Navigating the legal landscape as a small business owner in New Orleans can be challenging without proper guidance. A small business attorney serves as your legal advocate, helping you understand and comply with federal, state, and local regulations while protecting your business interests. New Orleans, with its unique blend of civil law heritage and modern business environment, presents distinct legal considerations that require specialized knowledge. Whether you’re launching a French Quarter boutique, a Garden District restaurant, or a tech startup in the Warehouse District, having a qualified small business attorney can make the difference between costly legal missteps and a thriving enterprise.

Small business attorneys in New Orleans offer specialized expertise in various aspects of business law, from entity formation and contract drafting to intellectual property protection and regulatory compliance. They understand the nuances of Louisiana’s legal system, which differs from other states due to its roots in Napoleonic code rather than common law. As your business grows, managing legal requirements becomes increasingly complex, requiring careful scheduling and attention to detail. With the right legal partner, you can focus on running your business while ensuring all legal matters are handled properly and proactively.

The Role of Small Business Attorneys in New Orleans

A small business attorney in New Orleans serves as a crucial advisor throughout your business journey. From the initial stages of business formation to navigating growth challenges and potential disputes, these legal professionals provide guidance tailored to your specific industry and goals. Unlike general practice attorneys, small business specialists have in-depth knowledge of commercial regulations, tax implications, and contractual best practices relevant to entrepreneurs in the New Orleans market.

- Business Formation Guidance: Advising on the most advantageous business structure (LLC, corporation, partnership) based on your specific circumstances and Louisiana state requirements.

- Regulatory Compliance: Ensuring your business adheres to local New Orleans ordinances, Louisiana state laws, and federal regulations applicable to your industry.

- Contract Development: Creating, reviewing, and negotiating legally sound contracts with vendors, clients, employees, and partners.

- Risk Management: Identifying potential legal vulnerabilities and implementing preventative measures to protect your business interests.

- Dispute Resolution: Representing your business in litigation, arbitration, or mediation when conflicts arise.

Effectively working with a small business attorney requires clear communication and efficient scheduling. Many law firms now utilize digital tools to streamline client interactions and document management. These systems help ensure important deadlines are met and legal obligations are fulfilled in a timely manner, reducing the risk of compliance issues or missed opportunities.

Key Legal Services for Small Businesses in New Orleans

Small business attorneys in New Orleans provide a comprehensive range of services designed to address the unique challenges facing entrepreneurs in this vibrant city. Understanding these service offerings can help you determine when to engage legal counsel and how to maximize the value of your attorney relationship. Properly managing your legal requirements requires careful attention to timing and detail.

- Business Entity Formation: Determining the optimal business structure, preparing and filing necessary documentation with the Louisiana Secretary of State, and establishing proper governance documents.

- Commercial Lease Review: Analyzing lease agreements for New Orleans properties to protect your interests and negotiate favorable terms.

- Intellectual Property Protection: Securing trademarks, copyrights, and patents to safeguard your business innovations and brand identity.

- Employment Law Compliance: Creating employee handbooks, developing employment contracts, and ensuring adherence to Louisiana labor laws.

- Business Succession Planning: Developing strategies for ownership transition, whether through sale, inheritance, or other arrangements.

Technology has transformed how legal services are delivered, with many attorneys using digital communication platforms and cloud-based document management systems. These tools facilitate better client collaboration and more efficient service delivery. Implementing a systematic approach to managing legal tasks helps ensure nothing falls through the cracks, particularly when dealing with time-sensitive filings or compliance deadlines.

Legal Compliance Considerations for New Orleans Businesses

Compliance with applicable laws and regulations is critical for business success and longevity in New Orleans. The city’s unique regulatory environment includes specific licensing requirements, zoning restrictions, and local ordinances that differ from other Louisiana municipalities. A small business attorney can help you navigate this complex landscape and implement systems to maintain ongoing compliance as regulations evolve.

- Local Business Licenses and Permits: Obtaining necessary authorizations from the City of New Orleans, including occupational licenses, alcohol permits, or special use approvals.

- Tax Compliance: Navigating Louisiana’s unique tax structure, including state sales tax, parish taxes, and New Orleans-specific tax obligations.

- Historic District Regulations: Understanding and adhering to special requirements for businesses operating in historic neighborhoods like the French Quarter or Garden District.

- Industry-Specific Regulations: Complying with regulations particular to your business type, such as food service, hospitality, healthcare, or professional services.

- Data Privacy and Security: Implementing appropriate safeguards for customer information and ensuring compliance with applicable privacy laws.

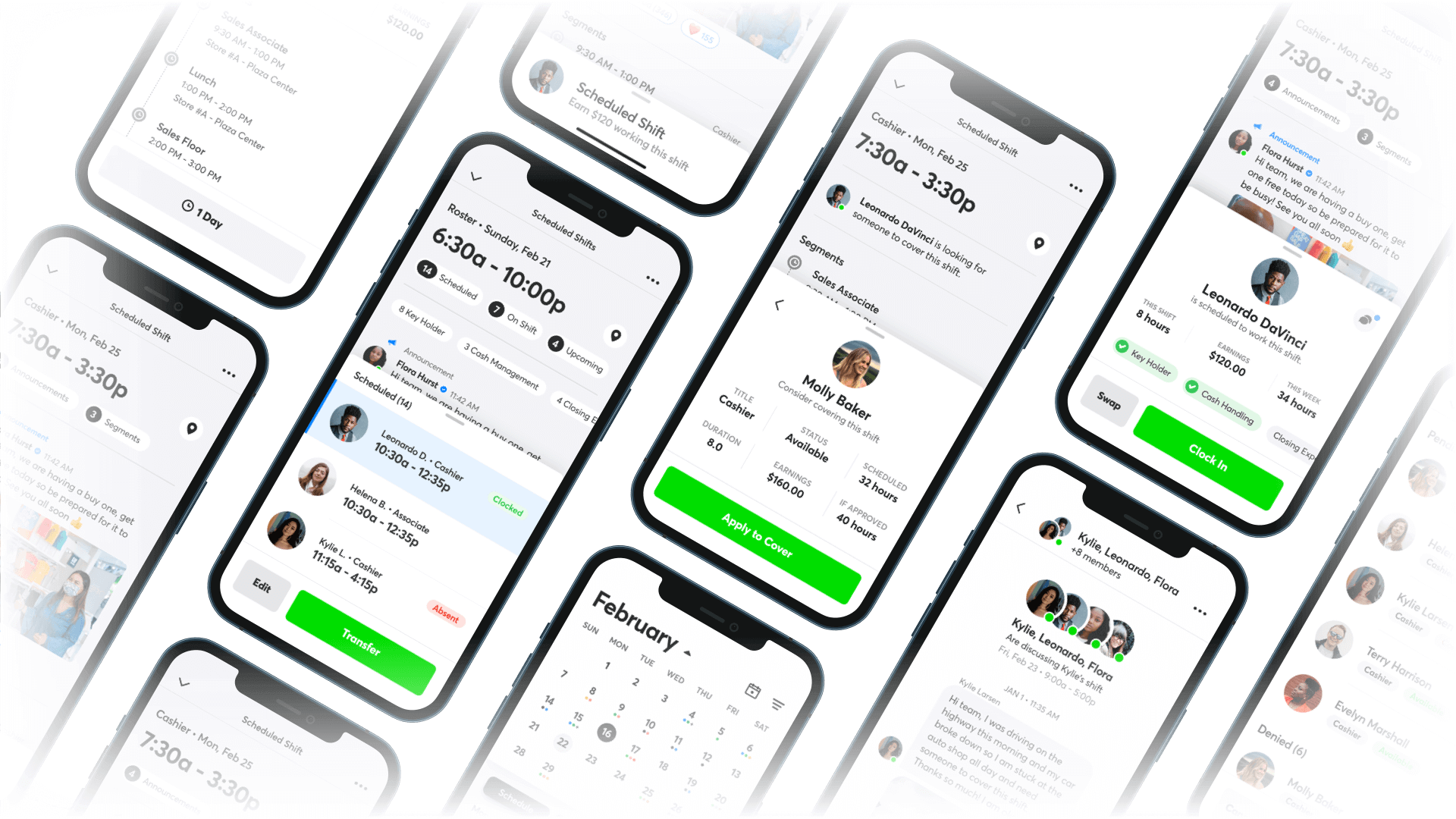

Maintaining compliance requires careful tracking of deadlines and requirements. Many businesses benefit from implementing digital scheduling and reminder systems to manage compliance tasks. With tools like Shyft, businesses can organize compliance-related activities, assign responsibilities to team members, and ensure nothing important is overlooked. This proactive approach helps prevent costly penalties and business disruptions.

Finding the Right Small Business Attorney in New Orleans

Selecting the ideal legal partner for your New Orleans business requires careful consideration of several factors. The right attorney will not only have relevant expertise but will also understand your business goals and industry challenges. Take time to research potential attorneys and schedule initial consultations to assess their fit with your specific needs and working style.

- Industry Experience: Look for attorneys with expertise in your specific sector, whether it’s hospitality, tourism, healthcare, technology, or creative arts.

- Local Knowledge: Prioritize lawyers familiar with New Orleans business regulations, local courts, and the regional business community.

- Firm Size Considerations: Evaluate whether a solo practitioner, boutique firm, or larger law office best suits your needs and budget.

- Communication Style: Choose an attorney whose communication approach aligns with your preferences, whether that’s detailed explanations or straightforward guidance.

- Fee Structure Transparency: Seek attorneys who provide clear information about billing practices, rates, and potential additional costs.

Scheduling initial consultations with multiple attorneys allows you to compare their approaches and expertise. Many law firms now offer virtual consultations, making it easier to fit these important meetings into your busy schedule. When preparing for these meetings, organize your questions and business information in advance to make the most of your time. This structured approach helps ensure you find an attorney who can truly serve as a valuable partner in your business journey.

Working Effectively with Your Small Business Attorney

Developing a productive relationship with your small business attorney can significantly impact the value you receive from legal services. Establishing clear expectations, maintaining open communication, and organizing your business information will help maximize the effectiveness of your legal counsel while potentially reducing costs. Consider implementing systems to streamline your attorney interactions and document management.

- Proactive Communication: Consult your attorney before making major business decisions rather than seeking help only when problems arise.

- Document Organization: Maintain well-organized business records and provide complete information when requesting legal assistance.

- Regular Legal Check-ups: Schedule periodic reviews of your business operations to identify potential legal issues before they become problems.

- Clear Scope Definition: Explicitly define the scope of work for each legal project to avoid misunderstandings about services and fees.

- Team Integration: Introduce your attorney to key team members who may need to communicate with them on specific matters.

Effective communication strategies and scheduling tools can significantly improve your attorney relationship. Consider establishing regular check-in meetings to address ongoing legal matters and using project management software to track legal tasks and deadlines. Many businesses find that implementing digital solutions for document sharing and meeting scheduling reduces administrative burden and improves collaboration with their legal team.

Cost Considerations and Fee Structures

Understanding the various fee arrangements offered by small business attorneys in New Orleans allows you to better plan your legal budget and avoid unexpected costs. Different legal matters may warrant different fee structures, and a transparent discussion about costs should be part of your initial attorney consultations. Developing a clear agreement about billing practices helps prevent misunderstandings and financial surprises.

- Hourly Billing: The traditional approach where attorneys charge a set rate for each hour worked, typically ranging from $150-$500+ per hour depending on experience and specialization.

- Flat Fee Services: Predetermined rates for specific services like business formation, trademark registration, or contract drafting.

- Retainer Arrangements: Monthly or annual fees that secure a certain amount of legal services or priority access to your attorney.

- Contingency Fees: Payment based on outcomes, most common in litigation where the attorney receives a percentage of any settlement or judgment.

- Alternative Fee Arrangements: Hybrid models or value-based billing options that align legal costs with business objectives.

Managing legal expenses requires careful planning and cost management strategies. Consider bundling similar legal tasks to increase efficiency and reduce billable hours. Digital tools can help track legal spending and allocate resources appropriately. Some businesses find that implementing regular legal budget reviews helps identify areas where costs can be optimized without sacrificing quality of representation.

Legal Technology and Resources for Small Business Owners

The legal technology landscape has evolved significantly, offering small business owners in New Orleans innovative tools to complement their attorney relationships. These resources can help streamline routine legal tasks, improve document management, and facilitate better communication with your legal team. Understanding available technologies allows you to create an integrated approach to managing your business’s legal needs.

- Legal Document Automation: Software platforms that generate standard legal documents with customization based on Louisiana requirements.

- Contract Management Systems: Digital solutions for storing, tracking, and managing business agreements and their key provisions.

- E-Signature Platforms: Tools that facilitate legally binding electronic signatures for business documents.

- Compliance Tracking Software: Applications that monitor regulatory requirements and deadlines relevant to your business.

- Legal Research Databases: Resources providing access to Louisiana laws, regulations, and case law affecting small businesses.

Integrating legal technology with operational systems like employee scheduling and team communication creates a more cohesive business management approach. For example, connecting compliance deadlines with your team scheduling software ensures responsible parties are available to handle important legal tasks. Tools like Shyft can help coordinate team responsibilities around legal obligations, making it easier to maintain compliance while running your business efficiently.

Industry-Specific Legal Considerations in New Orleans

Different industries in New Orleans face unique legal challenges that require specialized knowledge and tailored legal strategies. Working with an attorney who understands the specific regulations and common legal issues in your sector can provide significant advantages. Consider how industry-specific expertise might benefit your business when selecting legal counsel.

- Hospitality and Tourism: Navigating alcohol licensing, food service regulations, event permits, and liability considerations unique to New Orleans’ vibrant tourism economy.

- Creative Industries: Addressing intellectual property protection, performance contracts, and licensing arrangements for musicians, artists, and content creators.

- Real Estate and Construction: Managing zoning requirements, historic preservation regulations, contractor agreements, and property development compliance.

- Healthcare Services: Ensuring compliance with federal and state healthcare regulations, privacy laws, and professional licensing requirements.

- Maritime and Shipping: Addressing the unique legal framework governing businesses connected to the Mississippi River and Port of New Orleans.

Industry-specific regulations often include particular scheduling and reporting requirements that must be carefully managed. For businesses in hospitality, healthcare, or retail, coordinating staff schedules with regulatory compliance needs can be complex. Digital tools that integrate workforce management with compliance tracking help ensure your business meets its legal obligations while maintaining operational efficiency.

Preparing for Business Growth and Legal Transitions

As your New Orleans business evolves, your legal needs will change accordingly. Anticipating these shifts and working with your attorney to plan for growth can prevent legal complications and position your business for sustainable success. Developing a forward-looking legal strategy helps ensure your business remains compliant and protected through various stages of development.

- Scalable Legal Structures: Creating business entities and governance documents that accommodate future growth and potential investors.

- Expansion Planning: Addressing regulatory requirements for opening additional locations or expanding into new service areas.

- Hiring and HR Infrastructure: Developing legally sound employment policies and procedures that grow with your workforce.

- Intellectual Property Strategy: Building a comprehensive approach to protecting your business assets and brand as you enter new markets.

- Exit Strategy Planning: Preparing for eventual business transitions through sale, succession, or other arrangements.

Business growth often brings increased complexity in managing operations and legal compliance. As your team expands, implementing robust systems for scheduling, communication, and training becomes increasingly important. Digital platforms that scale with your business help maintain organizational efficiency while ensuring legal requirements continue to be met across all aspects of your operations.

Conclusion

A qualified small business attorney is an invaluable partner in navigating the complex legal landscape of New Orleans. From entity formation and contract development to compliance management and dispute resolution, these legal professionals provide guidance that helps protect your business while supporting its growth objectives. The unique legal environment of New Orleans, with its distinctive regulatory framework and business opportunities, makes local legal expertise particularly valuable for entrepreneurs operating in this vibrant city.

Investing in a strong attorney relationship is not merely about addressing problems as they arise—it’s about creating a proactive legal strategy that anticipates challenges and positions your business for long-term success. By carefully selecting the right attorney, establishing clear communication practices, and integrating legal considerations into your business operations through tools like Shyft, you can build a foundation that supports sustainable growth while minimizing legal risks. Remember that legal guidance should be viewed as an essential business investment rather than a discretionary expense, particularly in a market as unique and opportunity-rich as New Orleans.

FAQ

1. When should I hire a small business attorney in New Orleans?

You should consult with a small business attorney before starting your business to ensure proper formation and compliance from the beginning. Additionally, seek legal counsel when negotiating important contracts, hiring employees, facing potential litigation, considering major business changes (expansion, acquisition, new products/services), or encountering regulatory issues. Many business owners benefit from establishing an ongoing relationship with an attorney who can provide proactive guidance rather than waiting until problems arise. Regular legal check-ups, similar to scheduling performance evaluations in your business, can help identify potential issues before they become serious problems.

2. How much does a small business attorney in New Orleans typically cost?

Legal fees in New Orleans vary based on attorney experience, firm size, and the complexity of your legal needs. Hourly rates typically range from $150-$500+, with experienced business attorneys often charging $250-$350 per hour. Many routine services like business formation or contract drafting may be offered at flat rates ranging from $500-$5,000 depending on complexity. Some attorneys offer monthly retainer arrangements starting around $500-$2,500, which provide access to ongoing legal advice. When budgeting for legal expenses, consider implementing cost management strategies to optimize your investment while ensuring your business receives necessary legal protection.

3. What’s the difference between a general practice attorney and a small business attorney in New Orleans?

A general practice attorney handles a wide variety of legal matters across different areas of law, while a small business attorney specializes specifically in business-related legal issues. Small business attorneys in New Orleans possess deeper knowledge of Louisiana’s business laws, local regulations, tax considerations, and industry-specific requirements. They’re more familiar with the unique aspects of New Orleans’ business environment, including parish-specific ordinances and the city’s distinctive legal culture. This specialized expertise allows them to provide more targeted, efficient advice for entrepreneurs and can be particularly valuable when navigating complex regulatory frameworks or industry-specific compliance requirements. Much like how specialized scheduling approaches better address specific business needs, specialized legal counsel offers more tailored solutions.

4. How can I prepare for my first meeting with a small business attorney?

To maximize the value of your initial consultation, gather key business documents including any existing formation papers, contracts, leases, licenses, permits, and financial information relevant to your legal questions. Prepare a concise business overview describing your operations, goals, and specific legal concerns. Develop a list of questions addressing your most pressing legal needs and long-term objectives. Consider what you’re looking for in an attorney relationship, including communication preferences and budget constraints. Be ready to discuss your business timeline and any upcoming deadlines. This preparation ensures your attorney can provide targeted advice from the first meeting and helps establish an efficient working relationship. Using digital organization tools can help you manage these documents and preparation tasks effectively.

5. What are some red flags to watch for when selecting a small business attorney in New Orleans?

Be cautious of attorneys who make guarantees about specific outcomes, as legal matters inherently involve uncertainty. Watch for poor communication, including delayed responses or unclear explanations of complex issues. Be wary of attorneys who seem unfamiliar with New Orleans-specific regulations or your industry’s unique legal challenges. Avoid those who are unwilling to provide clear information about their fee structure or who pressure you into unnecessary services. Be concerned if an attorney lacks references or has negative reviews regarding their business law expertise. Trust your instincts about personal compatibility, as you’ll be working closely with this professional on important matters. A good attorney relationship, like effective team communication, should feel collaborative and supportive rather than confusing or frustrating.