Table Of Contents

Maine Labor Laws: A Comprehensive Guide

Maine is known for its beautiful coastline, vibrant small businesses, and diverse industries ranging from agriculture and fishing to cutting-edge healthcare and hospitality. But if you’re running a business in the Pine Tree State—no matter if you’re a boutique shop in Portland or a bustling family restaurant in Bangor—understanding Maine’s labor laws is critical. Whether you manage a small team or a large workforce, compliance with these regulations helps you avoid legal entanglements and foster a fair, productive environment.

This comprehensive guide covers everything from the latest minimum wage requirements to leave entitlements, child labor laws, and discrimination policies. By the end, you’ll know what to post on your breakroom walls, how to classify your workers, and where to go if you have additional questions. Let’s explore the key aspects of Maine’s labor and employment framework—equipping you with clear, practical insights to keep your business operations running smoothly.

Minimum Wage in Maine

Maine’s minimum wage is adjusted annually to match changes in the cost of living. As of January 1, 2023, the statewide minimum wage stands at $13.80 per hour (26 M.R.S. §664(1)). This cost-of-living adjustment ensures wages keep pace with inflation, so always check the Maine Department of Labor (MDOL) for the latest figures.

Local ordinances can impose a higher wage than the state’s base. For instance, the City of Portland introduced its own minimum wage, which is currently $14.00 per hour in 2023. Portland also has hazard pay provisions during certain declared emergencies. If you operate in Portland, or any municipality that adjusts its rates, be sure to stay informed of local wage laws to maintain compliance.

Tipped Wages

For tipped workers, Maine law allows a tip credit of up to 50% of the state’s minimum wage (26 M.R.S. §664(2)). That means an employer may pay tipped employees a direct cash wage of $6.90 per hour, provided tips bring total earnings to at least $13.80. Employers must ensure that if an employee’s tips don’t make up the difference, the business covers any shortfall. Tip pooling is permitted, but it cannot include managers or supervisors, and must comply with both Maine and federal regulations.

Overtime & Double Time

Most non-exempt employees in Maine are entitled to overtime pay at 1.5 times their regular rate after working more than 40 hours in a workweek (26 M.R.S. §664(3)). While Maine does not have a separate double-time requirement, certain holidays or special conditions might be covered by employment contracts or collective bargaining agreements. Typical exemptions include executive, administrative, and professional roles—generally in line with the Federal Fair Labor Standards Act (FLSA) exemptions.

Meal and Rest Breaks

Unlike some states with multiple break requirements, Maine’s statute is fairly straightforward: employees must receive a 30-minute unpaid rest break after working six consecutive hours (26 M.R.S. §601). If a break is interrupted or an employee must stay on duty, that time must be counted as paid work time.

Additionally, Maine law and federal regulations require that employers give nursing mothers reasonable break time and access to a private (non-bathroom) space for expressing breast milk (26 M.R.S. §604). Complying with these rules ensures your workforce feels supported in balancing personal and professional responsibilities.

Child Labor Laws

In Maine, minors under 16 must have a valid work permit, typically approved by a school’s superintendent (26 M.R.S. §§771-786). This permit outlines the allowable jobs and specific hours they may work. For those aged 16 and 17, the law slightly broadens allowable work hours but still imposes some limits, especially during school days.

Hazardous or dangerous occupations are generally off-limits to minors. Whether you run a summer camp or a seasonal farm operation, ensure you’re familiar with these stipulations. Non-compliance can lead to hefty fines and potential harm to your brand reputation.

Final Paycheck & Wage Payment Rules

When an employee separates from your company—whether through resignation, layoff, or discharge—Maine law requires payment of all earned wages by the next established payday (26 M.R.S. §626). Employers should also review permissible deduction rules, ensuring any withholdings are authorized in writing. Keeping clear records of wages and hours is a crucial safeguard in case of disputes.

Employee Classification

Properly classifying workers as either employees or independent contractors is vital. Maine uses a multi-factor test aligned with federal standards, focusing on the degree of control, the independence of the worker, and the nature of the services provided (39-A M.R.S. §102(13) and 26 M.R.S. §§1043, 1221). Misclassification can lead to back taxes, unpaid benefits, fines, and even legal action.

Leave Requirements

Earned Paid Leave (EPL): Maine made headlines by enacting a law that grants 1 hour of paid leave for every 40 hours worked, up to 40 hours per year, for businesses with 10 or more employees (26 M.R.S. §637). This leave can be used for any reason—not just illness. Ensuring your payroll system accurately tracks accrued hours is key. Many small businesses find scheduling software, like Shyft, helpful for managing employee hours and leave balances seamlessly.

Maine Family Medical Leave (FML): For employers with 15 or more employees, Maine requires up to 10 weeks of unpaid, job-protected leave within a two-year period for qualifying reasons (26 M.R.S. §§843-848). This runs parallel to the federal Family and Medical Leave Act (FMLA), though it’s important to note the differences, including coverage thresholds and permissible leave reasons.

Other Leaves: Domestic violence leave provides specific job protections for employees dealing with violence or abuse issues, and Maine also adheres to federal guidelines for military leave (USERRA). Familiarize yourself with any additional municipal rules that might mandate paid sick leave beyond the state requirement.

Anti-Discrimination, Harassment, and Required Training

The Maine Human Rights Act protects employees from discrimination on the basis of race, color, sex, sexual orientation, age, religion, ancestry, national origin, and disability, among other categories (5 M.R.S. §§4551-4634). This broad protection covers hiring, promotions, terminations, and other employment decisions.

Harassment prevention is a focal point in Maine. Businesses with 15 or more employees must conduct sexual harassment training within one year of hire for new employees, and supervisors require an enhanced version (26 M.R.S. §807). Posting a “Sexual Harassment is Illegal” poster in the workplace is mandatory, and these materials can be obtained from the Maine Human Rights Commission (MHRC) or the Maine Department of Labor.

Pay Transparency

While Maine doesn’t have a salary range disclosure requirement like some other states, 26 M.R.S. §628 protects employees discussing or inquiring about their own wages or those of coworkers. Retaliating against employees for wage discussions is prohibited, so ensure your policies don’t contain outdated language barring such discussions.

Workplace Safety (OSHA)

Federal OSHA standards apply in Maine, as the state does not operate its own OSHA-approved plan. Nonetheless, Maine’s Bureau of Labor Standards provides safety training, inspections, and educational resources. Employers should display the mandatory federal OSHA “Job Safety and Health: It’s the Law” poster in a common area, along with any state-required posters. Maintaining clear safety policies is pivotal to reducing accidents, improving morale, and staying on the right side of the law.

Workers’ Compensation

Maine requires almost all employers with one or more employees to carry workers’ compensation insurance (39-A M.R.S. §401). If an employee is injured on the job, workers’ comp covers medical expenses and partial wage replacement. The Maine Workers’ Compensation Board oversees compliance and dispute resolution. Failure to secure coverage can result in severe penalties, including fines and potential business shutdown orders.

Unemployment Insurance

Employers in Maine must also pay into the state’s Unemployment Insurance (UI) system. This fund provides temporary financial support for workers who lose their jobs through no fault of their own. The Maine Department of Labor administers UI, and employers must maintain accurate payroll records to calculate and remit correct contributions. Detailed guidelines can be found in 26 M.R.S. §1043 et seq.

Privacy & Data Protection

While Maine doesn’t have a law mirroring the California Consumer Privacy Act (CCPA) specifically for employee data, businesses must still take care when handling personal information. Employee medical records often require extra confidentiality, especially if protected by the Health Insurance Portability and Accountability Act (HIPAA). A 2019 law in Maine also places restrictions on how Internet Service Providers (ISPs) manage consumer data, but this may not directly impact every small business.

Drug, Alcohol, and Cannabis Testing Policies

Maine law requires that employers who wish to drug test must have a state-approved drug testing policy and offer an Employee Assistance Program (EAP) (26 M.R.S. §§681-690). Testing without such a policy can expose an employer to liability. Additionally, while Maine has legalized recreational cannabis, businesses remain free to ban on-duty use or possession. Employers generally are not obligated to accommodate marijuana consumption at the workplace.

Recordkeeping & Reporting Requirements

Every employer should maintain thorough records of payroll, working hours, and any relevant benefits or leave documentation. Maine law stipulates that payroll records be kept for at least three years (26 M.R.S. §622). This includes details like wage rates, hours worked each day, and total earnings in each pay period. Good recordkeeping is critical when responding to wage claims, unemployment hearings, or workers’ compensation disputes.

Whistleblower Protections

Maine safeguards employees who report legal violations or refuse to undertake unlawful activities. Under the Maine Whistleblowers’ Protection Act (26 M.R.S. §§831-840), it’s illegal for an employer to retaliate against workers who come forward about unsafe or illegal conduct. Awareness of these protections fosters a culture of integrity and trust, allowing potential issues to be addressed before they become crises.

Special Industry Laws

Some industries in Maine face unique regulations:

Agricultural Workers: Certain agricultural employees may be exempt from overtime under Maine and federal law. Child labor restrictions also differ, allowing minors more flexibility in farm work but still prohibiting hazardous tasks.

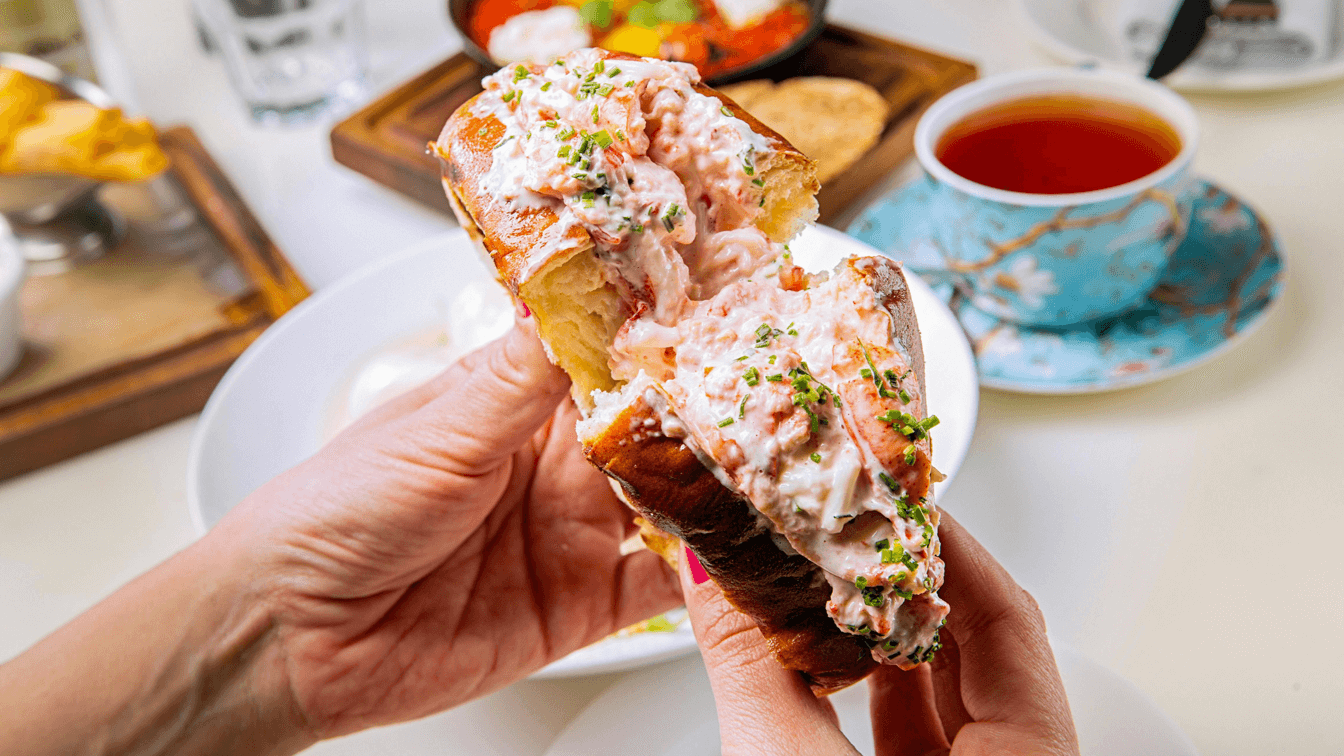

Hospitality: Restaurants and hotels often rely on tipped workers, making tip credit rules especially relevant. Also, local minimum wage rules—like those in Portland—significantly impact this sector.

Healthcare: Hospitals and clinics must comply with specific regulations on nurse overtime (26 M.R.S. §603), limiting the circumstances under which mandatory overtime can be required. Additional infection-control and safety requirements may also apply.

Penalties & Enforcement

Enforcement typically comes through agencies like the Maine Department of Labor (wage and hour violations), the Maine Human Rights Commission (discrimination), or the Workers’ Compensation Board (work injuries). Non-compliance can result in:

• Civil fines

• Back wages plus interest or damages

• Reinstatement of terminated employees

• Criminal penalties in extreme cases

Additional State-Specific Regulations

Maine is generally an “employment-at-will” state, meaning either the employer or the employee can terminate the relationship at any time, for any lawful reason. However, various statutory protections—from anti-discrimination to whistleblower laws—limit an employer’s right to terminate in certain situations. In addition, the required posters that employers must display often change or update; you can download the most recent mandatory postings from the Maine Department of Labor website.

Best Practices & Compliance Tips

• Stay Updated: Since Maine’s minimum wage is tied to the Consumer Price Index and often changes annually, mark your calendar to check for new rates each January. Monitoring other legislative updates—from leave expansions to training mandates—safeguards against non-compliance.

• Draft Written Policies: Whether it’s an employee handbook or a standalone policy, put your procedures for wages, breaks, overtime, anti-harassment training, and drug testing in writing. Clear, accessible policies reduce confusion among managers and staff.

• Use Reliable Tools: Tracking overtime, paid leave, and schedules can get complicated. Consider using scheduling software like Shyft to streamline shift swaps, track hours, and manage leave requests efficiently. Proper digital tracking also supports your recordkeeping requirements.

• Display Posters Promptly: Maine’s required posters change. Regularly download the newest ones from the MDOL’s official site and place them in a highly visible area.

• Consult Professionals: Regulations can be nuanced, especially around independent contractor classification and leave laws. Speaking with an employment attorney or HR consultant can save you from costly mistakes down the line.

Summary

Maine’s labor laws encapsulate a broad set of responsibilities for employers, spanning from basic wage regulations to nuanced workplace safety mandates. With annual adjustments to the minimum wage and a wide array of protections—from whistleblower rights to mandated anti-harassment training—staying current is essential. By designing clear, written policies, leveraging technology, and consulting the right resources, businesses can not only remain compliant but also foster a transparent, fair, and engaged workforce.

Conclusion

From local minimum wage ordinances to drug-testing protocols, Maine’s regulations cover virtually every facet of the employer-employee relationship. Adhering to these rules isn’t merely about sidestepping penalties—solid compliance fosters trust, safety, and satisfaction among your team members, which can translate to better service or product quality for your customers.

Before making any big changes to your practices—like introducing a new leave policy or refining your wage structures—be sure to review the official Maine Department of Labor guidelines or consult a legal expert. Each business is unique, and the right approach takes both your operational needs and Maine’s legal landscape into account.

FAQ: Maine Labor Laws

Do local cities like Portland have different minimum wages?

Yes. Portland has a higher local minimum wage ($14.00 per hour in 2023) and hazard pay during declared emergencies. Always confirm local rules to ensure correct payment.

How does Maine’s Earned Paid Leave differ from traditional sick leave?

Maine’s Earned Paid Leave (EPL) is more flexible, allowing employees to use accrued hours for any reason, not just illness. Employers with 10 or more employees must offer EPL, accruing at a rate of 1 hour for every 40 worked, up to 40 hours per year.

Is an unpaid lunch break mandatory for all employees?

In Maine, workers are entitled to a 30-minute unpaid rest break after 6 consecutive hours. If the employee’s break is interrupted or they remain on-duty, it must be paid.

Are small businesses exempt from sexual harassment training requirements?

Employers with fewer than 15 employees are not required under Maine law to conduct formal sexual harassment training. However, training is a best practice for all businesses and mandatory for those with 15 or more employees.

Where can I find official Maine labor law posters?

You can download required posters from the Maine Department of Labor’s official website. Make sure to regularly update these postings to reflect any law changes.

Disclaimer: The information provided here is for general guidance only and may not reflect the most recent legal or policy changes. Always consult relevant experts and official resources to ensure compliance with local laws.