Managing employee records in Las Vegas, Nevada requires careful attention to federal, state, and local regulations. Proper recordkeeping isn’t just a best practice—it’s a legal necessity that protects your business from potential liability while ensuring compliance with various labor laws. Organizations in Las Vegas must navigate a complex web of requirements regarding how long to keep employee documents, what format they should be stored in, and how to properly dispose of them when retention periods expire. Effective employee records retention schedules help businesses maintain organized documentation systems that support human resources functions while meeting legal obligations specific to Nevada.

A well-structured employee records retention schedule is an essential component of comprehensive workforce management technology for businesses of all sizes. From hiring documents to performance reviews, payroll records to benefits enrollment forms, each type of employee record has specific retention requirements. For Las Vegas employers, staying current with both federal mandates and Nevada-specific regulations can be challenging, particularly as laws evolve. This guide will examine the key components of an effective employee records retention schedule, essential timeframes, and best practices for maintaining compliant documentation systems in Las Vegas, Nevada.

Legal Framework for Records Retention in Las Vegas

Las Vegas businesses must comply with a multi-layered legal framework when establishing their employee records retention schedules. Understanding these requirements is critical for maintaining compliance and avoiding potential penalties. Records retention obligations stem from federal, state, and in some cases, local regulations, creating a complex web of requirements that businesses must navigate.

- Federal Requirements: Federal laws like the Fair Labor Standards Act (FLSA), Equal Employment Opportunity laws, the Employee Retirement Income Security Act (ERISA), and Occupational Safety and Health Administration (OSHA) regulations establish baseline retention requirements.

- Nevada State Laws: Nevada has specific statutes regarding employment records, including NRS 608.115, which requires employers to maintain records of wages, hours worked, and conditions of employment.

- Statute of Limitations: Many retention periods align with statutes of limitations for potential employment claims, which can vary by claim type.

- Industry-Specific Regulations: Companies in highly regulated industries such as healthcare, gaming, or financial services face additional record-keeping requirements.

- Local Ordinances: Las Vegas and Clark County may have additional requirements for businesses operating within their jurisdictions.

Employers should consider implementing workforce optimization software that includes records management capabilities to ensure compliance with this complex regulatory environment. Digital solutions can help track retention periods, automate document lifecycle management, and maintain audit trails of records handling. Having centralized records management can significantly reduce the administrative burden while improving compliance.

Essential Employee Records and Retention Periods

Different types of employee records have varying retention requirements based on the governing regulations. Las Vegas employers should organize their retention schedules according to document categories, ensuring that records are kept for the appropriate timeframes. Implementing a document retention policy that clearly outlines these requirements can help maintain compliance.

- Hiring Records: Applications, resumes, job descriptions, and interview notes should be retained for at least one year from the hiring decision (three years for federal contractors).

- Payroll Records: Under both FLSA and Nevada law, payroll records, including time cards, wage rates, and pay stubs, must be kept for at least three years.

- Tax Documents: Employment tax records should be maintained for at least four years after the tax is due or paid, whichever is later.

- Personnel Files: Employment contracts, performance evaluations, disciplinary actions, and commendations should be kept for the duration of employment plus three years.

- Medical Records: Employee medical records, including health insurance records and disability accommodation documents, must be kept separate from personnel files and retained for at least three years.

- I-9 Forms: These should be kept for three years after the date of hire or one year after termination, whichever is later.

Implementing employee management software with integrated records management capabilities can significantly simplify adherence to these varying retention requirements. Digital solutions can automatically track retention periods, send alerts when documents are approaching their destruction date, and maintain comprehensive audit trails of all record handling activities.

Digital Records Management Considerations

Many Las Vegas businesses are transitioning to digital record-keeping systems, which offer numerous advantages for implementing employee records retention schedules. Digital systems can automate many aspects of records management, reducing administrative burden while improving compliance. However, electronic records management comes with its own set of considerations and requirements.

- Legal Validity: Nevada recognizes electronic records as legally valid provided they meet requirements for authenticity, integrity, and accessibility.

- Security Requirements: Digital employee records must be protected with appropriate security measures, including access controls, encryption, and regular backups.

- Metadata Management: Electronic records should include metadata that documents creation dates, modifications, and access history.

- Conversion Processes: When converting paper records to digital format, businesses must ensure the integrity and completeness of the information.

- System Reliability: Electronic records systems should be reliable, with redundancies to prevent data loss and capabilities to retrieve information when needed.

Companies implementing HR management systems integration should ensure that their digital platforms comply with these requirements. Modern workforce management solutions can streamline records retention by automating document lifecycle management, from creation through destruction, while maintaining necessary audit trails. This integration can significantly reduce administrative overhead while ensuring compliance with retention requirements.

Creating an Effective Records Retention Policy

A comprehensive records retention policy is the foundation of effective records management for Las Vegas employers. This policy should clearly outline what records must be kept, for how long, and the procedures for storage, retrieval, and eventual destruction. Developing a tailored policy that addresses both regulatory requirements and business needs is essential for maintaining compliance while supporting operational efficiency.

- Policy Components: Include scope, responsibilities, retention schedules, storage methods, access controls, and destruction procedures in your policy document.

- Document Classification: Categorize documents based on type, sensitivity, and applicable retention requirements.

- Legal Review: Have your policy reviewed by legal counsel familiar with Nevada employment law to ensure compliance with all applicable regulations.

- Employee Communication: Ensure that all staff responsible for records management understand the policy and their responsibilities.

- Regular Updates: Review and update your policy annually to reflect changes in regulations or business practices.

Implementing compliance management software can help ensure adherence to your records retention policy. These solutions can provide automated workflows for document handling, track policy updates, and deliver training to employees responsible for records management. With proper systems in place, businesses can maintain consistent compliance with their retention policies while reducing the risk of human error.

Secure Storage and Access Controls

Properly securing employee records is a critical component of an effective records retention program. Las Vegas employers must implement appropriate security measures to protect confidential employee information from unauthorized access while ensuring that authorized personnel can retrieve necessary records when needed. Security considerations apply to both physical and digital records systems.

- Physical Records Security: Store paper records in secure, fire-resistant cabinets or rooms with limited access. Consider using locked filing systems and maintaining a check-out system for file access.

- Digital Security Measures: Implement encryption, access controls, secure backup systems, and audit trails for electronic records. Use multi-factor authentication for sensitive HR systems.

- Access Authorization: Clearly define who has access to which records and implement a permission-based system that restricts access to those with a legitimate business need.

- Employee Privacy: Balance security needs with employee privacy rights. Nevada law requires reasonable safeguards for personal information.

- Disaster Recovery: Develop plans for preserving and recovering employee records in case of natural disasters, which are particularly important in Las Vegas’s desert environment.

Modern cloud-based platforms offer robust security features for employee records management. These solutions typically include role-based access controls, encryption, and comprehensive audit trails that can help Las Vegas businesses maintain compliance with security requirements. When selecting a digital solution, ensure it meets industry standards for data protection and offers sufficient security guarantees for sensitive employee information.

Employee Rights to Records Access in Nevada

In Nevada, employees have specific rights regarding access to their employment records. Understanding these rights is essential for Las Vegas employers developing records retention schedules and access policies. While federal law provides some guidelines, Nevada has its own requirements regarding employee access to personnel files and other employment records.

- Nevada Access Rights: Under NRS 613.075, employees have the right to inspect their personnel records at reasonable times during regular business hours.

- Copy Requests: Employers must provide copies of personnel records upon employee request, though they may charge reasonable copying costs.

- Response Timeframe: While Nevada law doesn’t specify a timeframe, employers should respond to access requests promptly, typically within 30 days.

- Dispute Resolution: If employees dispute information in their files, they have the right to request corrections or add statements of disagreement.

- Access Limitations: Certain confidential business records or documents related to investigations may be excluded from access rights.

Implementing employee self-service portals can simplify the process of providing employees with access to their records. These digital platforms allow employees to securely view relevant documents without requiring HR intervention for every request. However, employers must ensure that these systems maintain appropriate access controls and comply with both Nevada’s requirements and broader data privacy regulations.

Implementing Systematic Records Destruction

Once retention periods expire, Las Vegas businesses must have systematic procedures for securely destroying employee records. Proper destruction protocols are essential for maintaining compliance with privacy regulations and protecting sensitive employee information. Without appropriate destruction methods, expired records can become liabilities rather than assets.

- Destruction Schedules: Establish regular intervals for reviewing records and identifying those eligible for destruction based on your retention schedule.

- Secure Methods: Physical records should be shredded, pulped, or incinerated. Digital records require secure deletion methods that prevent recovery.

- Litigation Holds: Implement procedures to suspend destruction of relevant records when litigation is pending or reasonably anticipated.

- Documentation: Maintain certificates of destruction that document what records were destroyed, when, how, and by whom.

- Vendor Management: If using third-party destruction services, ensure they provide appropriate security guarantees and certificates of destruction.

Implementing data-driven HR systems with automated retention tracking can significantly improve the efficiency and reliability of records destruction processes. These systems can flag records approaching their destruction dates, document approval workflows for destruction, and maintain comprehensive audit trails of the entire destruction process. This automation reduces the risk of human error while ensuring consistent application of destruction policies.

Technology Solutions for Records Management

Modern technology offers Las Vegas employers powerful tools to streamline employee records management and ensure compliance with retention requirements. Digital solutions can automate many aspects of the records lifecycle, from creation through destruction, while maintaining necessary documentation and security controls. Implementing appropriate technology can significantly reduce the administrative burden of records management while improving compliance.

- HRIS Systems: Comprehensive human resource information systems can centralize employee records management with built-in retention scheduling and security features.

- Document Management Solutions: Specialized document management systems offer features like version control, metadata management, and automated workflows.

- Cloud Storage: Secure cloud storage solutions provide accessibility while implementing appropriate security measures and disaster recovery capabilities.

- Mobile Access: Systems with mobile capabilities allow for secure access to employee records from anywhere, supporting flexible work arrangements.

- Integration Capabilities: Solutions that integrate with other business systems can streamline workflows and ensure consistent data across platforms.

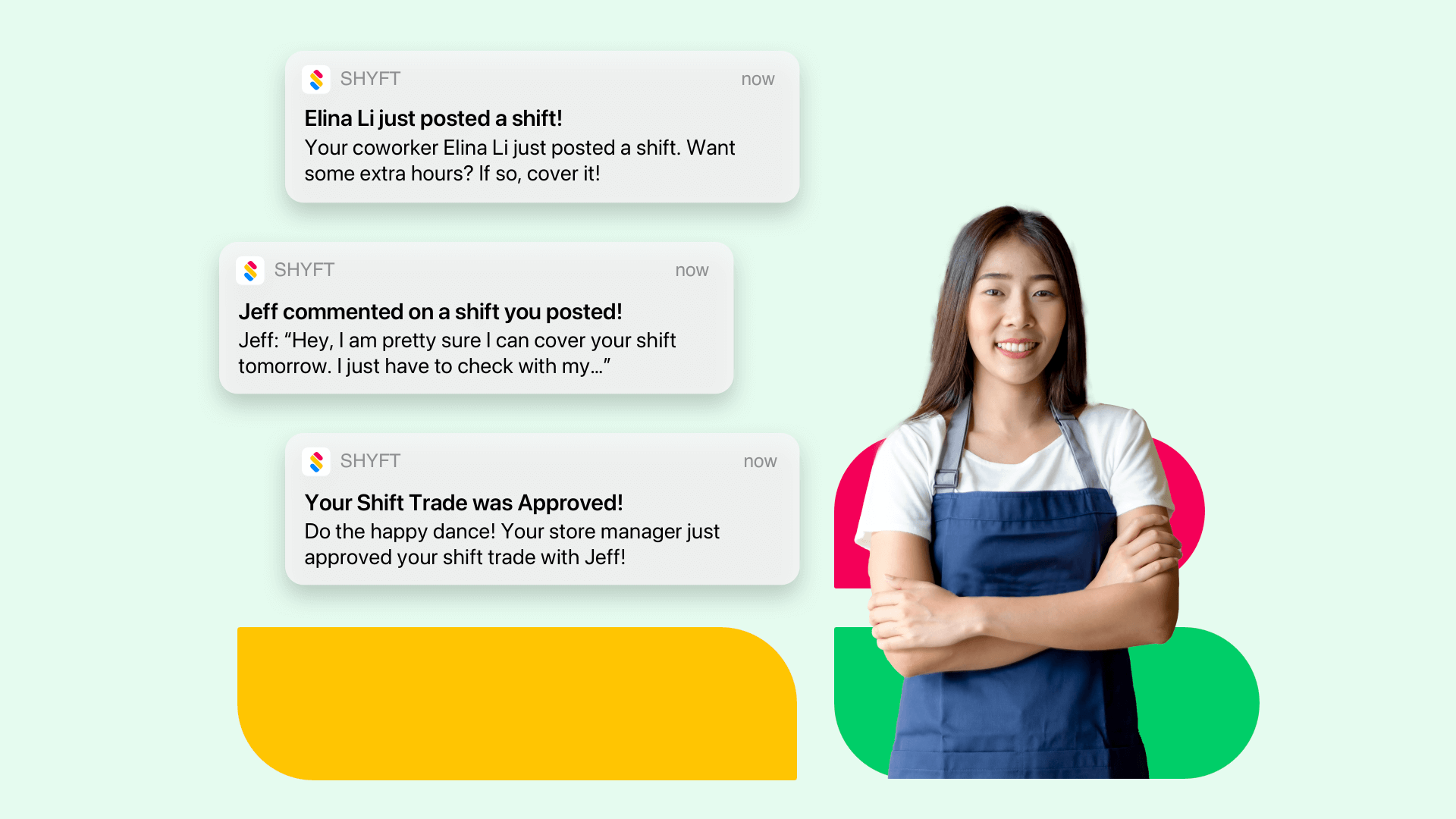

When selecting technology solutions, Las Vegas businesses should consider platforms like Shyft that offer mobile access capabilities alongside robust records management features. The ability to securely access and manage employee records remotely becomes increasingly important as workforce models evolve. Solutions with strong integration capabilities can connect with existing business systems to create a cohesive digital ecosystem that supports comprehensive records management.

Compliance Auditing and Monitoring

Regular auditing and monitoring of records management processes are essential for maintaining compliance with retention requirements. Las Vegas employers should implement systematic review procedures to ensure their records retention practices remain aligned with both regulatory requirements and internal policies. These reviews help identify and address compliance gaps before they lead to more significant issues.

- Regular Compliance Reviews: Conduct periodic audits of your records retention practices to verify compliance with current regulations.

- Process Verification: Regularly test your records management procedures to ensure they function as intended, from creation through destruction.

- Documentation Audits: Verify that retention documentation, including destruction certificates and access logs, is complete and accurate.

- Regulatory Updates: Monitor changes in federal, Nevada state, and local regulations that may affect your retention requirements.

- Continuous Improvement: Use audit findings to refine and improve your records management processes over time.

Implementing compliance reporting tools can help Las Vegas businesses maintain visibility into their records management practices. These solutions can generate regular compliance reports, track exceptions, and provide dashboards that highlight potential issues. With proper monitoring systems in place, organizations can demonstrate due diligence in maintaining compliant records retention practices—a significant advantage in case of regulatory inquiries or audits.

Special Considerations for Las Vegas Industries

Certain industries prominent in Las Vegas face additional records retention requirements beyond standard employment regulations. The unique business landscape of Las Vegas, with its strong hospitality, gaming, and entertainment sectors, creates specialized compliance considerations for employee records retention. Organizations in these industries must incorporate these additional requirements into their retention schedules.

- Gaming Industry: Casinos and gaming establishments must comply with Nevada Gaming Control Board regulations, which include specific employee record requirements and extended retention periods.

- Hospitality Sector: Hotels and restaurants may need to maintain additional records related to tip reporting, service charges, and employee scheduling that comply with Nevada’s specific requirements.

- Entertainment Venues: Performance venues and entertainment companies often need specialized records for performers, contractors, and temporary workers.

- Healthcare Providers: Medical facilities must comply with both HIPAA and Nevada’s medical privacy laws, requiring careful management of employee records that may contain protected health information.

- Construction Industry: Construction companies face additional OSHA record-keeping requirements and specific retention schedules for safety training documentation.

For businesses in these specialized sectors, implementing industry-specific regulations compliance tools can be invaluable. Solutions designed for hospitality or retail environments, for instance, may include pre-configured retention schedules and reporting tools tailored to these industries’ unique requirements. This specialized approach can significantly reduce the compliance burden while ensuring all industry-specific requirements are met.

Conclusion: Best Practices for Las Vegas Employers

Effective employee records retention requires a systematic approach that balances legal compliance with operational efficiency. For Las Vegas employers, developing a comprehensive records management strategy that addresses both federal and Nevada-specific requirements is essential for maintaining compliance while supporting business operations. By implementing appropriate policies, leveraging technology, and establishing regular review processes, organizations can create records retention systems that effectively meet their legal obligations.

Key best practices include developing a written records retention policy, implementing appropriate security measures for both physical and digital records, establishing clear processes for records creation and destruction, and leveraging technology to automate and streamline records management tasks. Regular compliance audits and staying current with regulatory changes will help ensure ongoing compliance. By treating employee records management as a strategic priority rather than an administrative burden, Las Vegas businesses can transform their recordkeeping practices into a valuable asset that supports both compliance and operational efficiency. Tools like Shyft’s employee scheduling and team communication platforms can integrate with your records management systems to create a comprehensive workforce management ecosystem that addresses all aspects of employee documentation needs.

FAQ

1. How long must I keep employee records in Las Vegas, Nevada?

Retention periods vary by document type. In Las Vegas, payroll records must be kept for at least three years under both federal (FLSA) and Nevada law. Personnel files should be retained for the duration of employment plus three years. Tax records should be kept for at least four years, while I-9 forms must be kept for three years after hire or one year after termination, whichever is later. OSHA records have a five-year retention requirement. For specialized industries like gaming, additional retention periods may apply. It’s advisable to develop a comprehensive retention schedule that addresses all record types and incorporates both federal and Nevada-specific requirements.

2. Are digital employee records legally valid in Nevada?

Yes, Nevada recognizes digital records as legally valid provided they meet requirements for authenticity, integrity, and accessibility. Nevada has adopted the Uniform Electronic Transactions Act (UETA), which establishes the legal equivalence of electronic records to paper documents. To ensure legal validity, electronic records systems should include features like secure access controls, reliable backup systems, audit trails, and the ability to produce readable copies when needed. Businesses should ensure their digital systems meet these requirements and properly document their electronic records management procedures to maintain legal validity.

3. Can employees request access to their personnel files in Nevada?

Yes, under Nevada Revised Statutes (NRS) 613.075, employees have the right to inspect their personnel records at reasonable times during regular business hours. Employers must provide copies upon request, though they may charge reasonable copying costs. While Nevada law doesn’t specify a response timeframe, employers should respond promptly to access requests, typically within 30 days. Employees also have the right to request corrections to information they believe is inaccurate or to add statements of disagreement to their files. Implementing employee self-service portals can streamline this process while maintaining appropriate access controls.

4. How should I safely destroy employee records after the retention period?

Safe destruction of expired employee records requires appropriate methods based on the record format. For physical records, secure shredding, pulping, or incineration are recommended methods. Digital records should be securely deleted using methods that prevent recovery, which may include specialized software or physical destruction of storage media. Before destruction, verify that retention periods have truly expired and that no litigation holds apply to the records. Document all destruction activities, including what was destroyed, when, how, and by whom. Consider using certified destruction services that provide certificates of destruction as evidence of proper handling.

5. What are the consequences of non-compliance with records retention requirements in Las Vegas?

Non-compliance with records retention requirements can result in various penalties depending on the violated regulations. These may include fines from regulatory agencies, such as Department of Labor penalties for FLSA violations or IRS penalties for tax record violations. Beyond direct penalties, non-compliance can create significant disadvantages in employment litigation, as missing records may lead to adverse inferences against the employer. Additionally, improper handling of sensitive employee information could trigger data privacy violations with their own penalties. For regulated industries like gaming in Las Vegas, non-compliance could potentially affect licensing. Implementing a comprehensive records management system with appropriate retention schedules is the best protection against these consequences.