Table Of Contents

Time Clock Punch In And Out: A Comprehensive Guide

Payroll processing affects every business, from startups hiring their first employee to large corporations with vast payroll demands. It’s the systematic approach of calculating employee compensation, withholding taxes, and ensuring every staff member receives the correct wage on time. Whether you’re running a small mom-and-pop shop or supervising hundreds of employees, having a solid grasp of payroll fundamentals is critical to your organization’s success.

In this guide, we’ll walk through the ins and outs of payroll processing to help you better understand its components, responsibilities, and best practices. Along the way, we’ll also highlight potential tools—like Shyft’s scheduling platform—that can seamlessly align your staff’s worked hours with reliable payroll solutions. Let’s begin!

Payroll Processing: The Essentials

Payroll processing generally refers to all the steps you must take to pay employees accurately and on time. It goes beyond merely cutting checks or direct deposits; it includes compliance with labor laws, ensuring proper withholdings, and maintaining meticulous records. Because labor regulations differ across regions, it’s crucial to understand your local requirements before diving in.

- Employee Classification: Correctly classify workers (e.g., full-time, part-time, or contractor) to ensure accurate tax treatment and benefits.

- Gross Pay Calculation: Factor in the hourly rate or salary, plus any overtime or tips.

- Deductions: This includes federal and state withholding, Social Security, and benefit contributions like health insurance.

- Record-Keeping: Retain detailed payroll documentation for all employees to meet legal requirements and resolve disputes.

As you navigate these foundational elements, remember to stay updated with regulations in your region. Compliance can change frequently, so consider consulting legal or accounting professionals if you have questions about which laws apply. The Shyft state labor laws resource page is a good place to track labor rules in many locations, but official government sites are your best reference for the latest legal requirements.

Key Steps in the Payroll Cycle

Understanding each step in the payroll cycle helps you better organize schedules, meet deadlines, and eliminate mistakes. A typical payroll cycle includes time tracking, calculating earnings, applying deductions, and issuing payments. Ensuring clarity and consistency in these steps avoids disputes, fosters trust, and supports employee satisfaction.

- Time Tracking: Monitor worked hours carefully. Automated systems like shift management solutions can help you track attendance and clock-ins.

- Gross Wage Calculation: Multiply worked hours by hourly rates (or consider the set salary). Don’t forget overtime and special pay types, such as double-time pay where applicable.

- Deductions & Taxes: Subtract taxes, Social Security, Medicare, and voluntary deductions (401k, health insurance). Net pay is what remains.

- Payment Distribution: Provide direct deposit, checks, or pay cards. Some states permit or regulate certain forms of payment.

After finalizing payments, distribute pay stubs or statements that show how wages were calculated. Maintain these records for future reference. For a deeper look at gross versus net income, check out the Shyft blog on Gross vs Net Income. Remember, exact payroll cycle steps might vary depending on employee pay structure, software used, and local tax requirements.

Choosing a Payroll Processing System

A reliable payroll processing system is indispensable. You may opt for standalone payroll software, integrated human resources systems, or cloud-based payroll processing services—whichever fits your business size and budget. Especially for small business payroll processing, the solution’s cost, ease of use, and compliance features are huge considerations.

- Scalability: Make sure the system can handle an expanding workforce, possibly across multiple locations.

- Integration: Look for a payroll processing system that syncs with your HR or employee schedule app to minimize manual data entry.

- Automatic Tax Filing: Many payroll platforms automatically calculate, withhold, and file taxes, saving time and reducing mistakes.

- Compliance Checks: Built-in notifications let you know if your payroll is veering off local, state, or federal laws.

While there are many providers, the top payroll processing companies typically offer robust customer support and reliable tax updates. If you prefer more hands-on control and real-time data, payroll processing software might be more suitable. This approach allows you to manage everything in-house while still taking advantage of automated calculations.

Staying Compliant with Labor Laws

Compliance is key to avoiding hefty penalties and legal challenges. Different regions have unique wage laws, overtime regulations, and record retention rules. Regularly monitoring these laws, setting reminders for filing deadlines, and maintaining open communication with your accounting team helps you stay on top of your obligations.

- Minimum Wage Laws: Refer to official guidelines and keep an eye on local legislative changes.

- Overtime Policies: Some jurisdictions enforce daily overtime or pay premiums beyond a certain threshold of hours.

- Record Retention: Maintain payroll records for multiple years; often a minimum of three years, though regulations vary.

- Employee Misclassification: Improperly classifying workers can result in back pay, interest, and legal action.

For more region-specific guides, you can check the Shyft state labor laws section, which features numerous pages dedicated to different states. However, these resources are often just a starting point. Always consult official labor websites or professional counsel for the most current updates, especially if you operate across multiple states or provinces.

Online Payroll Processing Benefits

Online payroll processing platforms offer real-time features that make it easier to run your business from anywhere. They often integrate seamlessly with scheduling solutions, track hours, and automatically handle pay calculations, even for multiple pay rates or shift differentials. Because everything happens in the cloud, you can run payroll on the go, reducing administrative overhead.

- Real-Time Data: Monitor hours worked and see up-to-date payroll summaries from any device.

- Security Features: Many platforms utilize encryption and multifactor authentication to protect sensitive data.

- Employee Self-Service: Team members can access pay stubs, tax forms, and time-off balances online.

- Automatic Reminders: Get alerts for upcoming paydays, direct deposit cutoffs, and tax filing deadlines.

Software-as-a-Service (SaaS) models for payroll processing for small business owners have become increasingly accessible. Even if you’re not tech-savvy, these services tend to be user-friendly and come with training resources and customer support channels. When considering an online payroll processing system, look for automatic updates so you’re always working with current tax rates.

Integrating Payroll with Scheduling Tools

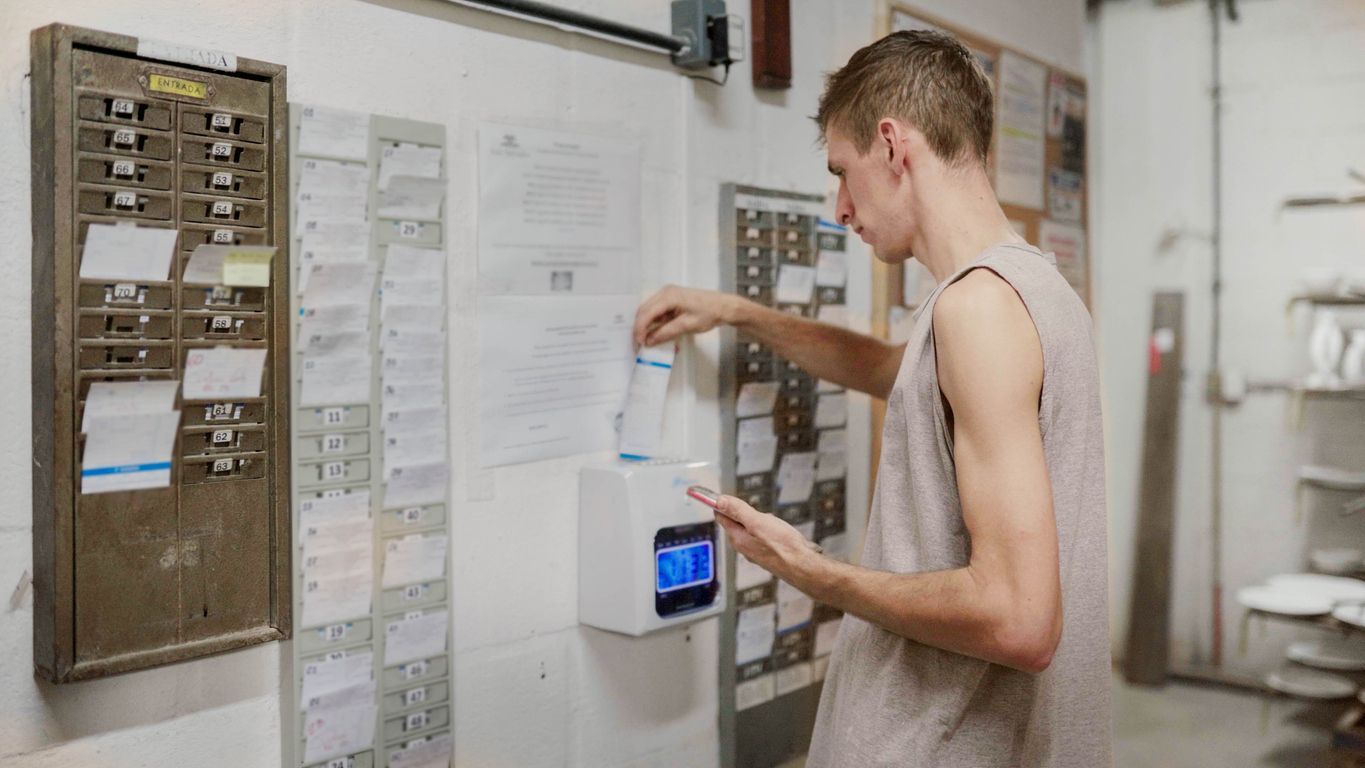

Most payroll errors arise from incorrect time tracking. By integrating payroll with robust scheduling software, you can drastically cut down on manual data entry and potential mistakes. Tools like Shyft connect your employees’ hours directly to your payroll system, allowing you to automate wage calculations based on accurate clock-ins and clock-outs.

- Automated Timesheets: Capture employee attendance data in real time, eliminating the need for manual spreadsheets.

- Overtime Alerts: Identify potential overtime situations in advance and plan budgets accordingly.

- Approval Workflows: Managers can approve timesheets before they sync with payroll, adding a layer of oversight.

- Analytics & Reports: Produce wage cost reports that combine scheduling and payroll data for strategic insights.

Such an integrated solution reduces administrative hours and frees you from double-checking timesheets. When scheduling data automatically flows into your payroll processing system, you’re not only increasing efficiency but also boosting transparency for employees. For more advanced shift strategies and scheduling patterns, you can explore Shyft’s resources on shift patterns and ways to reduce administrative costs.

Outsourcing to a Payroll Processing Company

Some businesses choose to outsource their payroll tasks entirely to specialized payroll processing companies. Outsourcing can help reduce administrative burdens, ensure compliance, and free up time for other core operations—particularly useful if you lack in-house expertise. However, it’s crucial to pick a reliable partner familiar with your industry regulations and local laws.

- Cost vs. Benefits: Although outsourcing has a price, it often saves money on overhead and expensive payroll errors.

- Expertise: External providers often have legal and tax experts well-versed in fast-changing regulations.

- Scalability: It’s simpler to expand your team because the provider handles the increased processing workload.

- Integration: Some payroll firms allow direct system integration, syncing employee hours from tools like Shyft.

Before committing, thoroughly vet the company’s security measures, track record, and service-level agreements. Remember, your business remains legally responsible for errors—ensure the payroll provider you choose is known for accuracy and integrity. If you ever decide to switch providers, clarify data ownership so you can smoothly migrate your payroll history.

Practical Tips for Small Business Payroll Processing

Small businesses often have limited resources for handling payroll administration. Effective strategies can help you stay on top of employee compensation, tax obligations, and compliance without being overwhelmed. Timely, organized payroll keeps your staff satisfied and your business thriving.

- Create a Calendar: Use an annual or monthly calendar marking important payroll dates, tax filing deadlines, and relevant state obligations.

- Utilize Software: Even basic, low-cost payroll software can handle complex tasks like time-and-a-half calculations for overtime.

- Conduct Audits: Regularly review timesheets, pay stubs, and withholdings to catch errors early.

- Manage Cash Flow: Budget for payroll taxes throughout the year, not just during quarterly or annual filing periods.

Small business owners juggling multiple responsibilities may want to consider an online or outsourced solution. Keep in mind that errors in payroll can quickly jeopardize worker morale. Using automated systems helps reduce mistakes and fosters greater employee trust in the process. If you’re exploring how better scheduling can balance employee needs with cost management, explore the Shyft blog on growing a small business through smarter scheduling.

Conclusion

Payroll processing remains a core pillar of any business, influencing everything from employee satisfaction to legal compliance. By mastering the fundamentals—accurate time tracking, compliant calculations, and thorough record-keeping—you ensure not only satisfied employees but also a well-functioning operation. Pairing payroll with a solid scheduling solution creates a robust system that helps you forecast costs and stay agile in responding to staff needs.

For best results, choose a method—be it in-house payroll processing software, outsourcing to payroll processing companies, or a hybrid approach—that aligns with your resources and expansion plans. And always keep your eyes on changing regulations. When in doubt, consult professional advisors. By prioritizing thorough, lawful payroll management, you’re setting your organization up for long-term success.

Frequently Asked Questions (FAQs)

What is payroll processing software?

Payroll processing software automates wage calculations, tax withholdings, and payment distribution to employees. Many solutions also handle generating payroll reports and filing taxes. The software often integrates with scheduling tools like Shyft to sync employee hours for accurate paychecks.

How do I choose between in-house payroll processing and outsourcing?

It depends on your budget, time constraints, and available expertise. In-house software allows more control but may require additional staff training. Outsourcing to payroll processing companies might cost more initially but can be worthwhile if your business lacks the time or skills to manage payroll internally.

What if my payroll isn’t compliant with labor laws?

Non-compliance can lead to penalties, audits, or even lawsuits. Always stay updated on wage laws, overtime regulations, and record-keeping requirements. For current local legislation, confirm information with official sources. The Shyft blog also discusses administrative strategies to help manage compliance.

Can online payroll processing handle different pay rates or shift differentials?

Yes, most online payroll processing solutions are designed to handle different pay structures, such as multiple hourly rates, tips, and overtime pay. The key is to input the correct data and ensure your scheduling or time tracking tool records distinct shift rates accurately.

How often should I update my payroll software?

Whenever there are new tax regulations or software feature improvements. Many payroll applications automatically update for tax rates, but you should confirm that your version is current. Regular updates help keep your payroll calculations accurate and compliant with ever-evolving laws.

Disclaimer: This guide provides general information about payroll processing. Laws and regulations frequently change, and they may differ depending on your location. Always consult professional or legal advice for your specific situation. For additional insights, check official government websites or a certified CPA firm.