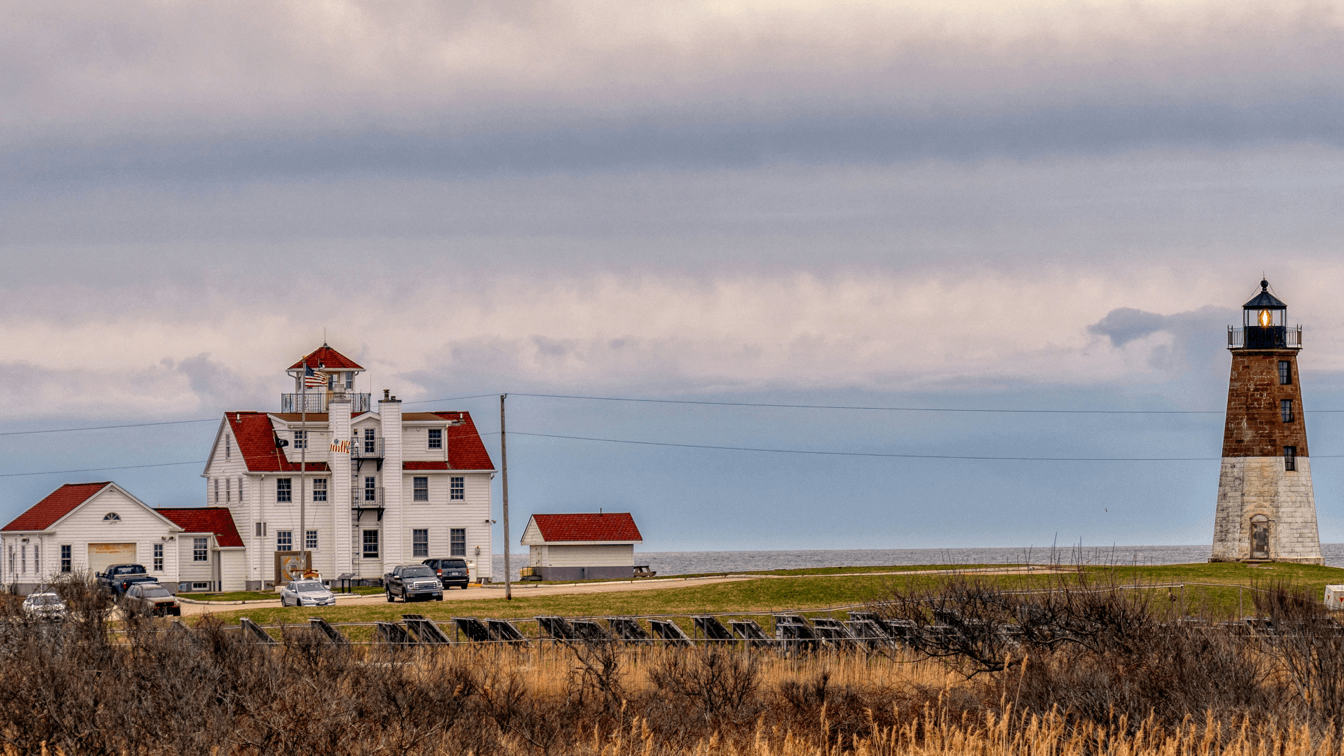

Commercial property insurance is a critical component of risk management for business owners in Providence, Rhode Island. As the capital city with a rich industrial history transitioning to a modern economy, Providence businesses face unique risks that require specialized insurance coverage. From historic buildings in the downtown area to manufacturing facilities along the waterfront, commercial properties in Providence require comprehensive insurance protection against a variety of potential losses. Understanding the intricacies of commercial property insurance can help business owners protect their investments while managing costs effectively in Rhode Island’s dynamic business environment.

The insurance landscape in Providence reflects the city’s diverse business ecosystem, with providers offering customized solutions to address specific industry needs. Local factors such as Rhode Island’s coastal location, weather patterns, and building codes all influence insurance requirements and premiums. Navigating these considerations while maintaining adequate coverage requires strategic planning and knowledge of both general insurance principles and Rhode Island-specific regulations. This guide explores essential aspects of commercial property insurance in Providence, providing business owners with practical information to make informed decisions about their risk management strategies.

Understanding Commercial Property Insurance in Providence

Commercial property insurance in Providence provides financial protection for physical assets owned or leased by businesses. The coastal location of Rhode Island creates unique considerations for property owners, particularly regarding weather-related risks. When structuring a policy, it’s important to consider both the specific characteristics of your property and the broader risk landscape of Providence. Just as effective shift planning ensures your business has the right coverage at the right time, comprehensive property insurance ensures your physical assets have the right protection at all times.

- Building Coverage: Protects the physical structure of your commercial property, including permanently installed fixtures and equipment.

- Business Personal Property: Covers inventory, furniture, equipment, and other contents inside your building.

- Business Income Protection: Compensates for lost income if your business operations are interrupted due to covered property damage.

- Extra Expense Coverage: Helps cover additional costs incurred to continue operations after a covered loss.

- Property of Others: Protects items belonging to others that are in your care, custody, or control.

Providence’s historic districts contain many older buildings that may require specialized coverage or heritage considerations in insurance policies. Working with insurers familiar with the local market can help ensure your policy addresses the specific characteristics of properties in the area. Effective workforce planning and property insurance both require careful attention to detail to protect your most valuable assets—your team and your physical infrastructure.

Types of Commercial Property Insurance Coverage in Rhode Island

Rhode Island businesses have access to various types of commercial property insurance policies, each designed to address specific risks and property types. Understanding the differences between policy types is crucial for ensuring you have appropriate coverage. Managing these insurance choices is similar to managing shift changes in your business—both require careful planning and consideration of various factors to maintain smooth operations.

- Basic Form Policies: Cover fundamental risks like fire, lightning, explosion, windstorm, hail, smoke, vandalism, and sprinkler leakage.

- Broad Form Policies: Include basic coverages plus additional perils such as falling objects, weight of snow or ice, and water damage.

- Special Form Policies: Provide the most comprehensive coverage, protecting against all perils except those specifically excluded.

- Builders Risk Insurance: Designed for properties under construction or renovation in Providence.

- Flood Insurance: Particularly important in Rhode Island’s coastal areas, as standard policies typically exclude flood damage.

Many Providence businesses opt for package policies like Business Owner’s Policies (BOPs), which combine property and liability coverage at a more affordable rate than purchasing separate policies. This integrated approach to risk management is similar to how integration capabilities in business systems create efficiencies by connecting different functions. When evaluating coverage options, consider both the value of your property and the specific risks your business faces in Providence.

Common Risks for Providence Businesses

Providence businesses face several location-specific risks that should inform their commercial property insurance decisions. Understanding these risks helps in developing a comprehensive risk management strategy. Like implementing conflict resolution in scheduling, identifying and addressing potential property risks before they become problems is a proactive approach to business management.

- Coastal Weather Events: As a coastal state, Rhode Island is vulnerable to hurricanes, nor’easters, and strong coastal storms that can damage commercial properties.

- Flooding: Areas near the Providence River, Woonasquatucket River, and other waterways have increased flood risks, particularly during storm surges or heavy precipitation events.

- Winter Weather: Heavy snowfall, ice storms, and freeze-thaw cycles can cause structural damage, roof collapse, and water damage from burst pipes.

- Urban Risks: Properties in densely developed areas face risks related to adjacent buildings, including fire spread and water damage from neighboring properties.

- Historic Building Vulnerabilities: Providence’s many historic structures may have outdated electrical systems, plumbing, or structural elements that increase certain risks.

Businesses should work with insurance professionals who understand Providence’s unique risk landscape to develop coverage that addresses these specific concerns. This specialized approach to risk management parallels how industry-specific regulations require tailored compliance strategies. Many insurers offer risk assessment services to help identify property-specific vulnerabilities and recommend mitigation measures that could lower premiums and reduce potential losses.

Insurance Requirements and Regulations in Rhode Island

While commercial property insurance is not legally mandated in Rhode Island, certain situations create de facto requirements for coverage. Understanding these requirements helps businesses maintain compliance while protecting their assets. Similar to how labor law compliance is essential for workforce management, adhering to insurance-related regulations and contractual obligations is crucial for property management.

- Mortgage Requirements: Most commercial lenders require property insurance as a condition of financing for Providence properties.

- Lease Agreements: Commercial leases typically require tenants to maintain certain levels of property insurance.

- Client Contracts: Some client agreements may require businesses to maintain specific insurance coverages.

- Historic District Requirements: Properties in Providence’s historic districts may have additional insurance requirements related to preservation standards.

- Rhode Island Building Codes: Insurance policies may need to address code compliance upgrades following property damage.

The Rhode Island Department of Business Regulation oversees insurance providers in the state and can be a resource for businesses with questions about insurance regulations. Understanding these regulatory aspects is similar to implementing compliance with health and safety regulations—both require attention to detail and awareness of legal frameworks. Working with an insurance professional who specializes in commercial properties in Providence can help ensure your coverage meets all applicable requirements.

Finding the Right Insurance Provider in Providence

Selecting the right insurance provider is a critical decision for Providence businesses. Local insurers often have specialized knowledge of the Providence market, while national carriers may offer more extensive resources. This decision-making process is comparable to selecting the right scheduling software—both require evaluating providers based on your specific business needs and circumstances.

- Local Market Knowledge: Providers familiar with Providence’s unique characteristics can offer more tailored coverage options.

- Industry Specialization: Some insurers specialize in certain industries common in Providence, such as education, healthcare, or manufacturing.

- Claims Handling Reputation: Research how efficiently and fairly potential insurers handle claims, particularly for businesses similar to yours.

- Risk Management Services: Many quality insurers offer additional services to help businesses identify and mitigate risks.

- Financial Stability: Check ratings from agencies like A.M. Best or Standard & Poor’s to ensure your insurer has the financial strength to pay claims.

Consider working with an independent insurance agent who can provide options from multiple carriers and help navigate the complexities of commercial property insurance. This approach to finding specialized expertise mirrors the benefits of scheduling software mastery—both leverage specialized knowledge to optimize outcomes. Take time to compare not just premiums but also coverage limits, deductibles, exclusions, and additional services when evaluating potential providers.

Cost Factors for Commercial Property Insurance in Providence

Several factors influence the cost of commercial property insurance in Providence. Understanding these variables can help businesses manage their insurance expenses while maintaining adequate coverage. This cost management approach is similar to cost management in other business operations—both require balancing protection with financial efficiency.

- Property Location: Properties in flood zones or areas with higher crime rates may face higher premiums.

- Building Characteristics: Age, construction materials, square footage, and fire protection systems all affect insurance costs.

- Business Operations: The nature of activities conducted on the premises influences risk levels and thus insurance costs.

- Coverage Limits and Deductibles: Higher coverage limits increase premiums, while higher deductibles typically lower them.

- Claims History: Businesses with previous claims may face higher premiums than those with clean records.

Businesses can often reduce insurance costs through risk mitigation measures such as installing security systems, upgrading electrical systems, or improving fire protection. Many insurers offer premium discounts for these improvements. This strategic approach to reducing costs parallels how resource allocation optimizes business operations—both focus on maximizing value while minimizing expenses. Regular property valuations are also important to ensure you’re neither underinsured nor paying for excessive coverage.

Risk Management Strategies for Providence Businesses

Effective risk management extends beyond purchasing insurance to include proactive measures that reduce the likelihood and potential impact of property losses. Implementing a comprehensive risk management strategy can both protect your business and potentially lower insurance premiums. This holistic approach is comparable to how performance evaluation and improvement enhances business operations—both involve systematic assessment and strategic action.

- Risk Assessment: Regularly evaluate your property for potential hazards and vulnerabilities specific to Providence’s environment.

- Preventive Maintenance: Develop schedules for inspecting and maintaining building systems to prevent failures that could lead to property damage.

- Emergency Preparedness: Create and practice emergency response plans for situations like fires, floods, or severe weather events common in Rhode Island.

- Security Measures: Implement appropriate security systems and protocols to reduce theft and vandalism risks.

- Business Continuity Planning: Develop strategies to maintain operations during and after property damage events.

Many insurance providers offer risk management consultations to help identify and address potential issues before they result in claims. These services can provide valuable insights specific to your property and business operations. Just as safety training and emergency preparedness protect your workforce, proactive risk management protects your physical assets. Consider forming a risk management committee within your organization to ensure ongoing attention to property risks and mitigation strategies.

Claims Process for Commercial Property Insurance

Understanding the claims process before experiencing a loss enables Providence businesses to respond effectively when property damage occurs. Proper preparation can significantly impact how quickly and successfully a claim is resolved. This preparation is similar to developing effective communication strategies—both require planning ahead to ensure smooth operations during challenging situations.

- Documentation Preparation: Maintain updated inventories, property valuations, and photographs of your business assets before any loss occurs.

- Immediate Response: Report damage promptly to your insurer and take reasonable steps to prevent further damage.

- Evidence Collection: Document all damage through photographs, videos, and written descriptions.

- Claims Forms: Complete all required paperwork accurately and thoroughly, providing supporting documentation.

- Professional Assistance: Consider engaging public adjusters or other professionals for complex claims to ensure fair settlements.

The claims process typically involves working with insurance adjusters who will evaluate the damage and determine coverage based on your policy terms. Having a clear understanding of your policy provisions before filing a claim can help avoid surprises during this process. This approach to claims management parallels communication tools integration in business operations—both require coordinated systems and clear information flow. Develop a claims management team within your organization to ensure someone is always prepared to handle the process efficiently.

Technology and Insurance Management for Providence Businesses

Modern technology offers valuable tools for managing commercial property insurance more effectively. From digital documentation to analytics-driven risk assessment, technology can streamline insurance processes and improve outcomes. This technological approach is comparable to leveraging Shyft for workforce management—both use digital solutions to enhance efficiency and effectiveness.

- Digital Asset Inventory: Use software to maintain comprehensive records of all business property, including purchase dates, values, and images.

- Risk Management Software: Implement programs that help identify, assess, and track property risks and mitigation efforts.

- Claims Management Systems: Utilize platforms that streamline the documentation and tracking of insurance claims.

- IoT Monitoring: Consider Internet of Things devices that can detect water leaks, temperature fluctuations, or security breaches before they cause significant damage.

- Data Analytics: Leverage analytics to identify patterns and trends that could inform risk management strategies.

Many insurance providers now offer client portals and mobile apps that make it easier to access policy information, report claims, and communicate with insurance representatives. These digital tools can be particularly valuable for businesses with multiple properties or complex insurance needs. Just as mobile access to scheduling systems improves workforce management, digital insurance tools improve property risk management. Consider appointing a technology champion within your organization to stay current with insurance technology developments and implementation opportunities.

Integrating Insurance with Overall Business Planning

Commercial property insurance should be integrated into broader business planning rather than treated as a separate consideration. This holistic approach ensures that insurance decisions align with overall business objectives and financial strategies. Similar to how strategic workforce planning integrates staffing with business goals, strategic insurance planning connects property protection with business development.

- Budget Planning: Incorporate insurance costs into annual budgeting processes, including projections for premium changes.

- Business Expansion: Consider insurance implications when acquiring new properties or expanding operations in Providence.

- Risk Financing: Evaluate options like self-insurance, captive insurance, or higher deductibles as part of financial strategy.

- Business Continuity: Ensure insurance coverage aligns with your business continuity and disaster recovery plans.

- Contractual Compliance: Maintain awareness of how insurance requirements in contracts affect your coverage needs.

Regular insurance reviews should be scheduled as part of your business planning cycle, particularly before renewals or when significant changes occur in your operations or property portfolio. This systematic approach to insurance planning is akin to compliance training for employees—both require regular updates and integration with changing business conditions. Consider creating cross-functional teams that include operations, finance, and risk management perspectives when making major insurance decisions.

Effective commercial property insurance management in Providence requires attention to local risk factors, regulatory requirements, and business needs. By understanding coverage options, working with knowledgeable providers, implementing risk management strategies, and leveraging technology, businesses can develop insurance programs that provide appropriate protection while supporting overall business objectives. Regular reviews and updates ensure that coverage remains aligned with changing circumstances and business goals.

For Providence business owners, commercial property insurance represents more than just a necessary expense—it’s a strategic investment in business resilience and sustainability. Taking a proactive, informed approach to insurance decisions helps protect physical assets while creating a foundation for long-term business success. With the right coverage in place, businesses can operate with confidence knowing they’re prepared to weather potential property-related challenges while focusing on growth and prosperity in Rhode Island’s vibrant business community.

FAQ

1. What makes commercial property insurance in Providence different from other locations?

Providence’s unique characteristics—including its coastal location, historic architecture, and Rhode Island-specific regulations—create distinct insurance considerations. Local weather risks like nor’easters, hurricanes, and flooding require specialized coverage options, while the city’s many historic buildings may need custom insurance solutions. Additionally, Rhode Island has its own insurance regulations and requirements that affect policy terms and claims processes. Working with insurers familiar with Providence’s specific risk landscape ensures your coverage addresses these local factors appropriately. This localized approach to risk management parallels how location-based management optimizes operations for specific environments.

2. How can I determine the right amount of commercial property insurance for my Providence business?

Determining appropriate coverage involves several steps: First, conduct a thorough property valuation, considering replacement costs rather than market value or depreciated value. Include all physical assets—buildings, equipment, inventory, and fixtures. Second, assess business interruption needs by calculating potential income loss during rebuilding periods. Third, consider Providence-specific risks like flooding or winter weather damage that might require additional coverage. Professional appraisals and risk assessments can provide valuable insights into appropriate coverage levels. Regular reviews are essential as property values, business operations, and risk factors change over time. This systematic approach to coverage determination is similar to how resource allocation requires careful analysis of business needs and priorities.

3. What flood insurance considerations are important for Providence businesses?

Flood insurance deserves special attention for Providence businesses due to the city’s waterfront location and numerous waterways. Standard commercial property policies typically exclude flood damage, making separate flood coverage essential for many locations. The National Flood Insurance Program (NFIP) provides coverage in participating communities, including Providence, though private market options are also available. Business owners should verify their property’s flood zone designation, as this affects both risk level and premium costs. Even properties outside designated high-risk zones may benefit from flood coverage, as approximately 25% of flood claims come from moderate to low-risk areas. Consider including coverage for both building and contents, and be aware of waiting periods (typically 30 days) before new flood policies take effect. This specialized approach to flood risk mirrors how industry-specific regulations require tailored compliance strategies.

4. How can technology improve commercial property insurance management?

Technology offers numerous tools to enhance property insurance management: Digital asset management systems create comprehensive, accessible inventories of all insured property. Risk assessment software identifies potential vulnerabilities and tracks mitigation efforts. IoT devices provide real-time monitoring of conditions like water leaks, temperature fluctuations, and security breaches, enabling early intervention before major damage occurs. Claims management platforms streamline documentation and tracking during the claims process. Mobile apps provide convenient access to policy information, claim filing, and communication with insurers. Data analytics help identify patterns and trends in property risks. Cloud-based documentation ensures critical insurance information remains accessible even if physical records are damaged. Just as technology in shift management improves workforce operations, these digital tools enhance property risk management by providing better information, increased efficiency, and improved outcomes.

5. What steps should I take after property damage occurs?

When property damage occurs, take these important steps: First, ensure safety by evacuating if necessary and addressing any immediate hazards. Contact emergency services if appropriate. Document the damage thoroughly through photographs, videos, and written descriptions before cleanup begins. Notify your insurance provider promptly—most policies require timely reporting. Take reasonable measures to prevent further damage, such as covering broken windows or shutting off water to leaking pipes. Keep detailed records of all expenses related to emergency repairs and temporary measures. Review your policy to understand coverage, deductibles, and claim filing requirements. Consider engaging professional assistance for complex claims, such as public adjusters who represent your interests. Maintain regular communication with your insurer throughout the claims process. This systematic approach to claims management is comparable to having emergency procedure definitions for workforce incidents—both require clear processes for responding to unexpected events.