For businesses and employees in Toledo, Ohio, understanding FICA payroll calculations is essential for proper tax compliance and financial planning. The Federal Insurance Contributions Act (FICA) taxes fund critical social programs like Social Security and Medicare, making accurate calculations crucial for both employers and workers. Businesses in Toledo must navigate federal FICA requirements while also considering Ohio’s specific payroll regulations. Whether you’re a small business owner in the Glass City or an employee seeking to understand your paycheck deductions, comprehending FICA tax calculations helps ensure proper financial management and compliance with tax laws.

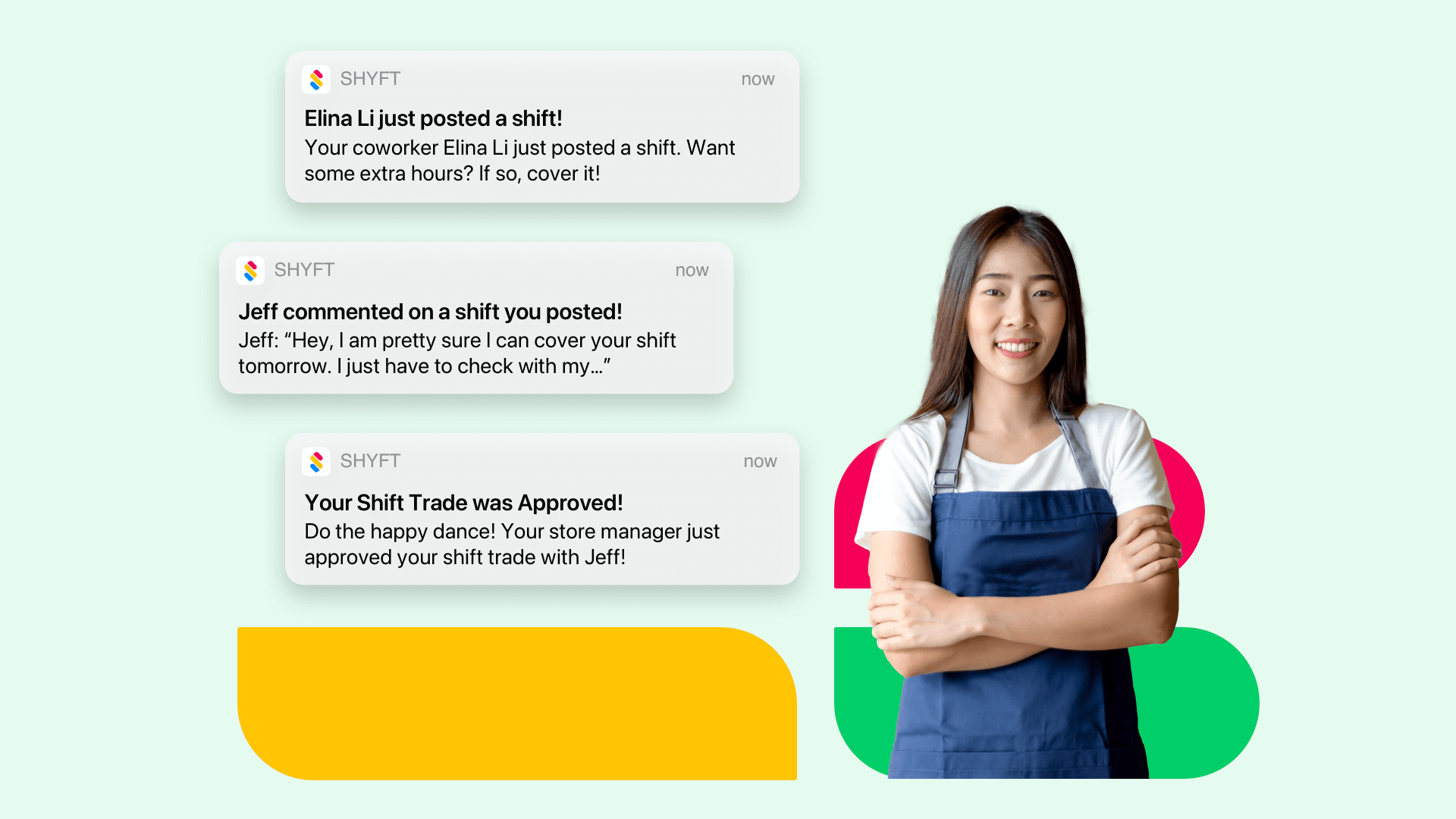

FICA taxes represent a significant portion of payroll processing responsibilities for Toledo employers. In today’s complex business environment, many organizations are turning to employee scheduling software and integrated payroll systems to streamline these calculations. With proper tools and knowledge, Toledo businesses can accurately manage FICA withholdings while maintaining compliance with both federal and Ohio-specific regulations. This comprehensive guide will explore everything you need to know about FICA payroll calculators in Toledo, from basic calculations to advanced compliance considerations.

Understanding FICA Taxes in Toledo, Ohio

FICA taxes are federal payroll taxes that apply uniformly across the United States, including Toledo, Ohio. These mandatory contributions fund Social Security and Medicare programs that provide benefits to retirees, disabled individuals, and qualifying healthcare recipients. For Toledo employers, understanding FICA is a fundamental aspect of payroll management that affects every employee and impacts business finances.

- Employer Responsibility: Toledo employers must withhold FICA taxes from employee wages and match these contributions dollar-for-dollar.

- Universal Application: FICA applies to virtually all employers in Toledo regardless of size, from small Glass City boutiques to large manufacturing operations.

- Local Compliance: While FICA is federal, Toledo businesses must integrate these calculations with Ohio state tax requirements.

- Calculation Accuracy: Using a reliable payroll integration system can help Toledo employers avoid costly calculation errors.

- Documentation Requirements: Toledo businesses must maintain detailed records of all FICA tax withholdings and payments.

For Toledo businesses managing diverse workforces, integrating FICA calculations with team communication tools ensures employees understand their paycheck deductions. Modern payroll systems help automate these calculations, reducing the administrative burden on Toledo’s business owners while improving accuracy. As local businesses grow, implementing efficient FICA management becomes increasingly important for maintaining compliance and operational efficiency.

Components of FICA: Social Security and Medicare

FICA taxes consist of two distinct components that Toledo employers must calculate separately: Social Security and Medicare taxes. Each component has different tax rates and wage base limitations that affect how they’re calculated for employees across various income levels. Understanding these differences is crucial for accurate payroll processing in Toledo businesses.

- Social Security Tax Rate: Currently set at 6.2% for both employees and employers (12.4% total), affecting all Toledo workers.

- Medicare Tax Rate: Set at 1.45% for both employees and employers (2.9% total), with an additional 0.9% for high-income Toledo employees.

- Wage Base Limit: Social Security taxes only apply up to a certain income threshold (adjusted annually), while Medicare taxes apply to all earnings.

- Self-Employment Considerations: Toledo’s self-employed individuals must pay both the employer and employee portions of FICA taxes.

- Additional Medicare Tax: High-income Toledo residents face an additional 0.9% Medicare tax on earnings above specific thresholds.

Toledo businesses with retail operations often manage employees with varying wage levels, making accurate FICA calculations particularly important. Implementing specialized payroll calculators helps ensure each component is properly calculated regardless of employee earnings. For Toledo’s growing businesses, staying current with annual adjustments to Social Security wage base limits is essential for maintaining tax compliance and accurate payroll records.

FICA Tax Rates and Wage Bases for Toledo Employers

Toledo employers must stay current with FICA tax rates and wage bases, which can change annually. The Social Security wage base, in particular, is adjusted each year based on changes in the national average wage index. Understanding these rates and thresholds is essential for accurate payroll tax calculations for Toledo businesses of all sizes.

- Current Social Security Wage Base: The maximum taxable earnings amount (updated annually) that determines when to stop withholding Social Security taxes.

- Medicare Unlimited Taxation: Unlike Social Security, Medicare taxes apply to all earnings without an upper limit for Toledo employees.

- Additional Medicare Tax Thresholds: The income levels that trigger additional Medicare tax withholding for higher-earning Toledo residents.

- Annual Adjustments: How Toledo businesses should prepare for yearly changes to the Social Security wage base.

- Calculation Tools: Using payroll software integration to automatically adjust for annual FICA rate and base changes.

Toledo businesses in the hospitality industry often face complex FICA calculations due to tipped employees and variable work schedules. Implementing effective scheduling systems that integrate with payroll calculators can streamline these processes. For all Toledo employers, staying informed about annual changes to FICA rates and wage bases ensures accurate tax withholding and helps avoid penalties for under-withholding taxes from employee paychecks.

Using FICA Payroll Calculators: Benefits for Toledo Businesses

FICA payroll calculators offer numerous advantages for Toledo businesses looking to streamline their payroll processes and ensure accuracy. These specialized tools help employers determine the correct amount of Social Security and Medicare taxes to withhold from employee paychecks while calculating the employer’s matching contributions. In a business environment where tax compliance is critical, these calculators have become essential tools for Toledo’s diverse business community.

- Calculation Accuracy: Eliminates human error in determining FICA withholdings for Toledo employees across various income levels.

- Time Efficiency: Automates complex calculations, allowing Toledo HR staff to focus on strategic initiatives rather than manual calculations.

- Compliance Assurance: Helps Toledo businesses stay current with changing tax regulations and annual adjustments to wage bases.

- Cost Reduction: Minimizes expenses related to tax penalties and correcting payroll errors for Toledo employers.

- Integration Capabilities: Many calculators work seamlessly with workforce optimization software and existing business systems.

Toledo businesses in the healthcare sector particularly benefit from specialized FICA calculators that can handle complex scenarios like multiple job roles and shift differentials. By implementing these tools alongside comprehensive scheduling solutions, Toledo employers can create more efficient payroll processes while ensuring tax compliance. The time saved through automation allows business owners to focus more on growth and less on administrative tasks.

FICA Compliance Requirements for Toledo Employers

Toledo employers must adhere to strict compliance requirements regarding FICA tax collection, reporting, and payment. Beyond simply calculating the correct amounts, businesses must follow specific procedures for depositing these taxes with the federal government and maintaining appropriate documentation. Understanding these requirements helps Toledo businesses avoid costly penalties and maintain good standing with tax authorities.

- Tax Deposit Schedule: Toledo employers must follow either a monthly or semi-weekly deposit schedule based on their tax liability history.

- Quarterly Reporting: Form 941 must be filed quarterly to report FICA taxes withheld and employer contributions.

- Annual W-2 Preparation: Accurate FICA withholding information must be included on W-2 forms for all Toledo employees.

- Record Retention: Toledo businesses must maintain FICA tax records for at least four years after the tax becomes due or is paid.

- Audit Preparation: Implementing data-driven HR practices helps ensure documentation is audit-ready.

For Toledo businesses with supply chain operations, coordinating FICA compliance across multiple locations requires robust systems and processes. Automated payroll solutions that integrate tax deposit scheduling can help ensure timely payments. Toledo employers should also consider implementing regular internal audits of their FICA procedures to identify and address any compliance issues before they lead to penalties or other negative consequences.

Special FICA Considerations for Toledo Small Businesses

Small businesses in Toledo face unique challenges when managing FICA taxes. With fewer administrative resources than larger corporations, these businesses must find efficient ways to ensure compliance while managing cash flow. Understanding special provisions and exemptions that may apply to small businesses can help Toledo entrepreneurs navigate FICA requirements more effectively.

- Family Employee Exceptions: Special rules may apply for family members employed in a Toledo small business.

- Seasonal Business Considerations: How Toledo’s seasonal businesses should manage FICA during fluctuating employment periods.

- Cash Flow Management: Strategies for Toledo small businesses to handle the employer’s matching FICA contribution.

- Agricultural Exemptions: Special FICA rules that may apply to Toledo’s agricultural employers.

- Resource Optimization: Using small business scheduling features to better manage labor costs and associated FICA taxes.

Toledo’s small businesses can benefit from integrated systems that combine shift marketplace capabilities with payroll functions to optimize staffing while managing tax obligations. Additionally, local business owners should consider consulting with tax professionals familiar with Toledo’s business environment to identify potential tax strategies specific to their situation. By understanding these special considerations, small businesses can maintain compliance while minimizing administrative burden.

Common FICA Calculation Mistakes to Avoid

Even with automated tools, Toledo employers can make mistakes when calculating FICA taxes. These errors can lead to underpayment or overpayment of taxes, creating potential liability for the business and confusion for employees. Recognizing common calculation pitfalls helps Toledo businesses implement safeguards to ensure accuracy in their payroll processes.

- Misclassifying Workers: Incorrectly categorizing employees as independent contractors to avoid FICA taxes carries significant penalties for Toledo businesses.

- Wage Base Errors: Failing to stop Social Security withholding when an employee exceeds the annual wage base limit.

- Additional Medicare Tax Oversights: Not withholding the additional 0.9% Medicare tax for Toledo’s high-income employees.

- Taxable Fringe Benefit Omissions: Overlooking FICA taxes due on taxable benefits provided to Toledo employees.

- Calculation Technology Gaps: Using outdated time tracking software that doesn’t integrate properly with payroll systems.

Toledo businesses with healthcare workers should be particularly careful about FICA calculations for employees who receive shift differentials, bonuses, or other special pay types that affect FICA withholding. Implementing regular audits of payroll processes can help identify calculation errors before they become systemic problems. Additionally, investing in ongoing training for payroll staff about FICA requirements ensures they stay current with changing regulations and calculation methods.

FICA Tax Reporting and Filing in Toledo

Beyond calculation, Toledo employers must understand the proper procedures for reporting and filing FICA taxes. This involves multiple forms submitted to the IRS on different schedules throughout the year. Proper reporting is just as important as accurate calculation for maintaining tax compliance and avoiding penalties.

- Form 941 Filing: Toledo employers must submit this quarterly form to report FICA taxes withheld and employer contributions.

- Electronic Federal Tax Payment System (EFTPS): Most Toledo businesses must use this system to deposit FICA taxes.

- Year-End W-2 Reporting: Accurate FICA information must be reported on employee W-2 forms by January 31.

- Schedule H for Household Employers: Toledo residents employing household workers have special FICA reporting requirements.

- Digital Compliance Solutions: How integration technologies streamline FICA reporting for Toledo businesses.

Toledo businesses with seasonal workers should pay special attention to filing requirements during periods of fluctuating employment. Creating a tax filing calendar with automated reminders can help ensure timely submission of all required forms. For growing businesses, transitioning to integrated payroll systems that automate tax reporting can significantly reduce the administrative burden while improving accuracy and timeliness of FICA tax filings.

Advanced FICA Considerations for Toledo Employers

Beyond basic FICA requirements, Toledo employers may encounter special situations that require advanced knowledge of tax regulations. These scenarios often apply to specific industries, employment arrangements, or employee classifications that have unique FICA implications. Understanding these advanced considerations helps Toledo businesses maintain compliance in complex situations.

- Non-Resident Alien Employees: Special FICA rules may apply to Toledo businesses employing international workers.

- Section 218 Agreements: How these affect FICA for Toledo government and nonprofit employees.

- Religious Organization Exemptions: FICA considerations for Toledo’s religious employers and employees.

- Tipped Employee Calculations: Proper FICA handling for Toledo’s restaurant and hospitality workers.

- Multi-State Employee Management: Using multi-location scheduling coordination for employees who work in Toledo and other locations.

Toledo businesses in nonprofit sectors should be particularly aware of potential FICA exemptions that may apply to their organizations. Implementing specialized payroll processes for different employee classifications ensures proper FICA handling across the workforce. For businesses dealing with these advanced scenarios, consulting with tax professionals who understand both federal FICA regulations and Ohio-specific tax considerations can provide valuable guidance and help avoid compliance issues.

Future FICA Changes and How They May Impact Toledo Businesses

Staying informed about potential changes to FICA regulations helps Toledo businesses prepare for future compliance requirements. Tax laws evolve over time, and proposed legislation may affect FICA rates, wage bases, or reporting requirements. Being proactive about these potential changes allows Toledo employers to adapt their payroll processes and plan for potential financial impacts.

- Potential Rate Adjustments: How proposed changes to FICA tax rates could affect Toledo businesses’ payroll costs.

- Wage Base Projections: Anticipated changes to the Social Security wage base and how Toledo employers should prepare.

- Digital Reporting Evolution: Moving toward more automated tax reporting systems and what this means for Toledo businesses.

- Legislative Proposals: Current discussions about FICA changes at federal and state levels that could affect Toledo employers.

- Technology Adaptation: How future trends in time tracking and payroll will impact FICA management.

Toledo businesses should stay connected with professional organizations and business operations resources that provide updates on potential tax changes. Implementing scalable payroll systems allows for easier adaptation to regulatory changes. Additionally, building flexibility into financial planning helps Toledo businesses absorb potential increases in employer FICA contributions without significant operational disruption.

Integrating FICA Calculations with Business Systems

For maximum efficiency, Toledo businesses should integrate FICA calculations with their broader business management systems. This integration creates a seamless flow of data between scheduling, time tracking, payroll, and accounting functions, reducing manual data entry and the potential for errors. Modern business systems offer numerous opportunities for integration that can streamline FICA management.

- Time Tracking Integration: How connecting attendance systems with payroll ensures accurate FICA calculations based on actual hours worked.

- Scheduling Software Connections: Using employee scheduling key features that feed into payroll processing.

- Accounting System Synchronization: Ensuring FICA tax liabilities are properly recorded in financial systems.

- Employee Self-Service Portals: Providing Toledo employees with visibility into their FICA contributions through digital platforms.

- Tax Filing Automation: Systems that prepare and submit required FICA tax forms electronically.

Toledo businesses with multiple departments or locations particularly benefit from integrated systems that provide enterprise-wide visibility into FICA tax obligations. By implementing comprehensive business management solutions, Toledo employers can create more efficient workflows that reduce administrative time spent on FICA calculations while improving accuracy. This integration also provides better data for financial planning and helps businesses prepare for potential audits by maintaining comprehensive digital records.

Conclusion

Effective management of FICA payroll calculations is essential for Toledo businesses to maintain tax compliance while optimizing their payroll processes. By understanding the components of FICA taxes, implementing appropriate calculation tools, and staying current with regulatory requirements, Toledo employers can avoid penalties while ensuring their employees’ Social Security and Medicare contributions are properly handled. As tax regulations continue to evolve, maintaining flexible systems and processes will help businesses adapt to changes without significant disruption.

Toledo businesses should consider FICA management as part of their broader workforce optimization strategy, integrating tax calculations with scheduling, time tracking, and other HR functions. By leveraging modern technology solutions like Shyft’s workforce management platform, employers can streamline administrative processes while maintaining accurate FICA calculations. This comprehensive approach not only ensures compliance but also creates more efficient operations that allow business owners to focus on growth rather than administrative tasks. Ultimately, proper FICA management contributes to the financial health of both businesses and their employees in Toledo’s diverse economic landscape.

FAQ

1. How do I calculate FICA taxes for my Toledo-based employees?

To calculate FICA taxes for Toledo employees, multiply the employee’s gross wages by the current Social Security tax rate (6.2%) up to the annual wage base limit, and by the Medicare tax rate (1.45%) for all wages. For employees earning above $200,000, apply the additional 0.9% Medicare tax to amounts exceeding this threshold. As an employer, you must match the employee’s Social Security and standard Medicare tax contributions. For accuracy, consider using a payroll calculator or software that automatically applies the current rates and wage base limits to each employee’s earnings.

2. Are there any FICA exemptions that apply to Toledo businesses?

While FICA taxes apply broadly, certain exemptions exist that may benefit Toledo businesses. These include exemptions for some student employees working at their educational institutions, certain family employment situations (like a parent employing their child under 18), some nonresident aliens, and employees of specific religious organizations that oppose Social Security benefits. Additionally, certain types of payments like business expense reimbursements and health insurance premiums are not subject to FICA taxes. Toledo businesses should consult with a tax professional to determine if any exemptions apply to their specific situation, as improperly claiming exemptions can result in significant penalties.

3. How often should Toledo employers remit FICA taxes?

The frequency for depositing FICA taxes depends on the size of your Toledo business’s tax liability. Most employers fall under either a monthly or semi-weekly deposit schedule. Monthly depositors must submit FICA taxes by the 15th day of the following month. Semi-weekly depositors (typically larger businesses with higher tax liabilities) must deposit taxes on Wednesdays or Fridays, depending on when paydays fall. Very small employers with tax liability under $1,000 for the year may be eligible to file and pay annually with their Form 944. The IRS determines your deposit schedule based on a lookback period, and Toledo businesses should receive notification of their required schedule from the IRS.

4. What are the penalties for incorrect FICA calculations in Toledo?

Toledo businesses face significant penalties for FICA calculation errors. Late deposits incur a penalty ranging from 2% to 15% of the unpaid tax, depending on how late the payment is made. Failure to file required returns like Form 941 results in penalties of 5% of the unpaid tax per month, up to 25%. Willful failure to collect or pay FICA taxes can result in penalties of 100% of the unpaid amount and possible criminal charges. Additionally, incorrect W-2 reporting carries penalties of up to $290 per form. To avoid these penalties, Toledo businesses should implement robust payroll systems with built-in compliance checks and consider periodic payroll audits to identify and correct potential issues.

5. How do recent tax law changes affect FICA calculations in Toledo?

Recent tax law changes that affect FICA calculations for Toledo businesses include annual adjustments to the Social Security wage base limit, which changes each year based on national average wage increases. Additionally, certain COVID-19 relief provisions temporarily allowed for deferral of employer FICA taxes, though these programs have now ended. The Social Security wage base increased to $160,200 for 2023, meaning employers must withhold Social Security tax on employee earnings up to this amount. Toledo businesses should stay informed about proposed legislation that could affect FICA rates or administration in the future, as Social Security funding remains a topic of ongoing policy discussion at the federal level.