Table Of Contents

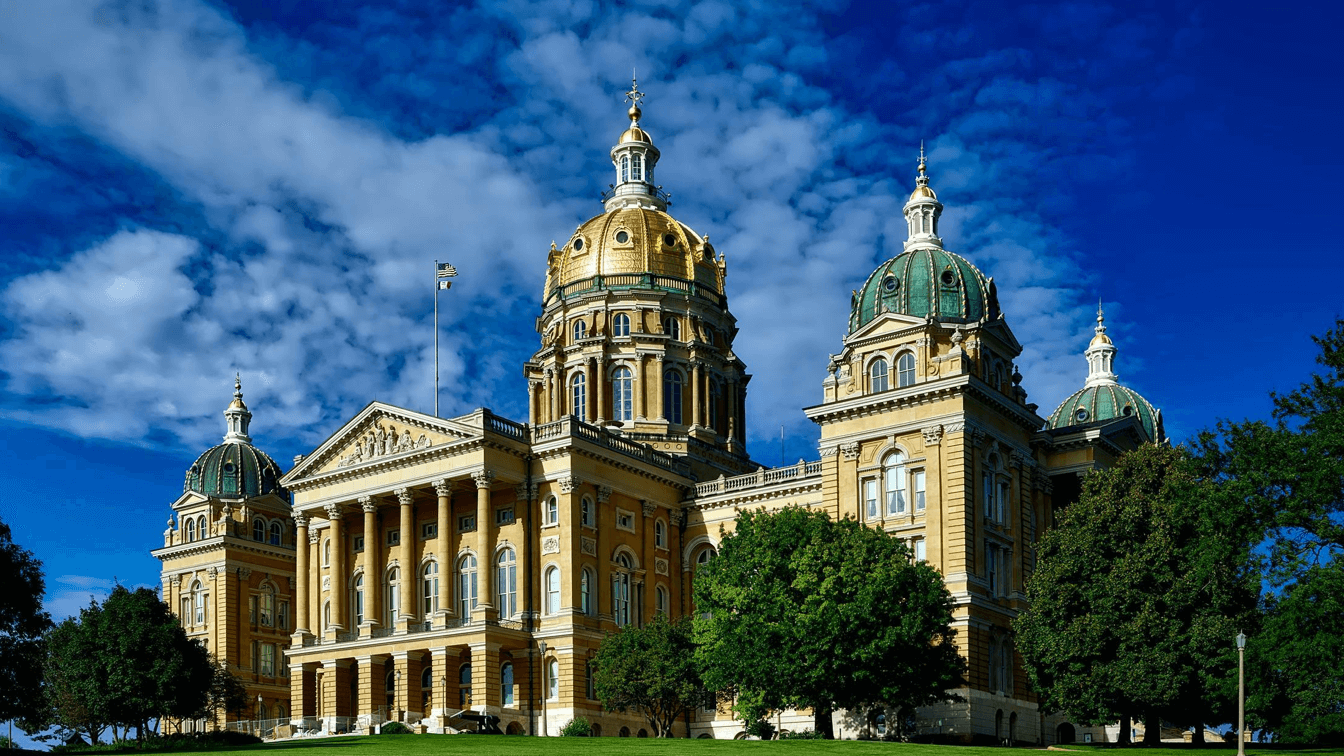

Iowa Labor Laws: A Comprehensive Guide

Iowa’s labor laws can seem daunting, especially if you’re juggling the daily tasks of running a small business. Understanding the basics—from minimum wage requirements to child labor protections—can help you stay compliant and foster a productive work environment. This guide gathers the latest information and official resources on Iowa labor laws, so you can put your energy where it matters most: growing your business and supporting your team.

Below, we’ll break down everything from overtime and drug testing to workplace safety, drawing on official sources like the Iowa Division of Labor, the Iowa Workforce Development, and the Iowa Civil Rights Commission. Whether you manage a restaurant in Des Moines, a boutique in Cedar Rapids, or an agricultural operation in rural Iowa, these laws shape how you hire, pay, and protect your workers.

From minimum wage regulations to the specifics of child labor and data protection, here’s what every Iowa employer needs to know.

1. Minimum Wage in Iowa

At the core of wage-related legislation in Iowa is a statewide minimum wage of $7.25 per hour. This amount mirrors the federal minimum wage set by the Fair Labor Standards Act (FLSA). Local governments in Iowa cannot establish a higher minimum wage due to state preemption laws, so your workers’ pay rate will be based on the statewide rate unless federal regulations change.

If you’re uncertain about how to manage wage reporting, the Iowa Division of Labor’s Wage FAQs can clarify recordkeeping and other requirements. You should maintain accurate payroll records for at least three years, aligning with Iowa Code § 91A.6.

2. Tipped Wages

For employees who earn tips—such as servers, bartenders, and delivery workers—Iowa allows a minimum cash wage of $4.35 per hour. Employers must ensure these workers’ combined tip income plus the $4.35 meets or exceeds the standard $7.25 per hour minimum wage. If it does not, you as the employer are responsible for making up the difference. This framework mirrors federal rules under the FLSA but is also outlined in Iowa Code § 91D.1(1)(b).

3. Overtime & Double Time

Iowa does not have a unique overtime law, so federal law takes precedence. Under the FLSA, non-exempt employees must receive 1.5 times their regular hourly rate for hours worked beyond 40 in a single workweek. Some industries have their own rules (e.g., healthcare’s 8/80 system), but generally, you’ll follow the standard 40-hour threshold. Be mindful of federal exemptions for executive, administrative, and professional roles.

4. Meal and Rest Breaks

One of the more common questions from new employers is about break requirements. For adults (18+), Iowa does not mandate meal or rest breaks. It’s fully at your discretion, though many employers provide breaks for morale and productivity reasons. However, minors are treated differently. Those under 16 must receive a 30-minute break after five continuous hours of work, in line with Iowa Code § 92.7.

5. Child Labor Laws

Child labor is regulated under Iowa Code Chapter 92. Typically, minors aged 14 and 15 need a work permit, and there are strict rules on how long and how late they can work—especially on school nights. In 2023, new legislation (SF 542) adjusted work hour limits for minors and offered waivers for certain restricted tasks, so check with Iowa Workforce Development for the latest updates.

Whether you run a small shop or a larger factory, it’s vital to follow these child labor guidelines. Violations can lead to significant penalties and bad press. For scheduling minors, using a convenient platform like Shyft can help ensure they don’t exceed permitted hours while streamlining the entire staffing process.

6. Final Paycheck & Wage Payment Rules

Under Iowa Code § 91A.4, employees who leave your business should receive their final paycheck by the next regularly scheduled payday. You may only make limited deductions (e.g., for benefits or authorized advances). Meanwhile, the Iowa Wage Payment Collection Law enforces your obligation to pay all earned wages promptly.

When an employee separates—whether by resignation, termination, or layoff—best practices suggest you confirm the final payment terms in writing to prevent misunderstandings or disputes.

7. Employee vs. Independent Contractor Classification

Iowa follows federal guidance, primarily the “right of control” test, to determine if a worker qualifies as an independent contractor rather than an employee. Misclassifying workers to bypass tax or benefit obligations can result in substantial penalties. Iowa Workforce Development’s Misclassification Unit investigates potential violations. If you’re ever uncertain, consult legal counsel or relevant state agencies before you finalize your classification.

8. Leave Requirements

Paid Sick Leave: Iowa does not require private employers to offer paid sick leave. Some companies still provide it as a benefit to attract and retain talent.

Family/Medical Leave: Larger employers (50+ employees) must comply with the federal Family and Medical Leave Act (FMLA), which guarantees up to 12 weeks of job-protected, unpaid leave in specified circumstances. Iowa law does not offer additional FMLA-like benefits.

Pregnancy/Disability Accommodations: Under the Iowa Civil Rights Act, it’s illegal to discriminate based on pregnancy or related conditions. You may be required to provide reasonable accommodations (e.g., modified duties or schedules) if they don’t cause undue hardship.

While not mandated, offering flexible scheduling or personal time off can improve employee engagement. Companies in Iowa often leverage scheduling software like Shyft to provide shift-swapping features and better transparency, cutting down on administrative load.

9. Anti-Discrimination, Harassment & Training

The Iowa Civil Rights Act (Iowa Code Chapter 216) forbids workplace discrimination based on race, creed, color, sex, sexual orientation, gender identity, national origin, religion, disability, or age (for individuals 18 or older). The Iowa Civil Rights Commission handles complaints and may impose fines or require corrective actions.

You should adopt clear policies and training programs to prevent harassment and discrimination. While Iowa does not mandate specific anti-harassment training for most private sector employers, implementing proactive training can reduce liability and foster a respectful workplace.

10. Pay Transparency

Iowa does not currently have a dedicated pay transparency law obligating you to disclose salary ranges or allow employees to discuss wages. However, the National Labor Relations Act (NLRA) generally protects employees’ right to discuss working conditions, including wages. It’s wise to refrain from policies that prohibit conversations about pay, as those could infringe on federal guidelines.

11. Workplace Safety (Iowa OSHA)

Iowa operates its own OSHA-approved plan known as Iowa OSHA, which typically adopts federal OSHA standards. Whether you run a restaurant or a manufacturing plant, you are required to maintain a safe environment, keep an updated OSHA 300 log of injuries and illnesses, and provide employees with any protective equipment needed to perform their jobs safely. For more details on state-specific standards, visit Iowa OSHA.

Employees who feel their safety is compromised may file complaints. Iowa Code § 88.9 protects individuals from retaliation when they report hazards in good faith.

12. Workers’ Compensation

Most employers in Iowa are required to carry workers’ compensation insurance to cover work-related injuries or illnesses. Iowa Code Chapters 85, 86, and 87 govern the system, offering medical and wage benefits to employees who are hurt on the job. The Iowa Division of Workers’ Compensation oversees claims and disputes. Proper coverage is not optional—failure to comply can lead to fines and potential business shutdowns.

13. Unemployment Insurance

Iowa, like all states, requires employers to pay into the state’s unemployment insurance program, administered by the Iowa Workforce Development. If an employee is let go through no fault of their own, they can file an unemployment claim. The process and eligibility criteria are spelled out on the agency’s website. Make sure you’re registered with the state and submit payroll taxes in a timely manner.

14. Privacy & Data Protection

In 2023, Iowa passed the Iowa Consumer Data Protection Act (HF 2506), which is set to take effect in 2025. While it primarily addresses consumer data, it underscores the growing importance of privacy. Review how you store, transfer, or share employee data. Although the law does not explicitly regulate employee data, aligning your business practices with emerging privacy standards can help you stay ahead of future legislative changes.

If you monitor electronic communications, be aware of employees’ reasonable expectation of privacy. Federal laws, such as the Electronic Communications Privacy Act (ECPA), may apply, and common-sense courtesy suggests letting employees know when they are being monitored.

15. Drug, Alcohol, and Cannabis Testing

Iowa law allows private employers to conduct drug and alcohol testing if they follow strict rules under Iowa Code § 730.5. Requirements include a written policy, confirmation testing, and providing employees with information about rehabilitation programs. Keep in mind that although medical cannabidiol is permitted in limited cases, recreational marijuana remains illegal in Iowa. Unlike some states, Iowa does not have explicit protections for off-duty cannabis use, so employers generally have broad discretion in their drug-free policies.

16. Recordkeeping & Reporting Requirements

Accurate recordkeeping is essential. Under Iowa law (Iowa Code § 91A.6), you must keep detailed wage records for three years. At the federal level, OSHA 300 logs must be retained for five years. Whenever you update policies, especially for wage payments or child labor, document them carefully. Failure to keep proper records can lead to penalties and hamper your ability to defend against wage disputes.

17. Whistleblower Protections

While Iowa doesn’t have an all-encompassing whistleblower law for private-sector employees, several statutes protect specific types of reporting (e.g., workers’ compensation fraud or wage law violations). In addition, Iowa Code § 88.9 shields employees from retaliation if they report unsafe working conditions to Iowa OSHA. If you discover employees making good-faith complaints, address their concerns rather than taking punitive measures.

18. Special Industry Laws

Certain industries—such as agriculture, hospitality, and healthcare—can have unique compliance rules. For instance, smaller family-run farms may be exempt from specific wage requirements under the FLSA’s agricultural exemptions. In healthcare settings, you might qualify for the 8/80 overtime system. Always verify whether your specific sector has separate or additional rules before you finalize any policies.

19. Penalties & Enforcement

The Iowa Division of Labor enforces wage laws, child labor rules, and Iowa OSHA requirements. The Iowa Civil Rights Commission handles discrimination claims, and the Iowa Division of Workers’ Compensation addresses workplace injury disputes. Penalties range from administrative fines and back-pay orders to, in rare cases, criminal charges. Make it a habit to stay updated by reading legislative alerts through the Iowa Legislature site.

20. Additional State-Specific Regulations

Iowa is a right-to-work state under Iowa Code Chapter 731. This means employees cannot be required to join or pay dues to a union. It also follows the employment-at-will doctrine, allowing you or an employee to end employment at any time for any lawful reason.

21. Best Practices & Compliance Tips

Stay Current: Labor laws can change quickly. Subscribe to updates from the Iowa Division of Labor and Iowa Legislature.

Maintain Written Policies: Formalize rules on wage payments, breaks, drug testing, anti-discrimination, and more. Make them clear and accessible.

Post Required Notices: Include the Iowa Minimum Wage poster, OSHA or Iowa OSHA poster, and applicable federal posters (FLSA, FMLA, EEO). The Iowa Civil Rights Commission poster might also be relevant.

Conduct Internal Audits: Periodic reviews of payroll records, employee classifications, and safety measures can help you identify and fix issues before an agency steps in.

Train Staff: Managers and HR personnel should be well-versed in key Iowa labor laws. Even a quick refresher on child labor or discrimination rules can prevent costly mistakes down the line.

Summary

From setting the minimum wage at $7.25 to establishing child labor protections, Iowa labor laws ensure both employers and employees have clear guidelines. While not every business will face each legal aspect daily, it’s crucial to know where to look and what steps to take when new questions surface. If you’re in doubt, consult the official Iowa Code or reach out to agencies like the Iowa Division of Labor. With careful planning, regular training, and tools like Shyft for flexible scheduling, you’ll be well on your way to maintaining compliance and fostering a thriving work environment.

Conclusion

As a small business owner or manager in the Hawkeye State, keeping pace with labor laws is essential for ethical and legal operations. From wage requirements and final paycheck rules to anti-discrimination mandates and safety standards, Iowa’s regulations form the bedrock of fair employment practices. With a proactive approach, these laws don’t have to be overwhelming—they can help you create a safe, fair, and supportive environment for your team.

When questions arise, remember that official sources like the Iowa Division of Labor and the Iowa Civil Rights Commission can provide authoritative guidance. Staying informed not only helps you avoid penalties but also strengthens your business by boosting employee trust and loyalty.

FAQ

1. Can Iowa cities or counties set a higher minimum wage?

No. Iowa state law preempts local jurisdictions from setting a higher rate, so the minimum wage is currently $7.25 per hour statewide.

2. Do I need to offer paid breaks to adult workers?

No. For employees aged 18 or older, Iowa law does not require paid or unpaid breaks. However, many employers choose to provide breaks as a best practice.

3. Are there state-specific overtime rules I need to follow?

Iowa defaults to federal overtime laws under the FLSA, which generally require overtime pay at 1.5 times the regular rate for hours worked over 40 in a week.

4. Does Iowa have a pay transparency law?

Not at this time. Iowa law does not mandate disclosures of pay ranges or protect employees’ rights to discuss wages beyond federal NLRA protections.

5. How quickly do I need to issue a final paycheck to a departing employee?

Under Iowa Code § 91A.4, you must issue the final paycheck by the next regularly scheduled payday. Limited deductions are allowed if legally authorized.

Disclaimer: The information provided here is for general guidance only and may not reflect the most recent legal or policy changes. Always consult relevant experts and official resources to ensure compliance with local laws.