Table Of Contents

Washington Labor Laws: A Comprehensive Guide

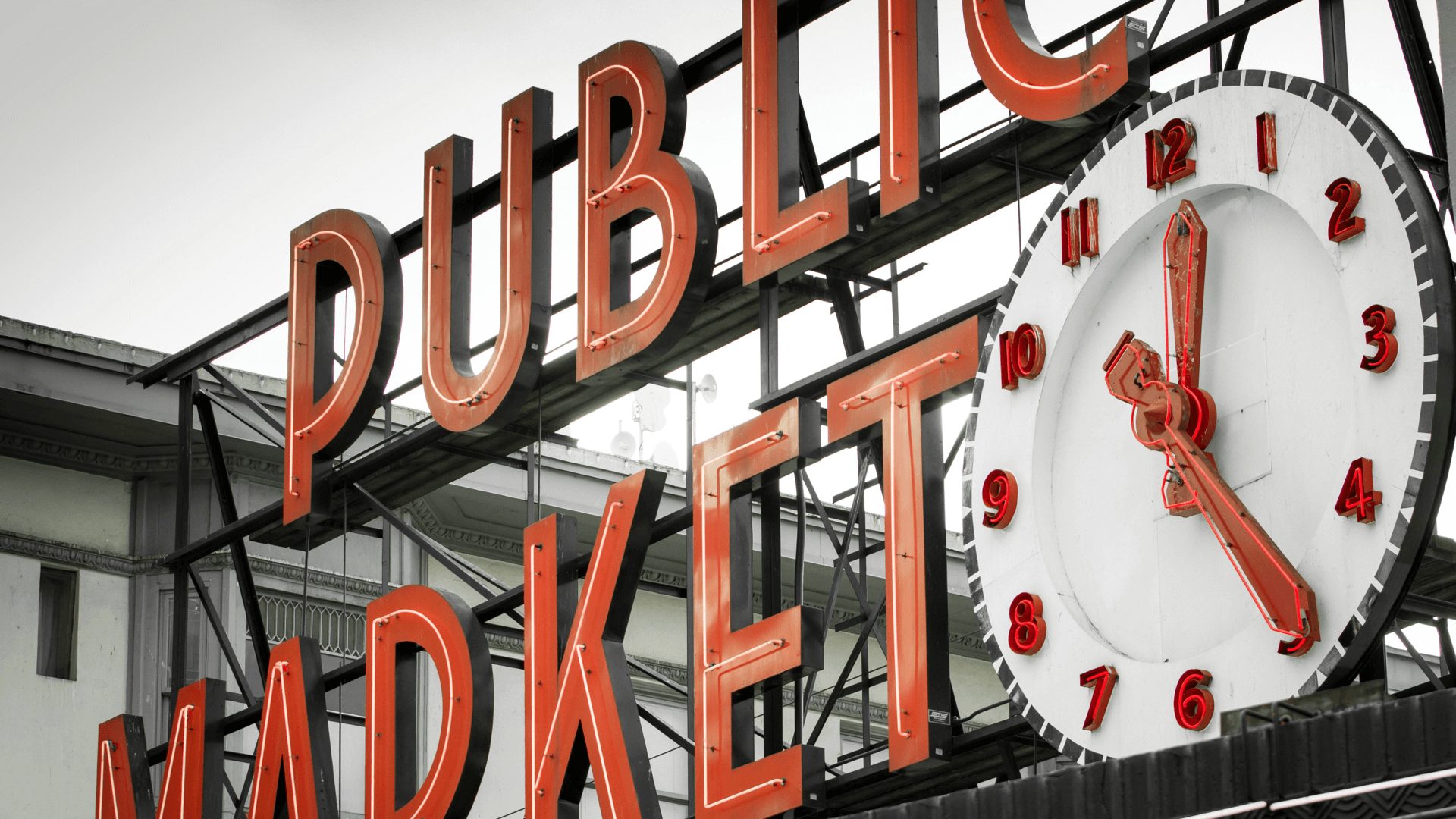

Whether you run a coffee shop in Seattle, a family-owned restaurant in Yakima, or a growing tech start-up in Spokane, understanding Washington’s labor laws is essential. The Evergreen State has its own set of regulations—beyond federal requirements—that shape everything from minimum wage rates to workplace privacy. In recent years, Washington has implemented groundbreaking policies on paid family leave, cannabis discrimination, and pay transparency, making compliance a bit more complex for employers.

This guide aims to simplify those complexities. We’ll walk through the most critical areas of Washington employment law, referencing official agencies like the Washington State Department of Labor & Industries (L&I), the Employment Security Department (ESD), and more. By the end, you’ll have a clear sense of what to do—and where to look—for staying on the right side of these regulations. Let’s dive in.

Washington Labor Laws

Washington sets high standards for worker protection and is often a trendsetter in progressive labor legislation. Below you’ll find an overview of the key areas that businesses—both small and large—must be aware of. For the full legal text and updates, check sites like the Washington Department of Labor & Industries (L&I) and the Employment Security Department (ESD).

1. Minimum Wage

Washington boasts one of the highest statewide minimum wages in the nation. In 2024, the rate is $16.28 per hour (L&I — Minimum Wage). This figure is adjusted every January 1 to account for inflation. Keep in mind that some cities have enacted their own higher local minimum wage requirements:

Seattle: Large employers (501+ employees worldwide) pay $19.67/hour. Small employers (≤500 employees) pay $19.67/hour unless they offer medical benefits or tips of at least $2.19/hour, in which case the minimum is $17.67/hour (Seattle Office of Labor Standards).

SeaTac: Certain hospitality and transportation workers are subject to a local minimum wage generally higher than the state rate (City of SeaTac).

2. Tipped Wages

Unlike some states, Washington does not allow tip credits against the minimum wage. Tipped employees must be paid the full state or local minimum wage in addition to any tips they earn (L&I — Tips and Service Charges). If you’re in the restaurant or hospitality industry, your business model should account for paying the higher base rate from day one.

3. Overtime & Double Time

Washington’s overtime rules require employers to pay time and a half for hours worked beyond 40 in a seven-day workweek (L&I — Overtime). Double time is not mandated by Washington law under normal circumstances, though collective bargaining agreements or specific industry regulations can offer higher rates. Additionally, the state has its own salary threshold for white-collar (exempt) employees, which increases yearly depending on employer size.

In 2024, for executive, administrative, or professional employees, the threshold varies by employer size. Smaller companies (1–50 employees) must pay a salary of at least 2.0 times the minimum wage. Larger employers (51+ employees) must pay 2.2 times the minimum wage. If an employee’s pay falls below that threshold, they are overtime-eligible.

4. Meal and Rest Breaks

Ensuring adequate meal and rest breaks is part of basic compliance. In Washington, employees who work more than five hours in a shift must be provided an unpaid 30-minute meal break, typically starting between the second and fifth hour (L&I — Meal and Rest Breaks). For every four hours of work, or the major portion thereof, employees are also entitled to a paid 10-minute rest break.

Workers who extend their shifts more than three hours beyond their usual schedule should receive an additional 30-minute unpaid meal period. If you run a busy kitchen or retail store, remember that scheduling tools—like Shyft—can help you ensure break compliance without chaos.

5. Child Labor Laws

Businesses hiring minors must follow strict regulations. Generally, the minimum age for non-agricultural work is 14, with additional restrictions on hours during school weeks (L&I — Youth Employment). Teens under 16 can work up to 16 hours per school week, and teens 16–17 can work up to 20 hours per school week. You’ll also need a minor work permit and parental/school authorization. Violations of these provisions can result in hefty fines and are often closely monitored by state agencies.

6. Final Paycheck & Wage Payment Rules

When an employment relationship ends, the final paycheck is due by the next regular payday—unless certain exceptions apply (L&I — Paycheck & Payday Requirements). Washington law disallows unauthorized deductions, such as for cash register shortages or uniforms, without proper written consent. Keep accurate records of hours worked and wages owed to avoid disputes.

7. Employee Classification (Employee vs. Independent Contractor)

Washington lacks a single “ABC” test, but uses multi-factor assessments for workers’ compensation (L&I), unemployment insurance (ESD), and wage/hour claims (L&I — Independent Contractors; ESD — Independent Contractors). The key question often boils down to who exerts control over work details, schedule, and method of payment. If you misclassify a worker, you risk penalties, back taxes, and potentially back pay for overtime or benefits.

8. Leave Requirements

Leave laws in Washington are robust, reflecting the state’s worker-friendly ethos. Employers must offer the following:

Paid Sick Leave (PSL): Accrual is at least one hour for every 40 hours worked, and the time can be used for personal illness, caring for a family member, or dealing with domestic violence issues (L&I — Paid Sick Leave).

Paid Family & Medical Leave (PFML): Administered by ESD, this program provides paid time off for bonding with a new child, serious personal health conditions, or caregiving for a family member (Paid Leave WA).

Family Care Act: Allows employees to use accrued paid leave to care for a sick family member (L&I — Family Care Act).

Remember, federal FMLA may also apply to your business if you have 50+ employees. Combining PFML and FMLA can be intricate, so consider creating a clear policy that references both sets of rules.

9. Anti-Discrimination and Harassment

The Washington Law Against Discrimination (RCW 49.60) protects employees on the basis of race, color, creed, sex, disability, national origin, marital status, sexual orientation, and more. It is enforced by the Washington State Human Rights Commission. Retaliation against employees who file complaints or cooperate in investigations is strictly prohibited. Employers are encouraged to maintain clear anti-harassment policies and conduct regular training.

10. Pay Transparency

Under Washington’s pay transparency rules, employers with 15 or more employees must disclose wage ranges or salary scales in job postings, as well as a general description of benefits (L&I — Pay Transparency). This law took effect in 2023 and aims to curb gender- and race-based pay disparities. If your business is smaller than 15 employees, transparency is still recommended as a best practice to build trust among applicants.

11. Workplace Safety (WISHA)

Washington operates its own version of OSHA, known as WISHA (Washington Industrial Safety and Health Act), overseen by L&I’s Division of Occupational Safety & Health (L&I — Workplace Safety and Health). Employers must comply with WISHA standards, provide safety training, and maintain a safe work environment. Injuries that require inpatient hospitalization or result in a fatality must be reported within designated timeframes. Failure to adhere to safety standards can result in substantial financial penalties.

12. Workers’ Compensation & Unemployment Insurance

Washington’s workers’ compensation system is primarily state-managed. Most employers must pay premiums to L&I, although some large companies are self-insured (L&I — Workers’ Compensation). Employers and employees typically split the premium cost based on risk classifications. The Employment Security Department (ESD) oversees unemployment insurance, which provides temporary benefits to eligible workers who lose their job through no fault of their own.

13. Privacy & Data Protection

While Washington has not yet passed a universal privacy law akin to California’s CCPA, the state does require employers to safeguard personal data, especially Social Security numbers and health information. In 2023, Washington enacted the My Health My Data Act, which imposes additional rules on handling consumer health data starting in 2024 (WA Attorney General — Privacy). Employers collecting health data as part of wellness programs or COVID-19 protocols should keep an eye on evolving requirements.

14. Drug & Alcohol Policies, Including Cannabis

Washington law does not strictly regulate private-sector drug and alcohol testing, but be mindful of privacy and discrimination concerns. Notably, effective January 1, 2024, it is unlawful to disqualify a job applicant solely for a positive pre-employment cannabis test (SB 5123). There are exceptions for safety-sensitive roles or where federal law mandates testing, but you should revise hiring policies to remain compliant.

15. Recordkeeping & Reporting Requirements

Employers must keep payroll records—showing hours worked, wages paid, and deductions—for a minimum of three years (L&I — Employers’ Recordkeeping). Additional documentation like minor work permits, safety training logs, and leave accrual records may also need secure retention. Washington agencies can request these records during audits or investigations, so consistent bookkeeping is paramount.

16. Whistleblower Protections

Retaliation is prohibited against employees who report potential violations of wage and hour laws, discrimination, or health and safety standards (L&I — Retaliation). Whistleblowers have the right to file complaints with L&I or the Washington State Human Rights Commission, and employers who retaliate risk significant penalties, including fines and legal liability.

17. Special Industry Laws

Some industries in Washington must adhere to additional requirements. Agricultural workers, for instance, are entitled to overtime pay after 40 hours per week, a change phased in fully by 2024 (L&I — Agricultural Labor). Healthcare employees have protections against mandatory overtime (L&I — Healthcare Overtime). In Seattle, large retail and food service employers face the Secure Scheduling Ordinance, mandating advance notice of work schedules (Seattle — Secure Scheduling).

18. Penalties & Enforcement

The Department of Labor & Industries is the primary enforcement agency for wage and hour, safety, and workers’ compensation issues. The Washington State Human Rights Commission handles discrimination complaints, while ESD focuses on unemployment and paid family/medical leave. Employers found in violation can face fines, back pay awards, civil penalties, and even criminal prosecution for egregious offenses (L&I — File a Complaint).

19. Additional State-Specific Labor Regulations

Washington also protects nursing mothers, requiring reasonable paid break time and a private, non-bathroom space for expressing milk. Further, the state’s Equal Pay and Opportunities Act broadens pay equity protections and prohibits retaliating against employees who discuss their wages (L&I — Equal Pay).

20. Best Practices & Compliance Tips

Staying compliant in Washington requires constant vigilance. Here are a few practical tips:

Stay Updated on Wages: Check for annual rate changes at L&I News & Updates and local city ordinances.

Post Mandatory Notices: Download the required workplace posters from L&I and display them in visible areas. This includes notices on worker rights, safety, and paid family/medical leave (Paid Family & Medical Leave Posters).

Use Scheduling Tools: Particularly if you need to juggle meal breaks, rest breaks, minor work restrictions, and advanced notice scheduling, a workforce management platform like Shyft can make life easier.

Educate Managers: Train supervisors on updated policies—especially around overtime, meal breaks, cannabis testing, and pay transparency. Uninformed managers are a leading cause of accidental compliance violations.

Document Everything: Maintain thorough payroll and timekeeping records for at least three years. This helps resolve any disputes quickly and accurately.

Summary

In a state as progressive and fast-evolving as Washington, employers must keep a keen eye on new legislation and rule updates. A few key areas—like local minimum wages, paid leave, cannabis discrimination, and pay transparency—tend to change frequently. By centralizing your documentation, training managers, and leveraging scheduling or HR software, you’ll be well on your way to fulfilling your obligations under Washington law.

Conclusion

As a small business or organization in Washington, your best bet is to stay proactive. Think of labor law compliance as a constant process of “weeding and feeding”—you trim outdated practices and nourish your policies with the latest legal developments. Doing so not only helps you sidestep penalties but also cultivates a positive, transparent workplace culture.

If you’ve been inspired to do a compliance check, start by reviewing your wage scales, employee classifications, and leave policies. With the right resources—public agencies, legal counsel, and user-friendly tools—you can meet state requirements and run a thriving, legally sound operation in Washington.

FAQ

Do all employers have to follow the state minimum wage?

Yes. Most businesses, regardless of size, must pay at least the state or local minimum wage. However, cities like Seattle or SeaTac may require higher rates, so check local laws.

Can I pay a separate, lower tipped wage in Washington?

No. Washington does not permit tip credits. You must pay the full minimum wage before any tips.

What happens if I fail to disclose salary ranges in job postings?

If you have 15 or more employees, you could face complaints or penalties under Washington’s pay transparency law. Smaller businesses are encouraged but not required to disclose ranges.

Is double time required in Washington?

No. Washington law only mandates time-and-a-half for hours worked over 40 in a workweek. Double time is not required unless stated in a collective bargaining agreement or policy.

Do I need special posters in my workplace?

Yes, Washington requires several posters including those about workers’ rights, minimum wage, safety, and paid family/medical leave. You can download them from L&I at no cost.

Disclaimer: The information provided here is for general guidance only and may not reflect the most recent legal or policy changes. Always consult relevant experts and official resources to ensure compliance with local laws.