Maintaining proper employee records retention schedules is a critical responsibility for businesses operating in Knoxville, Tennessee. Beyond being a regulatory requirement, a well-structured records management system protects your business from potential legal complications while streamlining operations. Employers in Knoxville must navigate federal, state, and sometimes local requirements that dictate how long different types of employee records must be kept. From payroll documentation to personnel files, understanding the specific retention periods helps ensure compliance while minimizing unnecessary storage costs. When properly implemented, a comprehensive records retention schedule serves as a cornerstone of sound business practices that can help your organization weather audits, respond to litigation, and maintain operational efficiency.

While federal regulations create a baseline for record retention, Tennessee state laws may impose additional requirements that Knoxville businesses must follow. Records retention isn’t simply about storing documents—it’s about creating accessible, organized systems that allow for quick retrieval when needed while ensuring proper destruction when retention periods expire. The digital transformation of workplace documentation has created both opportunities and challenges in this area, with electronic storage offering convenience but requiring appropriate security measures. For businesses struggling with employee scheduling alongside document management, solutions like Shyft can help manage workforce documentation while streamlining related processes such as time tracking and schedule management, creating a more integrated approach to workforce management and compliance.

Understanding Federal Requirements for Employee Records Retention

Federal laws establish the foundation for employee records retention that all Knoxville businesses must follow regardless of size. These regulations are administered by various agencies including the Department of Labor, the Equal Employment Opportunity Commission (EEOC), and the Internal Revenue Service (IRS). Understanding these baseline requirements is essential before addressing any Tennessee-specific guidelines.

- Fair Labor Standards Act (FLSA): Requires employers to keep payroll records, collective bargaining agreements, and sales and purchase records for at least three years. Records used to calculate wages must be kept for two years, including time cards, work schedules, and records of additions to or deductions from wages.

- Age Discrimination in Employment Act (ADEA): Mandates retention of payroll records for three years and personnel records for one year after termination. This includes job applications and other records relating to hiring, promotion, or termination.

- Family and Medical Leave Act (FMLA): Requires employers to maintain records relating to FMLA leave for three years, including dates of leave, FMLA communications, and benefits documentation.

- Americans with Disabilities Act (ADA): Mandates that employers keep records of accommodation requests and responses for at least one year from the date the record was made or the personnel action was taken.

- Occupational Safety and Health Act (OSHA): Requires employers to maintain records of work-related injuries and illnesses for five years following the end of the calendar year those records cover.

- Employee Retirement Income Security Act (ERISA): Mandates retention of benefit plan records for six years after filing the relevant report.

Failing to comply with these federal regulations can result in significant penalties, including fines and potential litigation. Knoxville businesses should consider using time tracking tools that automatically preserve digital records in compliance with these requirements. When implementing these practices, businesses should also consider how these federal requirements interact with Tennessee state laws to ensure comprehensive compliance.

Tennessee State-Specific Record Retention Requirements

Tennessee has additional record retention requirements that Knoxville employers must observe alongside federal regulations. These state-specific guidelines sometimes extend retention periods beyond federal minimums or cover additional document types, making it essential for local businesses to understand these nuances in their recordkeeping practices.

- Tennessee Wage Regulations: Tennessee requires employers to maintain payroll records for at least three years, which aligns with federal standards but may include state-specific payroll documentation.

- Workers’ Compensation Records: Under Tennessee law, employers must keep workers’ compensation records for at least five years after the injury date, including first reports of injury and subsequent claim documentation.

- Personnel Files: While Tennessee doesn’t specify a retention period for general personnel files, best practice suggests keeping these records for the duration of employment plus three years.

- Unemployment Insurance Records: Tennessee employers must maintain unemployment insurance records for at least five years, including wage reports and tax contribution documentation.

- Employment Eligibility Verification: I-9 forms must be retained for three years after the date of hire or one year after termination, whichever is later, in compliance with both federal and state requirements.

For Knoxville businesses with operations that span multiple locations, record keeping and documentation can become particularly complex. Using integrated management systems that maintain uniform documentation standards across all business locations helps ensure consistent compliance. Additionally, businesses should note that Tennessee has enacted data breach notification laws that may affect how employment records containing personal information are stored and protected, creating another layer of compliance consideration for electronic record systems.

Essential Employee Records Categories and Retention Periods

Understanding which employee records to keep and for how long is critical for Knoxville businesses. Different types of employment records have varying retention requirements based on their purpose and the laws governing them. Creating a comprehensive records management system requires categorizing documents properly and applying the appropriate retention schedules.

- Recruitment and Hiring Documents: Job postings, resumes, applications, and interview notes should be kept for at least one year after the hiring decision per EEOC guidelines. For unsuccessful applicants, maintaining these records helps defend against potential discrimination claims.

- Payroll and Compensation Records: Time cards, wage calculations, pay stubs, and salary histories should be kept for a minimum of three years under both federal and Tennessee requirements. Tax-related payroll documents may need to be kept longer for IRS compliance.

- Benefits Administration Records: Documentation of benefit plans, enrollments, and claims should be retained for at least six years after the filing of relevant ERISA reports. Health insurance portability records under HIPAA should be kept for six years.

- Performance and Disciplinary Records: Performance evaluations, disciplinary actions, and recognition awards should be kept for the duration of employment plus three years to defend against potential employment claims.

- Medical and Leave Records: Health-related documents, including FMLA requests, medical certifications, and accommodation requests, must be kept in separate, confidential files with restricted access for three years.

- Termination Records: Separation notices, exit interviews, and final payroll information should be maintained for at least three years after employment ends.

Using data protection standards is particularly important for sensitive employee information. For organizations managing complex shift schedules alongside these document retention requirements, integrated solutions can help maintain consistency and compliance. Modern workforce management technology often includes document management functionality that can automate retention schedules and ensure proper handling of confidential information.

Digital vs. Physical Record Storage Considerations

Knoxville businesses face important decisions about whether to maintain employee records in physical or digital formats. Each approach has distinct advantages and compliance considerations that impact your records retention strategy. The transition from paper to digital records requires careful planning to ensure legal compliance while maximizing efficiency.

- Legal Validity of Electronic Records: Under the Electronic Signatures in Global and National Commerce Act (E-SIGN) and Tennessee’s Uniform Electronic Transactions Act, properly maintained electronic records have the same legal standing as paper documents, provided they accurately reflect the information and remain accessible.

- Storage Space and Cost Considerations: Digital storage typically requires less physical space and can be more cost-effective for long-term retention. However, initial setup costs for secure digital systems may be higher than traditional filing systems.

- Security Requirements: Electronic records require robust cybersecurity measures, including encryption, access controls, and regular backups. Physical records need secure storage with fire protection and limited access controls.

- Accessibility and Retrieval: Digital records offer faster search capabilities and easier remote access, which can be particularly valuable for businesses with multiple locations or remote workers. Physical records may be more reliable during power outages or system failures.

- Disaster Recovery: Electronic systems should include off-site backups to protect against data loss. Physical records should have duplicate copies stored in separate locations for critical documents.

Many Knoxville businesses are adopting cloud storage services for employee records, which offer scalability and accessibility advantages. When implementing digital record systems, businesses should consider data privacy and security requirements, particularly for sensitive employee information. Regardless of the storage method chosen, having consistent processes for document classification, retention tracking, and secure destruction is essential for maintaining compliance and operational efficiency.

Implementing an Effective Records Retention Schedule

Creating and implementing a comprehensive records retention schedule requires methodical planning and organizational commitment. For Knoxville businesses, this process involves several key steps to ensure that your records management system meets both compliance requirements and operational needs.

- Conduct a Records Inventory: Begin by identifying all types of employee records your organization currently maintains, including both digital and physical formats. Document where records are stored, who maintains them, and current retention practices.

- Develop a Records Classification System: Categorize documents based on their content, purpose, and applicable retention requirements. This system should clearly define document types and their corresponding retention periods.

- Create Written Retention Policies and Procedures: Document your retention schedule in a formal policy that includes retention periods, storage methods, access controls, and destruction protocols. This should be reviewed by legal counsel to ensure compliance.

- Implement Tracking Mechanisms: Establish systems to track document creation dates, retention periods, and scheduled destruction dates. This could be through specialized records management software or customized database solutions.

- Train Staff on Records Management: Provide comprehensive training to all employees involved in creating, maintaining, or destroying records. This includes educating them on the importance of compliance and the specific procedures they must follow.

- Establish Regular Audits and Reviews: Schedule periodic audits of your records management system to identify and address compliance gaps. Review and update your retention schedule annually to account for regulatory changes.

When implementing these systems, consider using automation technologies to streamline recordkeeping processes. Organizations that manage complex workforce schedules may find value in integrated solutions that combine employee management software with records retention functionality. For successful implementation, secure executive sponsorship and designate specific team members as records management champions who can help drive adoption throughout the organization.

Best Practices for Secure Record Destruction

Proper destruction of employee records after retention periods expire is just as important as maintaining them during the required timeframes. Secure disposal practices protect sensitive employee information and demonstrate your organization’s commitment to data privacy and compliance with regulations including HIPAA and various state privacy laws applicable in Knoxville.

- Documented Destruction Policies: Establish written procedures that specify authorized destruction methods for different types of records, destruction timing, and required documentation of the process.

- Secure Destruction Methods: For physical records, use cross-cut shredding, pulping, or incineration depending on sensitivity levels. For electronic records, use secure deletion software that overwrites data multiple times, or physical destruction of storage media for highly sensitive information.

- Destruction Hold Procedures: Implement processes to suspend scheduled destruction when records may be needed for litigation, audits, or investigations. This legal hold should be clearly communicated to all relevant staff.

- Vendor Management: If using third-party destruction services, conduct due diligence on providers, ensure they follow industry standards like NAID certification, and obtain certificates of destruction for your records.

- Destruction Logs: Maintain detailed logs documenting what records were destroyed, when, by whom, and using what method. These logs provide evidence of compliance with your retention schedule.

When implementing these practices, consider developing automated reminder systems that alert administrators when records are eligible for destruction. For organizations using cloud computing services to store employee records, ensure that service agreements address secure data deletion and obtain verification that data has been properly removed from all storage locations including backups.

Privacy and Security Considerations for Employee Records

Protecting the privacy and security of employee records is a critical component of any records retention program in Knoxville. With increasing concerns about data breaches and identity theft, businesses must implement robust safeguards for sensitive employee information while ensuring appropriate access for legitimate business purposes.

- Access Controls: Implement role-based access restrictions that limit employee record access to authorized personnel with a legitimate business need. This applies to both physical files and electronic systems.

- Confidentiality Policies: Develop and enforce clear policies regarding the confidentiality of employee information, including disciplinary consequences for unauthorized access or disclosure.

- Separation of Sensitive Information: Maintain separate, secure files for medical records, I-9 forms, and other highly sensitive information as required by regulations like ADA and HIPAA.

- Data Encryption: Use encryption for electronic employee records both in transit and at rest, particularly for files containing Social Security numbers, financial information, or health data.

- Security Monitoring: Implement systems to detect and log access attempts to employee records, with regular reviews to identify suspicious activity.

- Employee Privacy Notices: Provide clear notices to employees about what information is collected, how it’s used, how long it’s retained, and their rights regarding their personal data.

For organizations using third-party systems for employee records management, conduct thorough vendor security assessments and establish clear data protection agreements. Additionally, businesses should consider how digital workplace technologies might create new privacy challenges, such as increased data collection through integrated systems. Regular security training for all staff members who handle employee records is essential for maintaining a culture of privacy and compliance.

Managing Records During Business Changes and Transitions

Business transitions such as mergers, acquisitions, relocations, or closures present unique challenges for employee records management in Knoxville. During these periods of change, maintaining proper records retention practices is crucial to ensure compliance continuity and protect both the business and its employees.

- Pre-Transition Audits: Before any major business change, conduct a comprehensive audit of all employee records to verify completeness, proper storage, and compliance with retention requirements.

- Succession Planning for Records Management: Identify who will be responsible for records management during and after the transition, ensuring clear handoff of responsibilities and institutional knowledge.

- Record Transfer Protocols: Establish detailed procedures for securely transferring records to new ownership or locations, including chain of custody documentation and verification processes.

- System Integration Planning: When merging record systems from different organizations, develop a detailed plan for standardizing retention schedules, classification systems, and access controls.

- Business Closure Considerations: If closing a business, identify where records will be stored for their remaining retention periods and who will be responsible for eventual destruction.

During transitions, maintaining change management approach best practices helps ensure records retention compliance doesn’t fall through the cracks. For businesses using electronic records management systems, data migration capabilities become especially important during transitions. Consider engaging specialized consultants for complex records transfers, particularly when dealing with regulated industries or highly sensitive employee information.

Technology Solutions for Employee Records Management

Modern technology offers numerous solutions to streamline employee records management for Knoxville businesses. These tools can automate retention schedules, improve security, and enhance accessibility while reducing the administrative burden of compliance. Selecting the right technology requires careful evaluation of your specific business needs and regulatory requirements.

- Electronic Document Management Systems (EDMS): Specialized platforms that manage the entire lifecycle of employee records, including creation, storage, retrieval, and scheduled destruction. These systems often include workflow automation for document approvals and processing.

- Human Resource Information Systems (HRIS): Comprehensive workforce management platforms that include employee record management alongside other HR functions like payroll, benefits administration, and performance management.

- Cloud-Based Storage Solutions: Secure, scalable platforms that allow for remote access to employee records while maintaining version control and audit trails. These solutions often offer robust disaster recovery capabilities.

- Records Retention Software: Specialized applications that track retention schedules, automate disposition notifications, and maintain destruction logs to demonstrate compliance.

- Digital Signature Platforms: Tools that enable secure electronic signing of employment documents, ensuring the authenticity and integrity of digital records.

When evaluating technology solutions, consider integration capabilities with your existing systems, particularly if you use employee scheduling software like Shyft. Look for platforms that offer mobile experience capabilities to facilitate access for remote managers and employees. Additionally, ensure any technology solution includes robust security features that comply with relevant data protection regulations, including role-based access controls and comprehensive audit logging.

Preparing for Audits and Legal Requests

Knoxville businesses must be prepared to respond to audits from regulatory agencies or requests for employee records during litigation. Being audit-ready isn’t just about maintaining records—it’s about organizing them in a way that allows for prompt, accurate responses when records are requested. Proper preparation can significantly reduce stress and potential penalties during these situations.

- Audit Response Procedures: Develop written protocols for responding to agency audits or legal discovery requests, including identifying who will coordinate the response and how records will be gathered.

- Records Locator Systems: Maintain updated indexes or databases that help quickly identify and locate specific employee records across all storage locations and formats.

- Chain of Custody Documentation: Implement processes to document the handling of records during audits or legal proceedings, including who accessed them and when.

- Legal Hold Procedures: Establish clear protocols for implementing legal holds that suspend normal destruction schedules when litigation is reasonably anticipated.

- Regular Self-Audits: Conduct periodic internal reviews of your records management system to identify and address compliance gaps before an external audit occurs.

Consider implementing compliance training programs for staff responsible for records management to ensure they understand legal requirements and response procedures. For organizations with complex workforce scheduling, reporting and analytics tools can help demonstrate compliance with labor laws through comprehensive time and attendance records. Having proper documentation of your records management policies and consistent enforcement of these policies can significantly strengthen your position during regulatory audits or employment litigation.

The Benefits of Comprehensive Records Management

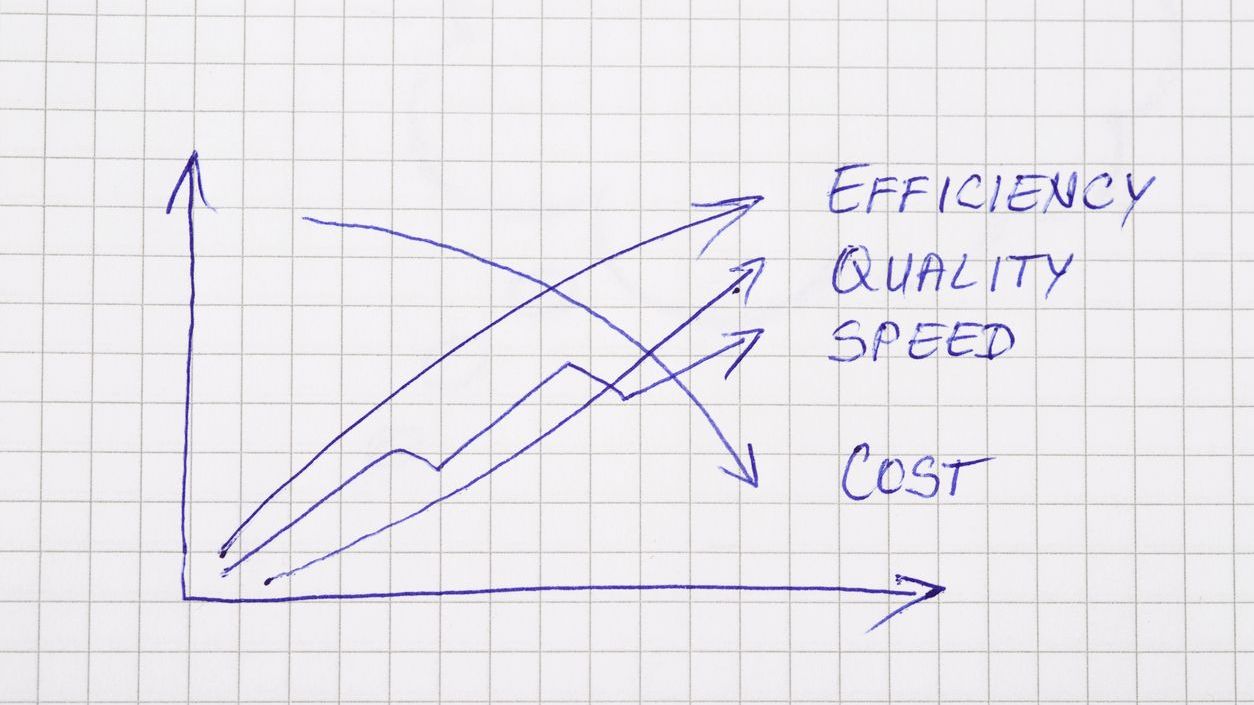

Implementing a thorough employee records retention program offers Knoxville businesses numerous advantages beyond mere regulatory compliance. A well-designed system delivers operational efficiencies, reduces risks, and can contribute to better business decision-making through improved data management.

- Risk Mitigation: Proper records management significantly reduces legal and compliance risks by ensuring you can produce required documentation during audits, investigations, or litigation. This preparation can prevent or minimize penalties and adverse judgments.

- Operational Efficiency: Organized record systems reduce time spent searching for information, streamline responses to employee inquiries, and eliminate redundant record creation or storage.

- Cost Reduction: Systematic records management reduces storage costs by eliminating unnecessary document retention and optimizing storage methods based on access requirements.

- Improved Decision Making: Comprehensive employee records provide valuable data for workforce planning, identifying training needs, and making informed personnel decisions.

- Enhanced Corporate Knowledge: Proper documentation preserves institutional knowledge even through employee turnover, ensuring business continuity and consistent practices.

Organizations that integrate records management with broader workforce planning initiatives often see synergistic benefits. Modern HR management systems integration can connect employee records with scheduling, time tracking, and performance management, creating a more holistic approach to workforce management. Beyond operational benefits, demonstrating thorough records management practices enhances your organization’s reputation with employees, regulators, and business partners as a professionally managed operation committed to compliance.

Conclusion

Establishing an effective employee records retention schedule is a crucial investment for Knoxville businesses of all sizes. By understanding federal, Tennessee state, and industry-specific requirements, organizations can develop systems that ensure compliance while optimizing operational efficiency. The transition to digital record management offers significant opportunities for automation and improved accessibility, though it must be implemented with appropriate security and privacy controls. Regular review and updating of your retention policies and procedures is essential as regulations evolve and business needs change.

For businesses looking to enhance their records management practices, consider starting with a comprehensive audit of current systems, followed by developing a formal retention schedule and implementing appropriate technology solutions. Staff training, consistent enforcement, and regular compliance reviews complete the cycle of effective records management. By treating employee records retention as a strategic business function rather than merely an administrative burden, Knoxville organizations can transform compliance requirements into opportunities for operational improvement and risk reduction. Solutions like Shyft that integrate workforce documentation with scheduling and time tracking can further streamline these processes, creating more efficient, compliant operations.

FAQ

1. What are the minimum employee records retention periods for Knoxville businesses?

Knoxville businesses must follow both federal and Tennessee state retention requirements. At minimum, payroll records must be kept for 3 years, personnel files for at least 1 year after termination (though 3-5 years is recommended), tax records for 4 years, and OSHA records for 5 years. I-9 forms must be retained for 3 years after hire or 1 year after termination, whichever is later. Workers’ compensation records in Tennessee have a 5-year retention requirement. These are minimum requirements, and many businesses choose longer retention periods based on their specific industry and risk profile.

2. Can employee records be stored exclusively in digital format?

Yes, Knoxville businesses can legally maintain employee records exclusively in digital format, provided the electronic system meets certain requirements. Under federal law (including E-SIGN) and Tennessee’s Uniform Electronic Transactions Act, electronic records are legally valid if they accurately reflect the information in the original document and remain accessible for the required retention period. The digital system must include appropriate security measures, backup procedures, and the ability to produce legible hard copies if needed for audits or legal proceedings. Some documents with specific regulatory requirements, such as certain OSHA forms, may have additional specifications for electronic storage.

3. How should sensitive employee information be protected in record systems?

Sensitive employee information requires enhanced protection in record systems. Medical records, including ADA accommodations and FMLA documentation, must be maintained in separate, confidential files with restricted access. Personal identifying information such as Social Security numbers should be redacted or encrypted when possible. For digital systems, implement role-based access controls, encryption for data at rest and in transit, secure authentication, and comprehensive audit trails of record access. Physical records containing sensitive information should be stored in locked cabinets with controlled access. All staff who handle employee records should receive regular training on confidentiality requirements and data protection procedures. Additionally, businesses should have a data breach response plan in case sensitive employee information is compromised.

4. What are the penalties for non-compliance with records retention requirements?

Penalties for non-compliance with records retention requirements can be substantial for Knoxville businesses. Federal penalties vary by agency: Department of Labor violations can result in fines up to $1,000 per employee for FLSA recordkeeping violations. IRS penalties for failure to maintain tax records can range from $50 to $1,100 per form, plus potential tax liabilities and interest. EEOC-related recordkeeping violations may result in adverse presumptions during discrimination investigations. OSHA recordkeeping violations can incur penalties up to $14,502 per violation. Beyond direct penalties, insufficient records retention can severely weaken a company’s position in employment litigation, potentially resulting in significant damage awards. Additionally, improper handling of personal information could trigger data breach notification requirements and associated costs.

5. How often should records retention policies be reviewed and updated?

Records retention policies should be reviewed at least annually to ensure they remain current with changing regulations and business needs. Additional reviews should be triggered by significant events such as new legislation affecting record retention (at federal, Tennessee state, or local levels), organizational changes like mergers or acquisitions, implementation of new HR or document management systems, or expansion into new business activities that create different types of records. The review process should include consultation with legal counsel to address regulatory changes, HR professionals to incorporate operational insights, and IT personnel to address technological considerations. Following each review, document any policy updates, communicate changes to relevant staff, and provide training on new requirements or procedures to ensure consistent implementation.