When employment ends, whether through resignation, termination, layoff, or retirement, employers in Cleveland, Ohio must navigate specific legal requirements regarding final paychecks. Understanding these obligations is crucial for maintaining compliance with state regulations and avoiding costly penalties. While Ohio’s final paycheck laws set the baseline requirements, Cleveland employers must also consider local ordinances, company policies, and best practices that may impact the termination process. Properly managing final paychecks is not only a legal obligation but also an important aspect of maintaining a positive employer brand and respectful offboarding experience.

The final paycheck process represents one of the last interactions between employers and departing employees, making it a critical component of the offboarding experience. How this process is handled can significantly impact an employee’s lasting impression of the organization and potentially affect everything from future referrals to online reviews. For Cleveland employers, implementing efficient scheduling practices and payroll systems can help ensure final paychecks are accurate, timely, and compliant with all applicable laws. This comprehensive guide will explore everything Cleveland employers need to know about final paycheck requirements, including timing, content, deductions, special considerations, and best practices for seamless termination processing.

Understanding Ohio’s Final Paycheck Laws

Ohio law establishes the fundamental requirements for final paycheck distribution that Cleveland employers must follow. Unlike some states with specific timeframes for final paycheck delivery, Ohio maintains the same pay schedule requirements for final paychecks as regular payroll. This means employers must issue a departing employee’s final paycheck by the regular pay date for the pay period in which the employee worked. Understanding these basic requirements is essential for compliance with labor laws and proper termination procedures.

While Ohio doesn’t require accelerated payment schedules for final paychecks, employers should be aware of the following key regulations:

- Standard Pay Schedule Applies: Employers must provide final paychecks by the regular payday for the pay period when the employee last worked.

- No Early Payment Requirement: Unlike states such as California or Massachusetts, Ohio doesn’t mandate immediate payment upon termination.

- Payment Method Consistency: Final paychecks should generally be delivered using the same method as regular paychecks, whether direct deposit or physical check.

- Wage Theft Prevention: Intentionally withholding final paychecks can violate Ohio’s wage theft prevention laws.

- Written Pay Policies: Employers should maintain clear, written policies regarding final pay procedures as part of their compliance training.

Cleveland employers should also note that while state law doesn’t distinguish between voluntary and involuntary terminations for final paycheck timing, implementing a workforce optimization framework that streamlines the offboarding process can be beneficial for both the organization and departing employees.

What Must Be Included in Final Paychecks

When preparing final paychecks for departing employees in Cleveland, employers must ensure they include all compensation owed. This extends beyond basic hourly wages or salary to encompass several other potential earnings. Utilizing automated scheduling and payroll systems can help employers accurately track and calculate these various components.

The final paycheck must include payment for all elements of compensation owed to the employee, including:

- All Hours Worked: Payment for all regular hours worked up to the termination date, calculated at the employee’s standard rate of pay.

- Overtime Pay: Any overtime hours worked in the final pay period must be paid at the appropriate overtime rate (typically 1.5 times the regular rate for hours worked beyond 40 in a workweek).

- Commissions and Bonuses: Any earned commissions or bonuses that have vested according to the company’s policies or agreements.

- Accrued Benefits: Payment for any accrued and unused benefits that are payable upon termination according to company policy, such as paid time off (PTO).

- Expense Reimbursements: Outstanding expense reimbursements for business-related expenses incurred by the employee.

Employers should maintain detailed records and documentation of all calculations related to final pay, as these may be subject to scrutiny in case of disputes. It’s particularly important to have clear policies regarding payouts for accrued benefits like vacation time, as Ohio law does not mandate such payments unless company policy establishes them as earned wages.

Accrued PTO and Vacation Time in Final Paychecks

One of the most common questions Cleveland employers face regarding final paychecks is how to handle accrued but unused paid time off (PTO), vacation time, or sick leave. In Ohio, the requirement to pay out these benefits depends primarily on the employer’s established policies rather than state law. This gives employers significant flexibility but also makes it essential to have clear, consistent policies that are communicated to employees through effective team communication channels.

Here’s what Cleveland employers need to know about handling accrued time off in final paychecks:

- Policy-Dependent Payout: Ohio law does not require employers to pay out accrued vacation or PTO unless their established policies or employment contracts promise such payment.

- Written Policy Importance: Employers should maintain clear written policies on PTO payout upon termination, ideally in the employee handbook and accessible through employee self-service portals.

- Consistent Application: Whatever policy is established must be applied consistently to avoid claims of discrimination or unfair treatment.

- Conditional Payouts: Some employers implement policies that make PTO payout conditional on factors such as providing adequate notice or completing the full offboarding process.

- Sick Leave Considerations: While vacation time is often treated as earned compensation, sick leave is frequently excluded from final paycheck requirements unless specifically included in company policy.

Employers implementing PTO policies should consider using mobile access tools that allow employees to easily track their accrued time, which can help prevent disputes during the offboarding process. Remember that once a policy establishes PTO as earned compensation, it becomes legally enforceable in Ohio, and failure to pay could result in wage claims.

Legal Deductions from Final Paychecks

When processing final paychecks, Cleveland employers must be careful about what deductions they make. While certain deductions are permitted or even required by law, others may be illegal and could expose employers to liability. Implementing proper time tracking tools can help ensure accurate calculations and appropriate deductions.

Here are the types of deductions that can legally be taken from final paychecks in Cleveland:

- Required Deductions: Federal and state income tax withholding, Social Security, Medicare, and any court-ordered garnishments or child support payments must continue to be deducted.

- Authorized Deductions: Deductions the employee has previously authorized in writing, such as health insurance premiums, retirement contributions, or union dues.

- Company Property: The value of company property not returned by the employee, provided there is prior written authorization from the employee agreeing to such deductions.

- Wage Advances: Recovery of wage advances or overpayments, provided proper documentation exists and the deduction doesn’t reduce wages below minimum wage.

- Uniform and Tool Deductions: Costs for unreturned uniforms or tools, subject to prior agreement and minimum wage restrictions.

Employers should be aware that Ohio law restricts deductions that would bring an employee’s pay below minimum wage, even in the final paycheck. Additionally, many deductions require prior written authorization from the employee. Organizations with a mobile workforce management system can streamline the process of obtaining and documenting such authorizations.

Managing Final Pay for Different Types of Separations

The circumstances surrounding an employee’s departure can impact how final paychecks are handled in Cleveland. While Ohio law doesn’t specifically differentiate timing requirements based on separation type, employers often implement different processes for voluntary resignations versus involuntary terminations. Using performance metrics and workforce planning tools can help organizations better prepare for various separation scenarios.

Consider these guidelines for managing final pay across different types of employment separations:

- Voluntary Resignation: When employees provide notice, employers can process final pay through the regular payroll cycle, ensuring all accrued benefits are accurately calculated according to company policy.

- Involuntary Termination: While not legally required in Ohio, some Cleveland employers opt to provide final paychecks on the last day of employment for terminated employees to create a clean break.

- Layoffs: For reductions in force, employers may need to process multiple final paychecks simultaneously, requiring careful coordination between HR and payroll departments.

- Job Abandonment: When employees stop showing up without notice, employers should document attempts to contact them and follow company policy for processing final pay.

- Death of Employee: Final paychecks may need to be issued to the employee’s estate or legal representative, requiring additional documentation.

Regardless of separation type, employers should ensure consistent application of policies and maintain detailed documentation. Implementing offboarding processes with clear checklists can help ensure final pay compliance across all separation scenarios. For organizations with shift workers, utilizing a comprehensive shift schedule system can facilitate accurate tracking of final hours worked.

Handling Disputes and Claims Related to Final Paychecks

Even with the best intentions and processes, disputes over final paychecks can arise. Cleveland employers should be prepared to address these situations promptly and effectively to minimize potential legal consequences. Implementing clear conflict resolution procedures can help manage these challenging situations.

Here’s how employers can prepare for and address final paycheck disputes:

- Documentation Requirements: Maintain comprehensive documentation of all wage calculations, hours worked, and deductions to quickly address any challenges to final pay amounts.

- Employee Wage Claims: Be aware that employees can file wage claims with the Ohio Department of Commerce’s Division of Industrial Compliance if they believe they haven’t received proper payment.

- Statute of Limitations: The statute of limitations for wage claims in Ohio is generally two years, giving former employees ample time to raise concerns about final pay.

- Penalties for Non-Compliance: Employers who willfully withhold final pay may face penalties including paying the owed wages plus liquidated damages.

- Internal Resolution Process: Establish a clear process for addressing final paycheck disputes that includes a point of contact and timeframe for resolution.

Implementing data-driven decision making processes in payroll and HR operations can help reduce errors that lead to disputes. When disputes do arise, having a systematic approach to investigation and resolution can help maintain positive relationships even through the separation process. For Cleveland employers with complex shift structures, scheduling software mastery can be essential for accurate final pay calculations.

Best Practices for Final Paycheck Management

To ensure compliance with Ohio law and maintain positive employee relations, Cleveland employers should implement best practices for managing final paychecks. A systematic approach to termination processing can help prevent errors, reduce disputes, and create a more professional offboarding experience. Using change management principles can help organizations continuously improve their final paycheck processes.

Consider implementing these best practices for final paycheck management:

- Clear Written Policies: Develop comprehensive, written policies regarding final pay, including timing, treatment of accrued benefits, and authorized deductions.

- Termination Checklists: Create detailed checklists for HR and payroll staff that cover all aspects of final pay processing, ensuring nothing is overlooked.

- Exit Interviews: Use exit interviews to review final pay calculations with departing employees and address any questions or concerns immediately.

- Payroll System Optimization: Configure payroll systems to flag final paychecks for special review to ensure accuracy and compliance.

- Training and Education: Provide regular training to HR and payroll staff on final paycheck requirements and company policies.

Additionally, employers should consider implementing automation technologies to reduce manual errors in final pay calculations. Using a comprehensive human resource management system can help integrate termination workflows with payroll processing, ensuring all aspects of offboarding are handled efficiently and accurately.

Technology Solutions for Final Paycheck Processing

Modern technology solutions can significantly streamline final paycheck processing for Cleveland employers. By leveraging digital tools, organizations can reduce errors, ensure compliance, and create a more efficient offboarding experience. Implementing integrated integration capabilities between HR, scheduling, and payroll systems is particularly valuable for final pay accuracy.

Consider these technology solutions to enhance final paycheck management:

- Integrated HRIS Systems: Utilize Human Resource Information Systems that connect termination processing directly with payroll, automatically triggering final paycheck preparation when an employee separation is recorded.

- Digital Offboarding Portals: Implement employee self-service portals that provide departing employees with visibility into their final pay calculations and expected payment date.

- Time and Attendance Automation: Use automated time tracking systems to ensure accurate calculation of final hours worked, especially for hourly employees.

- Compliance Monitoring Tools: Employ software that automatically flags potential compliance issues with final paychecks based on Ohio regulations.

- Digital Document Management: Maintain electronic records of all termination documents, final pay calculations, and employee acknowledgments for easy retrieval if disputes arise.

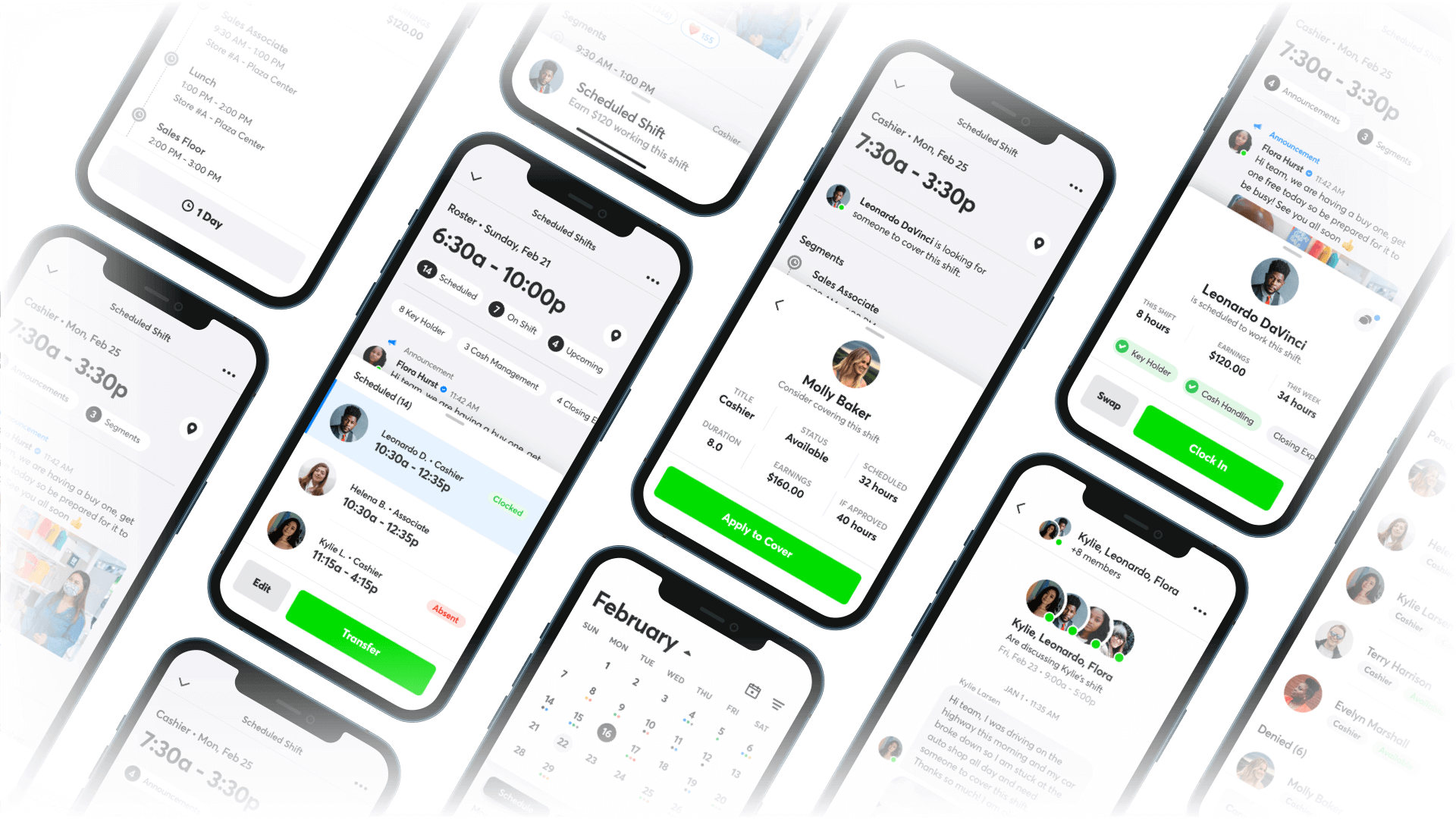

For organizations with complex scheduling needs, platforms like Shyft offer employee scheduling solutions that integrate with payroll systems to ensure accurate tracking of final hours worked. This integration is particularly valuable for industries with variable schedules, such as retail, hospitality, and healthcare, where calculating final pay can be more complex.

Final Paycheck Requirements for Special Employment Situations

Some employment situations present unique challenges for final paycheck processing in Cleveland. Employers must be prepared to handle special circumstances while still maintaining compliance with Ohio law. Implementing flexible workforce scheduling systems can help accommodate these diverse situations.

Here are considerations for handling final paychecks in special employment situations:

- Seasonal Employees: Clarify in advance whether seasonal positions have defined end dates and how final pay will be handled, including any season-completion bonuses.

- Remote Workers: For remote employees based in Cleveland, ensure final paycheck processing complies with Ohio law, even if the employer is headquartered elsewhere.

- Contract Workers: Distinguish between employees and independent contractors, as contractors typically receive final payment according to contract terms rather than employment laws.

- Commissioned Sales Staff: Develop clear policies for how pending commissions will be handled after termination, including calculation methods and payment timeframes.

- Tipped Employees: Ensure final paychecks for tipped employees include accurate tip credit calculations and all reported tips through the last day worked.

Organizations with diverse workforce models should consider implementing reporting and analytics tools that can account for these various employment types when processing final pay. For businesses that rely heavily on shift work, maintaining accurate records of all scheduled and worked shifts is essential for final paycheck accuracy.

Conclusion

Managing final paychecks effectively is a critical component of the termination and offboarding process for Cleveland employers. While Ohio law provides the basic framework requiring final pay by the regular payday for the last pay period worked, employers must navigate numerous considerations to ensure compliance and maintain positive employee relations. From accurately calculating all earned wages and properly handling accrued PTO to making only authorized deductions and addressing special employment situations, final paycheck processing requires attention to detail and systematic procedures.

By implementing clear policies, leveraging technology solutions, and following best practices, Cleveland employers can streamline the final paycheck process while minimizing legal risks and disputes. Remember that the final paycheck represents one of the last touchpoints with departing employees and can significantly impact their perception of the organization. Taking a thoughtful, compliant approach to final pay not only satisfies legal requirements but also contributes to a professional offboarding experience that respects the employee’s contributions. For organizations looking to enhance their termination processes, solutions like Shyft can help integrate scheduling, time tracking, and payroll systems to ensure accurate and timely final paychecks while optimizing overall workforce management.

FAQ

1. When must employers in Cleveland deliver final paychecks to terminated employees?

In Cleveland, Ohio, employers must provide final paychecks by the regularly scheduled payday for the pay period in which the employee last worked. Unlike some states, Ohio does not require immediate payment upon termination or have different timeframes for voluntary versus involuntary separations. However, employers should always consult their own policies, as some companies choose to issue final paychecks sooner than legally required as a best practice.

2. Is an employer in Cleveland required to pay out unused vacation time in the final paycheck?

Ohio law does not specifically require employers to pay out accrued but unused vacation time upon termination. However, if an employer has established a policy or practice of paying out unused vacation time, or if this benefit is included in an employment contract or collective bargaining agreement, then the employer must honor that commitment. The key factor is the employer’s established policy, which should be clearly documented and consistently applied to all employees to avoid discrimination claims.

3. What deductions can legally be taken from a final paycheck in Cleveland?

Legal deductions from final paychecks in Cleveland include mandatory withholdings (federal and state taxes, Social Security, Medicare), court-ordered garnishments, and deductions the employee has authorized in writing. Employers may also deduct the value of unreturned company property or outstanding advances, provided there is prior written authorization and the deduction doesn’t reduce pay below minimum wage. However, employers should be cautious with final paycheck deductions, as improper deductions can lead to wage claims and penalties.

4. What penalties might Cleveland employers face for failing to provide proper final paychecks?

Employers in Cleveland who fail to properly provide final paychecks may face several consequences. These can include wage claims filed with the Ohio Department of Commerce, civil lawsuits for unpaid wages, and potential liquidated damages equal to the amount of unpaid wages in cases of willful violations. Additionally, employers may be responsible for the employee’s attorney fees and court costs if the employee prevails in a wage claim lawsuit. Beyond legal penalties, improper final paycheck handling can damage an employer’s reputation and affect their ability to attract talent.

5. How should Cleveland employers handle final paychecks for employees who have died?

When an employee passes away, Cleveland employers must issue the final paycheck to the appropriate legal representative. In Ohio, if the amount due is $5,000 or less and no executor or administrator has been appointed, the employer may release the final pay to the employee’s spouse, children, parents, or siblings (in that order of priority). For amounts over $5,000 or in complex situations, the final paycheck should be issued to the executor or administrator of the estate. Employers should obtain proper documentation and may wish to consult with legal counsel to ensure proper handling of these sensitive situations.