When employment relationships end in Cape Coral, Florida, navigating final paycheck rules becomes a critical concern for both employers and employees. Whether due to resignation, termination, layoff, or other separation circumstances, understanding the legal requirements surrounding final compensation ensures a smooth transition and helps avoid potential disputes and legal issues. Unlike some states with highly specific final paycheck laws, Florida takes a somewhat different approach that employers in Cape Coral must carefully understand and follow.

Florida operates under at-will employment principles, which impacts how final paychecks are handled. While the state doesn’t have laws specifically mandating when final paychecks must be issued, employers still need to comply with federal regulations, established employment contracts, and company policies. For businesses in Cape Coral, implementing efficient scheduling and payroll systems can help ensure compliance while maintaining positive relationships with departing employees.

Understanding Florida’s Final Paycheck Laws

Unlike many states that have specific timeframes for issuing final paychecks, Florida state law doesn’t mandate a specific deadline by which employers must provide final compensation to terminated employees. Instead, Florida follows the Fair Labor Standards Act (FLSA), which requires employers to pay employees for all hours worked but doesn’t specify timing for final paychecks. This creates a situation where employers in Cape Coral must rely on other guidelines to establish compliant practices.

- No State-Mandated Deadline: Florida law doesn’t specify a timeframe for final paycheck distribution, unlike states like California or New York.

- Regular Pay Schedule: In the absence of state laws, employers typically provide final paychecks on the next regular payday.

- Employment Contracts: Any timeframe specified in employment contracts or company handbooks becomes legally binding.

- FLSA Compliance: Federal requirements for minimum wage and overtime calculations still apply to final paychecks.

- Wage Claims: Employees can file wage claims with the U.S. Department of Labor if they believe their final paycheck was incorrect or withheld.

For Cape Coral businesses implementing offboarding processes, understanding these fundamentals helps establish appropriate policies. Many employers adopt best practices of processing final paychecks promptly to maintain goodwill and avoid potential disputes, even though Florida law doesn’t explicitly require immediate payment.

Timeframe for Final Paycheck Distribution in Cape Coral

Without state-mandated deadlines, Cape Coral employers typically follow established company policies and industry standards when issuing final paychecks. Understanding these common practices helps both employers and employees set appropriate expectations during the termination process. Effective employee scheduling systems can help track final working hours accurately for timely processing.

- Next Regular Payday: Most employers in Cape Coral issue final paychecks on the next scheduled payday after termination.

- Company Policy Variations: Some businesses may establish more specific timeframes in their employment policies.

- Immediate Payment: While not legally required, some employers choose to provide final paychecks immediately upon termination.

- Direct Deposit Considerations: For employees using direct deposit, employers should clarify if the final paycheck will be deposited or issued as a physical check.

- Policy Documentation: Timeframes should be clearly documented in employee handbooks and termination procedures.

Having clearly established and communicated policies regarding final paycheck timing helps Cape Coral employers maintain compliance with labor laws while setting appropriate expectations with departing employees. Many businesses find that implementing digital workforce management systems helps streamline this process, especially for companies with multiple locations or complex pay structures.

What Must Be Included in Final Paychecks

When preparing final paychecks for employees in Cape Coral, employers must ensure they include all compensation owed for work performed. This goes beyond regular wages to include various types of earned compensation. Using integrated payroll systems can help ensure all required elements are properly calculated and included.

- Regular Wages: Payment for all hours worked up to the termination date at the agreed-upon rate.

- Overtime Pay: Any overtime hours worked in the final pay period must be compensated at the required rate (typically 1.5x regular pay).

- Commissions: Earned commissions that have been finalized according to the company’s commission structure.

- Bonuses: Any earned bonuses that have vested or become payable according to company policy.

- Expense Reimbursements: Outstanding approved business expenses that have not yet been reimbursed.

Accuracy in final paycheck calculations is essential for regulatory compliance and preventing disputes. Cape Coral employers should implement verification processes to ensure all earned compensation is properly included. Many organizations use digital timekeeping systems that integrate with payroll processing to reduce errors and ensure comprehensive final paychecks.

Handling PTO, Vacation Pay, and Other Benefits

The treatment of accrued paid time off (PTO), vacation days, and other benefits in final paychecks is an area where Florida law gives employers significant discretion. Cape Coral businesses must understand their obligations and options regarding these benefits when processing terminations. Implementing advanced HR tools can help track and calculate these benefits accurately.

- Vacation/PTO Payout: Florida law doesn’t require employers to pay out unused vacation or PTO unless specified in company policy or employment contracts.

- Policy Enforcement: Whatever policy an employer establishes regarding PTO payouts must be consistently applied to avoid discrimination claims.

- Sick Leave: Similar to vacation time, payout of accrued sick leave is at the employer’s discretion unless otherwise specified in company policy.

- Health Insurance: Information about COBRA continuation coverage must be provided to eligible employees.

- Retirement Benefits: Details about 401(k) or pension plans should be addressed during the offboarding process.

Cape Coral employers should clearly document their policies regarding benefit payouts in employee handbooks and implement tracking tools to maintain accurate records of accrued benefits. Many businesses find that transparency about these policies during both hiring and termination processes helps reduce confusion and potential disputes over final compensation.

Permissible and Prohibited Deductions

When processing final paychecks in Cape Coral, employers must navigate federal and state regulations governing what can and cannot be deducted. Improper deductions can lead to wage claims and legal issues, making it essential to understand these boundaries. Utilizing compliance verification tools can help ensure deductions meet legal requirements.

- Permissible Deductions: Standard tax withholdings, garnishments with valid court orders, and deductions the employee has authorized in writing.

- Prohibited Deductions: Employers generally cannot deduct for cash register shortages, damaged equipment, or customer walkouts without specific written authorization.

- Company Property: While employers cannot deduct for unreturned property, they may pursue separate legal action to recover property value.

- Written Authorization: Any non-standard deduction requires specific written authorization from the employee.

- Minimum Wage Impact: Deductions cannot reduce an employee’s earnings below minimum wage for hours worked.

Employers in Cape Coral should document all deduction policies clearly and obtain proper authorization before implementing any non-standard deductions. Healthcare organizations and other businesses with complex compensation structures may benefit from specialized payroll systems that can properly handle various deduction types while maintaining compliance.

Record-Keeping Requirements

Proper documentation is essential when processing final paychecks for terminated employees in Cape Coral. Maintaining comprehensive records protects both employers and employees by providing evidence of compliance with wage and hour laws. Effective data management systems can streamline this record-keeping process.

- Payroll Records: Maintain detailed records of hours worked, pay rates, and calculations for at least three years under FLSA requirements.

- Termination Documentation: Keep records of termination reason, date, and final paycheck details.

- Benefit Calculations: Document how accrued benefits were calculated and processed in the final paycheck.

- Deduction Authorizations: Retain signed authorizations for any non-standard deductions made from final pay.

- Receipt Confirmation: Consider obtaining signed acknowledgment of final paycheck receipt.

Digital record-keeping solutions can help Cape Coral employers maintain organized, secure, and easily accessible payroll records. Many retail businesses and other industries with high turnover rates find that implementing specialized HR software significantly reduces administrative burden while improving compliance with record-keeping requirements.

Best Practices for Employers in Cape Coral

While Florida law provides flexibility regarding final paychecks, Cape Coral employers can implement best practices that go beyond minimum requirements to ensure smooth terminations and minimize potential disputes. Workforce optimization methodology can help establish efficient processes that protect both the business and employees.

- Clear Written Policies: Develop and communicate explicit policies regarding final paycheck timing and benefit payouts.

- Termination Checklists: Create comprehensive checklists for HR personnel to ensure all payroll and benefit matters are properly addressed.

- Exit Interviews: Use exit interviews to review final pay details and address any questions or concerns.

- Prompt Processing: Even though not legally required, aim to process final paychecks promptly to maintain goodwill.

- Technology Integration: Implement digital solutions that streamline final paycheck calculations and distributions.

Many Cape Coral businesses find that exceeding minimum requirements for final paycheck processing contributes to a positive company reputation and reduces the likelihood of disputes. Hospitality companies and other service-oriented businesses particularly benefit from maintaining goodwill with former employees who may influence public perception of the organization.

Employee Rights Regarding Final Paychecks

While Florida doesn’t have specific final paycheck laws, employees in Cape Coral still have important rights when it comes to receiving their earned compensation. Understanding these rights helps employees navigate terminations effectively and take appropriate action if issues arise. Employers using flexible scheduling options should ensure their systems accurately track all compensable time for final paycheck calculations.

- Right to Full Compensation: Employees are entitled to receive all earned wages for hours worked.

- Contract Enforcement: If employment contracts or company policies specify final paycheck timing or benefit payouts, employees can enforce these terms.

- Filing Wage Claims: Employees can file complaints with the U.S. Department of Labor for unpaid wages.

- Legal Recourse: For substantial disputes, employees may pursue civil litigation for unpaid wages.

- Protection from Retaliation: Employees are protected from retaliation for asserting their wage rights.

Employees should carefully review their employment agreements and company handbooks to understand specific policies regarding final compensation. Time tracking tools can help employees maintain their own records of hours worked to verify final paycheck accuracy, particularly for hourly workers in industries with variable schedules.

Common Disputes and Resolution Pathways

Despite best efforts, disputes regarding final paychecks sometimes arise between employers and departing employees in Cape Coral. Understanding common areas of contention and available resolution methods can help both parties address issues efficiently. Conflict resolution strategies can be applied to payroll disputes to reach fair solutions.

- Common Dispute Areas: Calculation of hours worked, overtime eligibility, commission determination, benefit payout policies, and unauthorized deductions.

- Direct Communication: Many disputes can be resolved through direct discussion between the employee and HR or payroll department.

- Department of Labor Claims: Employees can file wage claims with the federal Department of Labor’s Wage and Hour Division.

- Small Claims Court: For disputes under $8,000, Florida’s small claims court provides a relatively simple legal pathway.

- Documentation Importance: Thorough records from both employers and employees are crucial for resolving disputes.

Cape Coral employers can reduce the likelihood of disputes by implementing transparent policies and maintaining open communication during the termination process. Organizations using integrated time tracking systems often experience fewer disputes due to improved accuracy in wage calculations and better documentation of work hours.

Technology Solutions for Managing Final Paychecks

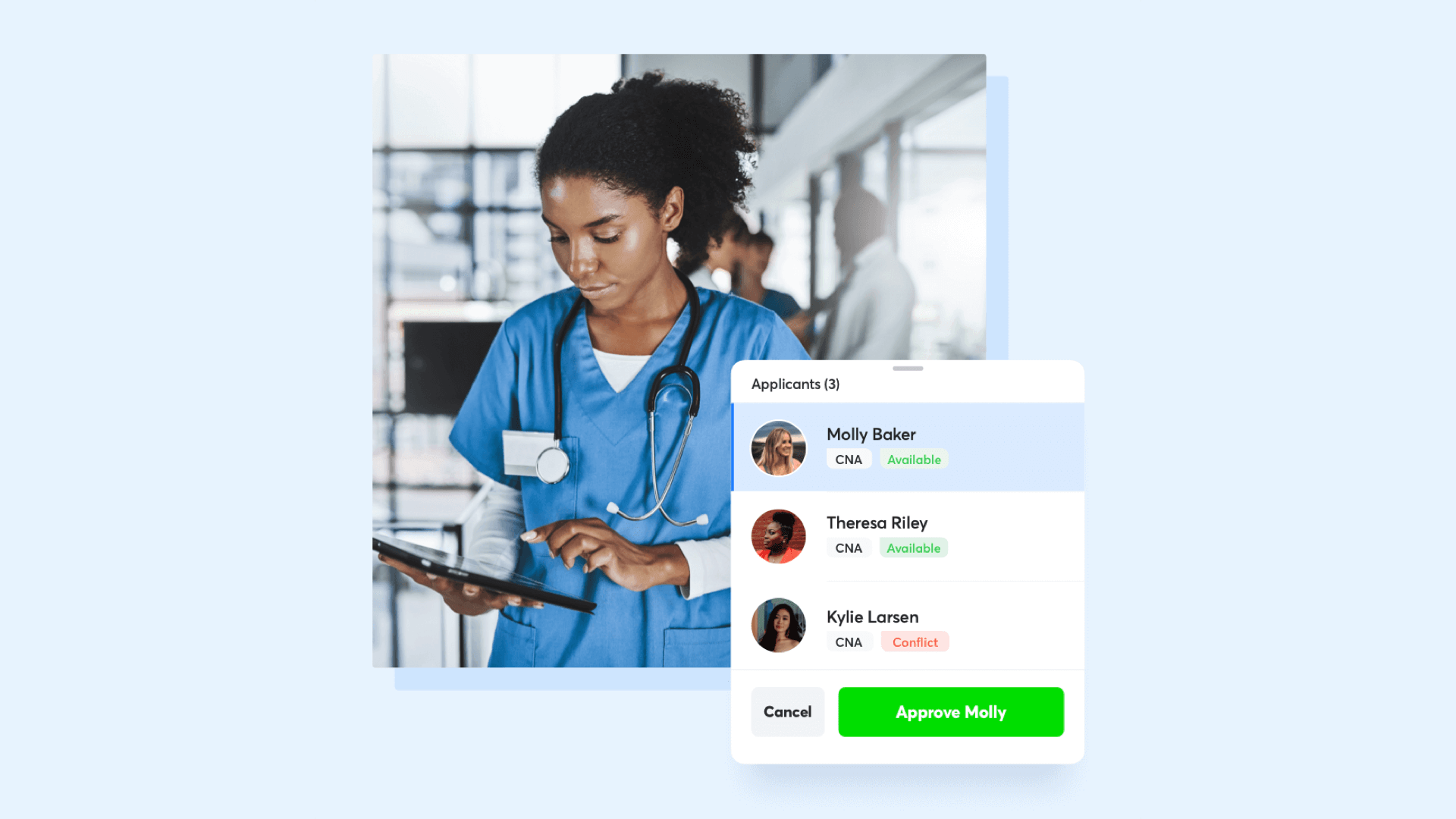

Modern technology offers Cape Coral employers powerful tools to streamline and improve the accuracy of final paycheck processing. Implementing appropriate digital solutions can reduce errors, ensure compliance, and create a more efficient offboarding experience. Shyft’s scheduling software and similar technologies help maintain accurate time records that form the foundation of correct final pay calculations.

- Integrated HRIS Systems: Human Resource Information Systems that connect time tracking, payroll, and benefits administration.

- Digital Time Tracking: Automated systems that accurately record work hours and calculate overtime for final pay periods.

- Offboarding Workflows: Customized digital workflows that guide HR personnel through the termination process.

- Compliance Monitoring: Software that verifies final paychecks meet all applicable regulations and company policies.

- Document Management: Secure digital storage for termination records and final paycheck documentation.

Businesses in Cape Coral increasingly recognize that investing in workforce management technology delivers significant returns by reducing administrative burdens, minimizing errors, and decreasing the risk of costly disputes. Industries with complex scheduling needs, such as healthcare and retail, particularly benefit from specialized systems that can accurately track hours and calculate appropriate compensation for final paychecks.

Conclusion

Navigating final paycheck rules in Cape Coral requires understanding Florida’s approach to wage regulations, which offers flexibility but also places responsibility on employers to establish and follow clear policies. While the state doesn’t mandate specific timeframes for final paycheck distribution, employers must still ensure all earned wages are paid accurately and that any benefit payouts align with established company policies. Proper documentation, clear communication, and consistent application of policies are essential for avoiding disputes and maintaining compliance with applicable federal regulations.

For both employers and employees in Cape Coral, knowledge of final paycheck requirements helps ensure smooth employment transitions. Employers can protect their organizations by implementing comprehensive offboarding procedures and leveraging technology solutions that improve accuracy and efficiency. Meanwhile, employees benefit from understanding their rights and the resources available if issues arise. By approaching final paychecks with attention to detail and commitment to fairness, Cape Coral businesses can maintain positive relationships with departing employees while fulfilling their legal obligations.

FAQ

1. When must employers in Cape Coral provide a final paycheck?

Florida law doesn’t specify a deadline for final paycheck distribution. In the absence of state requirements, Cape Coral employers typically issue final paychecks on the next regular payday following termination. However, any timeframe specified in employment contracts or company policies becomes legally binding. Some employers choose to issue final paychecks immediately upon termination as a best practice, though this isn’t legally required under Florida law.

2. Are employers in Cape Coral required to pay out unused vacation time?

Florida law doesn’t require employers to pay out unused vacation time or PTO unless specified in company policy or employment contracts. Cape Coral employers have discretion to establish their own policies regarding vacation payouts, but these policies must be clearly communicated and consistently applied to avoid discrimination claims. If an employer’s handbook or policies state that unused vacation will be paid upon termination, this creates a legal obligation that must be honored in the final paycheck.

3. What deductions can legally be made from a final paycheck in Cape Coral?

Legal deductions from final paychecks in Cape Coral include standard tax withholdings, court-ordered garnishments, and deductions the employee has authorized in writing. Employers generally cannot deduct for cash register shortages, damaged equipment, or unreturned property without specific written authorization. Additionally, deductions cannot reduce an employee’s earnings below minimum wage for hours worked. Employers should maintain proper documentation for all deductions, especially those beyond standard withholdings.

4. How can employees dispute an incorrect final paycheck?

Employees who believe their final paycheck is incorrect should first contact their employer’s HR or payroll department to address the issue directly. If this doesn’t resolve the problem, employees can file a wage claim with the U.S. Department of Labor’s Wage and Hour Division. For disputes under $8,000, Florida’s small claims court provides another option. Employees should gather documentation of hours worked, pay rates, and any relevant company policies to support their claim. The statute of limitations for federal wage claims is typically two years, extended to three years for willful violations.

5. What records should employers maintain regarding final paychecks?

Cape Coral employers should maintain comprehensive records related to final paychecks for at least three years under FLSA requirements. These records should include detailed documentation of hours worked, pay rates, overtime calculations, and any special payments like commissions or bonuses. Additionally, employers should keep records of termination details, benefit calculations, deduction authorizations, and evidence that the final paycheck was distributed. Digital record-keeping systems can help organize this information securely while ensuring it remains accessible if questions or disputes arise in the future.