychecks correctly. Additionally, team communication features can help ensure all relevant departments are notified promptly when termination occurs, initiating the final paycheck process immediately.

Special Circumstances and Exceptions

While Texas final paycheck laws establish clear general requirements, certain special circumstances may create exceptions or additional considerations. San Antonio employers should be aware of these unique situations to ensure proper handling of final compensation in all scenarios.

- Employee Death: Final wages must be paid to the employee’s legal beneficiary or estate representative.

- Disputed Terminations: Even when the reason for termination is disputed, final paycheck deadlines still apply.

- Independent Contractors: Different rules apply to contractors, who are covered by contract law rather than employment law.

- Seasonal Employment: The end of a defined seasonal period may have specific considerations depending on how the employment relationship was established.

- Company Bankruptcy: Special rules may apply, but employees’ wages generally have priority status in bankruptcy proceedings.

These special circumstances require additional attention to detail and sometimes specialized knowledge. Having well-documented process documentation for each scenario helps ensure consistent handling. For complex situations, consulting with HR consulting professionals or employment attorneys may be advisable. Implementing flexible workforce management technology that can adapt to these various scenarios helps maintain compliance even in unusual circumstances.

Common Mistakes San Antonio Employers Should Avoid

When handling final paychecks, San Antonio employers frequently make several common mistakes that can lead to legal issues and wage claims. Recognizing these pitfalls can help businesses avoid costly compliance problems and ensure smooth termination processes.

- Withholding Final Paychecks: Attempting to withhold final pay until company property is returned violates Texas law without prior written agreement.

- Missing Deadlines: Failing to provide final paychecks within the required timeframes is a common violation.

- Incorrect Calculations: Miscalculating wages, overtime, or commissions due can lead to underpayment claims.

- Unauthorized Deductions: Making deductions without proper written authorization from the employee.

- Poor Documentation: Failing to maintain adequate records of termination dates, final payment amounts, and delivery methods.

These mistakes often stem from inadequate systems or lack of training among managers and HR personnel. Implementing automated scheduling and payroll systems can help prevent calculation errors, while establishing clear termination procedures helps ensure deadlines are met. Regular compliance training for all managers involved in the termination process is also essential. Using tools that facilitate documentation practices ensures that proper records are maintained for all aspects of the final payment process.

Resources and Support for Final Paycheck Compliance

San Antonio employers seeking to maintain compliance with final paycheck laws have access to numerous resources and support options. Utilizing these resources can help businesses develop appropriate policies and procedures while staying updated on any changes to relevant regulations.

- Texas Workforce Commission: Offers detailed guidance, fact sheets, and advisory opinions on final paycheck requirements.

- Employment Attorneys: Local attorneys specializing in employment law can provide tailored advice for specific situations.

- HR Consultants: Professional consultants can help develop compliant termination procedures and policies.

- Industry Associations: Local business groups often provide resources and updates on employment law changes.

- Technology Solutions: Workforce management software can automate and streamline final paycheck processing.

Modern HR management systems integration with payroll and scheduling software provides a comprehensive solution for managing final paychecks. These integrated systems, like those offered by Shyft, ensure accurate calculation of all wage components and timely processing of final payments. Additionally, they provide valuable reporting and analytics capabilities that allow employers to monitor compliance and identify potential areas for improvement in their termination processes.

Conclusion: Ensuring Smooth Terminations Through Proper Final Paycheck Handling

Navigating final paycheck requirements in San Antonio requires a clear understanding of Texas labor laws and implementing effective processes to ensure compliance. By adhering to the strict timelines—six calendar days for terminations and the next regular payday for resignations—employers can avoid costly penalties and potential wage claims. Properly calculating all components of final compensation, including regular wages, overtime, commissions, and any applicable PTO payouts according to company policy, is essential for meeting legal obligations and maintaining positive relationships even as employment ends.

The most successful organizations view final paycheck compliance not as a burden but as an opportunity to demonstrate professionalism and respect for employees throughout the entire employment lifecycle. By implementing comprehensive termination procedures, leveraging technology solutions for accurate record-keeping, and staying informed about regulatory requirements, San Antonio employers can ensure smooth offboarding experiences. This approach not only minimizes legal risks but also protects company reputation—a valuable asset in today’s competitive labor market. Remember that while Texas law establishes minimum requirements, employers who go beyond compliance to create fair, transparent, and efficient termination processes ultimately benefit from stronger employer branding and reduced exposure to wage disputes.

FAQ

1. When must San Antonio employers provide final paychecks to terminated employees?

Under Texas law, employers in San Antonio must provide final paychecks to involuntarily terminated employees within six calendar days of their discharge. This timeline applies regardless of the reason for termination and includes weekends and holidays in the counting of days. For employees who voluntarily resign, employers must provide the final paycheck by the next regularly scheduled payday following the resignation. These deadlines are strictly enforced by the Texas Workforce Commission, and failure to meet them can result in penalties and wage claims.

2. Can San Antonio employers withhold money from a final paycheck?

Employers in San Antonio may only make deductions from final paychecks under specific circumstances. Standard deductions like taxes and court-ordered garnishments are always permissible. Other deductions, such as recovery of wage advances or unreturned company property, require written authorization from the employee. This authorization should be obtained in advance, typically at the time of hiring or when company property is issued. Employers cannot withhold an entire final paycheck simply because an employee has not returned company property unless there is specific prior written agreement allowing this action.

3. Does Texas law require payout of unused vacation time in final paychecks?

Texas law does not specifically require employers to pay out accrued, unused vacation or PTO upon termination. However, if an employer has a written policy or agreement stating that unused time will be paid out, then the Texas Workforce Commission will enforce this as part of the final wages due. This makes the employer’s written policies and employment agreements the controlling factor in determining whether vacation payout is required. Employers have the freedom to implement “use it or lose it” policies as long as these are clearly communicated to employees in advance through handbooks or other formal policy documents.

4. How can employees file a wage claim for final paycheck issues in San Antonio?

Employees who believe they have not received proper final payment can file a wage claim with the Texas Workforce Commission. Claims must be filed within 180 days from the date the wages were due. The process involves completing a Wage Claim form (available online or at TWC offices), providing documentation supporting the claim, and submitting it to the TWC. The TWC will investigate the claim, potentially hold a hearing, and make a determination. Employees can also pursue private legal action through small claims court or with the assistance of an employment attorney, though many choose the TWC process first due to its accessibility and lack of filing fees.

5. What penalties do San Antonio employers face for late or incorrect final paychecks?

Employers who fail to provide timely or accurate final paychecks can face several penalties. The TWC can order employers to pay the wages owed plus additional damages in some cases. Employers may also be required to pay the employee’s attorney fees and court costs if the employee prevails in a legal action. The TWC has authority to take collection actions against employers who fail to pay wage claim judgments, including placing liens on business property. Beyond these direct penalties, employers may suffer reputational damage that affects their ability to recruit and retain talent. Consistent violations may also trigger additional scrutiny from regulatory agencies.