In today’s competitive business environment, organizations across industries are increasingly focused on optimizing labor costs while maintaining operational excellence. Premium pay analytics represents a critical component of labor cost management within shift management capabilities, enabling businesses to gain deeper insights into one of their most significant expense categories. Premium pay—which includes overtime, holiday pay, shift differentials, and other premium wage elements—often constitutes a substantial portion of labor expenses, sometimes accounting for 10-15% of total payroll costs. By leveraging sophisticated analytics tools and methodologies, organizations can identify patterns, forecast premium pay expenses, and implement strategic initiatives to optimize these costs while maintaining employee satisfaction and operational performance.

Effective premium pay analytics goes beyond basic reporting to provide actionable insights that drive decision-making across multiple organizational levels. From front-line supervisors making daily staffing decisions to executive leadership evaluating long-term labor strategies, premium pay analytics enables data-driven approaches to managing these critical expenses. When implemented properly, these analytics capabilities can help organizations reduce unnecessary premium pay expenses, ensure compliance with labor regulations, improve scheduling efficiency, and ultimately enhance overall profitability. As labor markets remain tight and wage pressures continue, the ability to strategically manage premium pay expenses has become a competitive differentiator for organizations committed to operational excellence.

Understanding Premium Pay Components and Their Impact

Premium pay encompasses various compensation elements that exceed standard base pay rates, each with distinct triggers and cost implications. Understanding these components is the foundation of effective premium pay analytics. Overtime management typically represents the largest premium pay category for most organizations, with time-and-a-half or double-time rates significantly impacting labor budgets. Organizations must track not only the financial impact but also the root causes driving overtime utilization to develop effective mitigation strategies.

- Overtime Pay: Typically 1.5x or 2x regular pay rates, triggered after exceeding standard weekly hours (often 40 hours) or daily thresholds in some jurisdictions.

- Shift Differentials: Additional compensation for working less desirable shifts (nights, weekends), usually calculated as a percentage of base pay or fixed amount per hour.

- Holiday Premium Pay: Enhanced compensation for working on designated holidays, often at 1.5x or 2x regular rates.

- On-call Pay: Compensation for employees required to be available outside normal working hours, even when not actively working.

- Call-back Pay: Additional compensation when employees are called back to work after completing their regular shift.

The cumulative impact of these premium pay elements can substantially affect labor budgets, with some organizations seeing premium pay account for 10-20% of total labor costs. Labor cost comparison across departments, locations, or time periods reveals that premium pay often represents a significant opportunity for cost optimization. By implementing sophisticated analytics solutions like those offered by Shyft, organizations can transform raw premium pay data into actionable insights that drive strategic decision-making and operational improvements.

Essential Metrics and KPIs for Premium Pay Analytics

To effectively analyze and manage premium pay expenses, organizations must establish and monitor key performance indicators (KPIs) that provide meaningful insights into premium pay utilization and impact. These metrics serve as the foundation for identifying trends, benchmarking performance, and measuring improvement initiatives. Advanced reporting and analytics capabilities enable organizations to move beyond basic premium pay tracking to sophisticated analysis that drives strategic action.

- Premium Pay Percentage: Total premium pay as a percentage of overall labor costs, providing a high-level indicator of premium pay utilization relative to total compensation.

- Premium Pay by Type: Breakdown of premium pay expenses by category (overtime, holiday, shift differential), helping identify which premium pay elements contribute most to costs.

- Premium Hours Ratio: Number of premium pay hours compared to regular hours worked, indicating the relative frequency of premium pay situations.

- Avoidable vs. Unavoidable Premium Pay: Classification of premium expenses as either strategically necessary or potentially avoidable through improved scheduling or staffing practices.

- Premium Pay Variance: Comparison of actual premium pay expenses against budgeted amounts, highlighting areas of concern or improvement.

Organizations should incorporate schedule optimization metrics alongside premium pay analytics to gain a comprehensive view of labor cost management opportunities. By tracking these metrics consistently across time periods, departments, and locations, businesses can establish benchmarks, identify outliers, and measure the effectiveness of cost optimization initiatives. Well-designed dashboards and automated reporting tools facilitate regular review of these metrics, enabling timely interventions when premium pay utilization exceeds expected thresholds.

Advanced Analytics Techniques for Premium Pay Optimization

Modern premium pay analytics extends beyond descriptive reporting to incorporate advanced analytical techniques that enable deeper insights and more sophisticated optimization strategies. These approaches help organizations not only understand historical premium pay patterns but also predict future trends and proactively manage labor costs. Workforce analytics platforms increasingly leverage artificial intelligence and machine learning to uncover non-obvious patterns and relationships within premium pay data.

- Predictive Analytics: Forecasting future premium pay expenses based on historical patterns, scheduled events, and business volume projections to support proactive management.

- Root Cause Analysis: Systematic examination of factors driving premium pay utilization, including staffing levels, scheduling practices, absenteeism, and workload fluctuations.

- Scenario Modeling: Simulation of various staffing and scheduling scenarios to determine optimal approaches for minimizing premium pay while maintaining service levels.

- Anomaly Detection: Automated identification of unusual premium pay patterns that may indicate scheduling inefficiencies, policy violations, or opportunities for improvement.

- Correlation Analysis: Examination of relationships between premium pay utilization and factors such as customer demand, employee satisfaction, and operational performance.

These advanced techniques enable organizations to move from reactive management of premium pay expenses to proactive optimization strategies. Shift analytics and workforce demand forecasting capabilities allow businesses to anticipate potential premium pay situations before they occur and implement preventive measures. By combining these sophisticated analytics approaches with effective process improvements, organizations can achieve substantial reductions in premium pay expenses while maintaining operational performance and employee satisfaction.

Integrating Premium Pay Analytics with Scheduling Systems

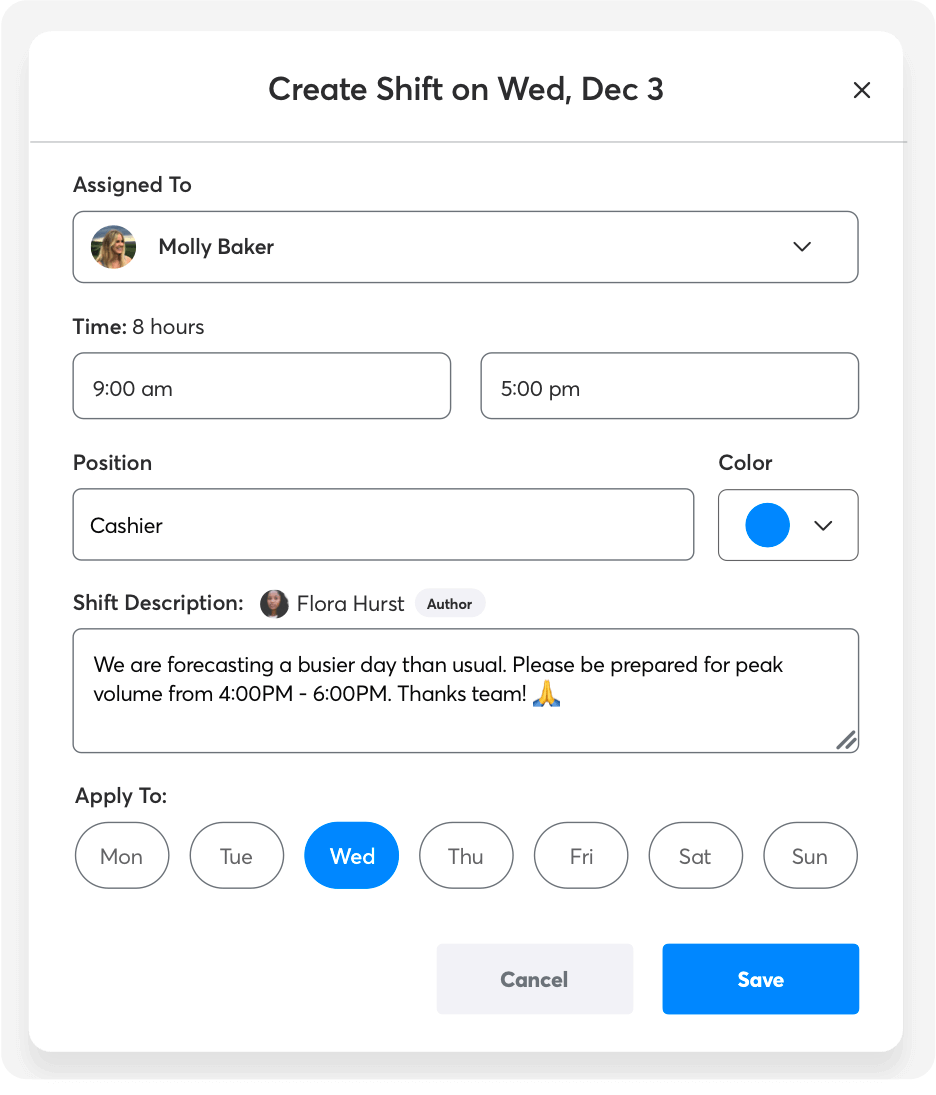

Effective premium pay management requires tight integration between analytics capabilities and scheduling systems to enable data-driven scheduling decisions that optimize labor costs. Modern employee scheduling platforms incorporate premium pay awareness into the scheduling process, helping managers make informed decisions that balance operational requirements with labor cost considerations. This integration creates a powerful feedback loop where analytics insights directly influence scheduling practices, and scheduling data enriches premium pay analytics.

- Predictive Alerts: Real-time notifications when scheduled shifts are likely to generate premium pay, allowing managers to consider alternatives before finalizing schedules.

- Optimization Algorithms: Automated scheduling tools that consider premium pay implications when generating or suggesting employee schedules.

- What-If Analysis: Interactive tools allowing managers to visualize premium pay impacts of different scheduling scenarios before implementation.

- Employee Eligibility Tracking: Systems that monitor employee hours and availability to identify potential overtime situations before they occur.

- Post-Schedule Analysis: Automated evaluation of implemented schedules to identify opportunities for future premium pay reduction.

Organizations can achieve significant cost savings through peak time scheduling optimization, which aligns staffing levels with demand patterns to minimize unnecessary premium pay. Advanced scheduling systems with integrated analytics capabilities enable more sophisticated approaches to labor optimization, including dynamic scheduling adjustments based on real-time conditions. When scheduling and premium pay analytics work in tandem, organizations can achieve the dual objectives of controlling labor costs and maintaining operational effectiveness.

Leveraging Technology for Premium Pay Analytics

Modern technology solutions have revolutionized the way organizations analyze and manage premium pay expenses. From basic reporting tools to sophisticated AI-powered analytics platforms, these technologies enable more comprehensive, accurate, and actionable premium pay insights. Effective implementation of technology solutions requires careful consideration of organizational needs, existing systems, and the specific premium pay challenges being addressed.

- Time and Attendance Systems: Accurate tracking of employee work hours and premium pay eligibility using time tracking tools that automatically calculate premium pay based on configured rules.

- Labor Management Systems: Comprehensive platforms that combine scheduling, time tracking, and analytics to provide integrated premium pay management capabilities.

- Business Intelligence Tools: Data visualization and analysis platforms that transform raw premium pay data into intuitive dashboards and reports.

- Payroll Integration: Systems that connect premium pay analytics with payroll integration techniques to ensure accurate calculation and payment of premium wages.

- Mobile Applications: Tools that provide managers and executives with on-the-go access to premium pay analytics and alerts, enabling timely decision-making.

Cloud-based solutions offer particular advantages for premium pay analytics, including enhanced accessibility, scalability, and integration capabilities. These platforms typically provide more frequent updates and innovations compared to on-premises alternatives. When evaluating technology solutions, organizations should prioritize systems that offer robust integration capabilities, intuitive user interfaces, configurable analytics, and strong security features. The right technology investment can dramatically improve an organization’s ability to manage premium pay expenses effectively.

Implementing Strategic Premium Pay Reduction Initiatives

Armed with insights from premium pay analytics, organizations can implement targeted initiatives to optimize premium pay expenses while maintaining operational performance. Successful implementation requires a strategic approach that balances short-term cost reduction with long-term operational sustainability. Cost management strategies should be developed with input from multiple stakeholders, including operations, finance, human resources, and frontline employees.

- Staffing Level Optimization: Adjusting base staffing levels to better align with typical demand patterns, reducing reliance on overtime to cover predictable needs.

- Cross-Training Programs: Developing employee skills across multiple roles to increase scheduling flexibility and reduce premium pay requirements during absences or demand spikes.

- Flexible Scheduling Policies: Implementing alternative scheduling approaches such as flex-time, compressed workweeks, or split shifts to provide coverage without triggering premium pay.

- Alternative Staffing Models: Utilizing part-time employees, temporary workers, or contingent staff to manage fluctuations without incurring overtime expenses.

- Process Improvement: Identifying and eliminating inefficiencies that contribute to overtime or other premium pay situations.

Organizations implementing hybrid labor cost management approaches often achieve the most sustainable results, combining multiple strategies to address different aspects of premium pay utilization. Prioritizing initiatives based on potential impact, implementation difficulty, and alignment with organizational objectives ensures resources are directed toward the most valuable opportunities. Regular monitoring of initiative results through premium pay analytics enables continuous refinement and optimization of the overall premium pay management strategy.

Balancing Premium Pay Reduction with Operational Performance

While reducing premium pay expenses represents a legitimate cost optimization goal, organizations must carefully balance this objective against operational requirements and employee considerations. Overly aggressive premium pay reduction initiatives can potentially impact service quality, employee satisfaction, and even regulatory compliance. Operational focus scheduling requires maintaining this delicate balance between cost control and operational effectiveness.

- Service Level Analysis: Evaluating how premium pay reduction initiatives might affect customer service metrics, response times, or product quality.

- Employee Feedback Mechanisms: Gathering input from employees about the impact of premium pay changes on their work experience and financial wellbeing.

- Strategic vs. Tactical Premium Pay: Distinguishing between premium pay that represents an investment in operational performance versus unnecessary expense due to inefficient scheduling.

- Total Cost Perspective: Considering how premium pay reduction might affect other costs, such as turnover, recruitment, or quality issues.

- Change Management Approach: Implementing premium pay changes thoughtfully with clear communication and appropriate phasing to minimize disruption.

Organizations should establish clear metrics to monitor both premium pay expenses and operational performance indicators during cost optimization initiatives. This balanced scorecard approach ensures that premium pay reduction doesn’t inadvertently undermine business performance. Advanced analytics can help identify the optimal balance point where premium pay is minimized without compromising operational effectiveness. As highlighted in research on overtime reduction savings, a thoughtful approach to premium pay management can deliver substantial cost benefits while maintaining or even improving operational performance.

Ensuring Compliance in Premium Pay Management

Premium pay management must operate within the boundaries of labor laws, regulations, and collective bargaining agreements. Compliance considerations should be integrated into premium pay analytics and management strategies to ensure that cost optimization efforts don’t create legal or contractual risks. Regulatory compliance solutions can help organizations navigate the complex landscape of premium pay requirements across different jurisdictions and employee classifications.

- Regulatory Tracking: Monitoring changes in labor laws affecting premium pay obligations across all relevant jurisdictions where the organization operates.

- Compliance Analytics: Incorporating compliance checks into premium pay analytics to identify potential violations before they occur.

- Documentation and Recordkeeping: Maintaining comprehensive records of hours worked, premium pay calculations, and policy applications to support compliance verification.

- Policy Enforcement: Ensuring consistent application of premium pay policies across the organization to avoid discrimination claims or contractual violations.

- Automated Compliance Controls: Implementing system rules and alerts that prevent scheduling or time recording practices that would violate premium pay regulations.

Compliance requirements should be treated as non-negotiable constraints within premium pay optimization efforts. While there may be legitimate strategies to minimize premium pay expenses, circumventing legal requirements should never be among them. Organizations should work with legal experts to ensure their premium pay analytics and management approaches align with all applicable regulations. The cost of compliance violations—including back pay, penalties, legal expenses, and reputational damage—far outweighs any short-term savings from non-compliant premium pay practices.

Future Trends in Premium Pay Analytics

The field of premium pay analytics continues to evolve, with emerging technologies and methodologies creating new opportunities for more sophisticated and effective labor cost management. Organizations that stay abreast of these trends can gain competitive advantages through enhanced premium pay optimization capabilities. Several key developments are shaping the future of premium pay analytics and management practices.

- AI-Powered Analytics: Advanced machine learning algorithms that can predict premium pay situations with greater accuracy and recommend specific preventive actions.

- Real-Time Analytics: Continuous monitoring and analysis of premium pay trends, enabling immediate interventions rather than retrospective review.

- Integrated Workforce Management: Comprehensive platforms that combine premium pay analytics with scheduling, time tracking, and other workforce management functions.

- Employee Self-Service: Tools that empower employees to manage their own schedules while providing visibility into premium pay implications.

- Automated Optimization: Systems that can automatically adjust schedules and staffing plans to minimize premium pay expenses while meeting operational requirements.

As labor costs continue to represent a significant portion of operating expenses for many organizations, investments in premium pay minimization capabilities are likely to deliver substantial returns. Organizations should develop roadmaps for enhancing their premium pay analytics capabilities, incorporating these emerging technologies and approaches as they become available. By building a foundation of strong premium pay analytics today, businesses position themselves to leverage future innovations effectively and maintain competitive labor cost structures in an increasingly challenging economic environment.

Conclusion

Premium pay analytics represents a powerful approach to labor cost management within the broader context of shift management capabilities. By implementing sophisticated analytics tools and methodologies, organizations can transform raw premium pay data into actionable insights that drive meaningful cost optimization while maintaining operational performance. The most successful premium pay management strategies combine data-driven analytics with thoughtful process improvements, technology enablement, and careful consideration of operational and employee impacts. Organizations that excel in premium pay analytics typically achieve 15-25% reductions in premium pay expenses while preserving service quality and employee satisfaction.

As labor markets evolve and technology capabilities advance, premium pay analytics will continue to grow in importance as a strategic business capability. Organizations should invest in developing robust premium pay analytics capabilities, integrating these tools with scheduling systems, and building the organizational competencies needed to translate analytics insights into effective action. By maintaining a balanced approach that considers both cost optimization and operational effectiveness, businesses can leverage premium pay analytics to achieve sustainable competitive advantages in their labor cost management practices. The journey toward premium pay optimization is ongoing, requiring continuous refinement and adaptation, but the potential benefits make it a worthwhile investment for organizations committed to operational excellence.

FAQ

1. What specific data should we collect to analyze premium pay effectively?

Effective premium pay analytics requires comprehensive data collection across multiple dimensions. Start with detailed time and attendance records that capture not just total hours but specific shift times, premiums applied, and associated rates. Track premium pay eligibility factors including employee classifications, skill certifications, and special assignments. Gather operational metrics like production volumes, customer traffic, or service levels to correlate with premium pay utilization. Include workforce demographics and schedule preferences to understand employee availability constraints. Finally, maintain historical records of scheduling decisions, staffing levels, and management approvals to identify patterns and accountability. Advanced time tracking tools can automate much of this data collection, ensuring accuracy and completeness while reducing administrative burden.

2. How can we calculate the ROI of premium pay analytics initiatives?

Calculating ROI for premium pay analytics initiatives requires comparing implementation costs against realized benefits. On the cost side, include technology investments, consulting services, staff training, and ongoing maintenance expenses. For benefits, quantify direct premium pay reductions achieved through improved scheduling and staffing practices. Consider secondary financial benefits such as reduced administrative time, improved compliance (fewer penalties/settlements), and increased productivity from better workforce utilization. Many organizations also include indirect benefits like improved employee satisfaction (reduced turnover) and enhanced service quality. The most comprehensive workforce optimization ROI calculations establish clear pre-implementation baselines and track specific improvement metrics over time, accounting for both tangible and intangible benefits across multiple timeframes (immediate, short-term, and long-term).

3. How frequently should we review premium pay analytics data?

Premium pay analytics should be reviewed at multiple frequencies to balance tactical responsiveness with strategic planning. Daily or real-time reviews enable immediate intervention for unusual premium pay situations, preventing small issues from becoming major expenses. Weekly analyses allow operational managers to identify short-term trends and make schedule adjustments for upcoming periods. Monthly reviews provide the opportunity to evaluate departmental and location performance against targets, allocate resources, and implement process improvements. Quarterly strategic reviews with executive leadership should focus on longer-term trends, policy effectiveness, and major initiative planning. Annual comprehensive analyses support budgeting processes and strategic workforce planning. Organizations with sophisticated reporting and analytics capabilities often implement automated alerts that trigger reviews based on threshold violations rather than fixed schedules, enabling more responsive premium pay management.

4. How do we balance premium pay reduction with employee satisfaction?

Balancing premium pay reduction with employee satisfaction requires a thoughtful approach that considers both business needs and employee perspectives. Start by distinguishing between premium pay that employees have come to rely on as part of their expected compensation versus truly exceptional situations. Implement transparent communication about premium pay management goals and involve employees in developing solutions. Consider gradual approaches to premium pay reduction that allow employees time to adjust financially. Focus first on premium pay resulting from inefficient processes or scheduling practices rather than taking away employee flexibility. Create alternative incentives or benefits that maintain total compensation while shifting from premium pay to more predictable elements. Monitor employee feedback and key indicators like turnover, engagement, and productivity during premium pay changes. Some organizations successfully implement hybrid labor cost management approaches that share the benefits of premium pay reduction with employees through other compensation mechanisms, creating win-win outcomes.

5. What role should frontline managers play in premium pay analytics?

Frontline managers serve as critical links between premium pay analytics insights and operational implementation. They should be equipped with user-friendly dashboards and reports that highlight relevant premium pay metrics for their areas of responsibility. Managers need training not just on analytical tools but on interpreting premium pay data and understanding root causes. They should be accountable for specific premium pay KPIs within their control, with clear performance expectations. Effective premium pay management requires frontline managers to make data-informed scheduling decisions, proactively address emerging premium pay risks, and balance cost considerations with operational needs. Managers should also gather feedback from employees about the impact of premium pay policies and contribute suggestions for improvement based on their operational knowledge. Organizations that invest in developing analytical capabilities among frontline managers through manager coaching on analytics typically achieve superior results in premium pay optimization compared to those that centralize analytics functions without operational integration.